Highlights: - Whirlpool is our preferred pick - Consumer durables industry is growing at a brisk pace - Product portfolio updation and volumes will be crucial to top-line growth - Margins depend on capacity utilisation rates, product mix and cost management measures

-------------------------------------------------

Considering the secular demand pattern for consumer durables, revenue visibility appears promising. Easier availability of finance, improved electrification coverage, higher disposable incomes and growing urbanisation have buoyed demand. However, from a company-specific perspective, delayed product launches and lack of innovation could be the major roadblocks to growth.

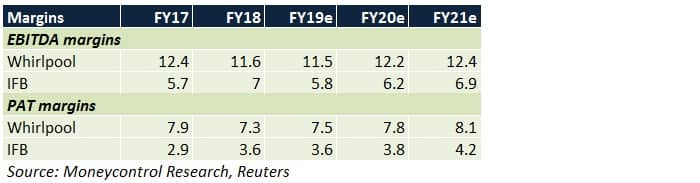

In this industry, margins largely depend on product mix, utilisation rates at manufacturing facilities and cost management initiatives. Stiff competition from other brands can make it difficult to pass on increasing costs (towards overheads, advertisements, dealer margins, raw materials) to buyers.

We prefer Whirlpool over IFB Industries, notwithstanding the former’s steep valuations. Given the sharp rally in Whirlpool’s stock price over the past fortnight, we advise buying on dips.

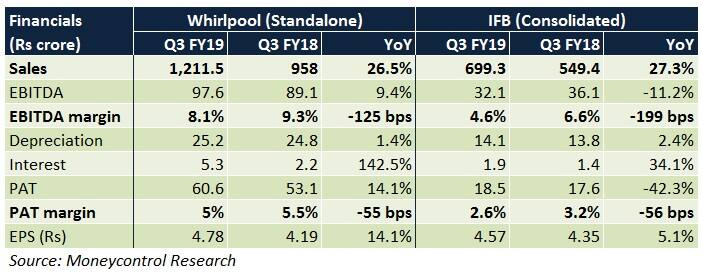

In Q3, Whirlpool and IFB reported robust top-line growth, primarily on the back of festive demand. Volatility in currency and commodity prices impacted margins.

- The company is expanding its trade channels, particularly in tier 2/3 cities and semi-urban India

- Through its joint venture with Elica (Whirlpool holds 49 percent), the company can leverage Elica’s wide distribution reach pan-India

Manufacturing capacities increasing- The capacity of direct cool refrigerators will increase from 0.6 million units to 2.7 million units by mid-2019

- Expansion of fully automatic washing machines at the Puducherry plant is underway

Changes in product portfolio- In addition to existing segments, new products will be launched in categories such as dishwashers, water purifiers and air purifiers

- In case of washing machines and refrigerators, the impetus is being laid on premium variants

- Volume growth will be prioritised through dealer incentives

Traction seen in exports- In the laundry appliances space, markets in South Africa and Morocco have seen good momentum

- In other home appliance segments, markets in the Philippines, Sri Lanka, Bangladesh and Nepal have been on an uptrend as well

Margin drivers- The company is raising prices across most product categories in Q4 FY19 to offset costs

- Intermediaries across trade channels are being consolidated

- Ramp-up of utilisation levels at factories (for refrigerators and washing machines in particular) is being undertaken

Premium valuations to sustain- The company has robust fundamentals and can fund expansion plans through internal accruals

- A diverse product range keeps demand seasonality at bay

- The stock has witnessed a steep upmove in the last 15 days and currently trades at 33 times its FY21 projected earnings

- Price corrections may provide entry opportunities

What about IFB? IFB is likely to face some short to medium-term challenges on account of the following:-

- Margins in the home appliances division (80-90 percent of the annual top-line) are not showing signs of improvement in recent times

- The market penetration of dishwashers is considerably low in India

- Dependence on imported components is still pretty high in product categories such as air conditioners. Commercial manufacturing of ACs in India will begin in January 2020

- The company’s foray into refrigerators has been delayed

Though the prospects of a meaningful re-rating cannot be ruled out, we are relatively less bullish on IFB as of now.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.