As you start exploring term life insurance options, you will find claim settlement ratio popping at many places, giving an impression of superior claims experience. But, is this inference correct? What does the claim settlement ratio really indicate?

If an insurer has a claim settlement ratio of 99 per cent, does it mean that there is a 99 per cent of your nominee receiving the claim? How should you compare different insurers? Is there anything you’re missing? Read on, to find out the truth.

So, what is claim settlement ratio?

The claim settlement ratio (CSR) basically measures the number of claims an insurance company has paid, against the number of claims made by the nominees/beneficiaries. It is expressed as a percentage and published every financial year.

For example, if an insurer has a claim settlement ratio of approximately 98 per cent, it means that the firm has settled 98 claims out of every 100 claims received.

Why does the claim settlement ratio not work?

CSR does not reflect likelihood of claim settlement:This ratio doesn’t give you the probability / likelihood of your claim being settled. It just speaks about the claims that have been settled by a company in the past.

-A high claim settlement ratio doesn’t mean that your claim will be settled.

-Likewise, a low ratio doesn’t mean that your claim won’t be settled.

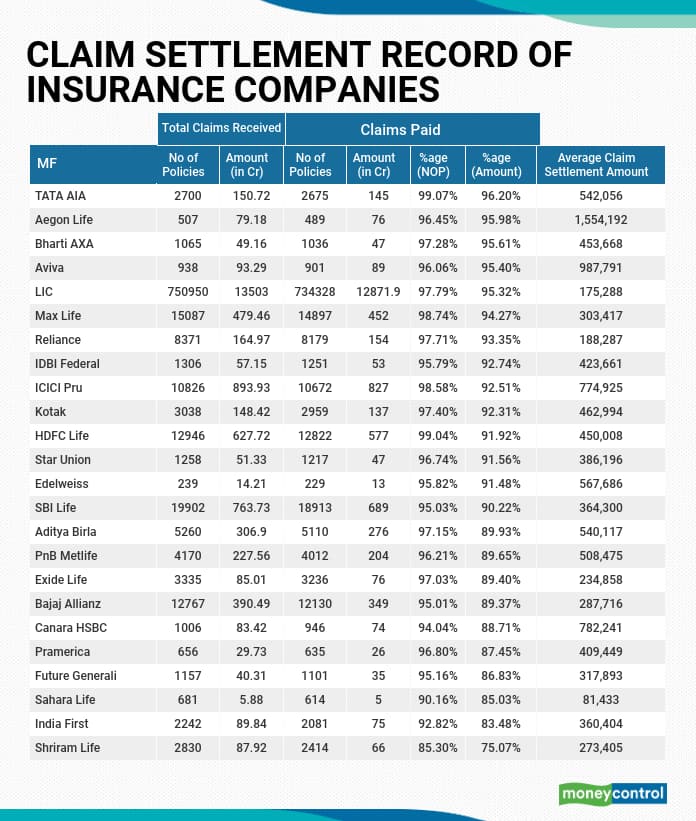

Number of claims not value of claimsSecondly, it doesn’t speak about the volume of claims settled: the total amount they paid. Only the numbers. While researching for our term insurance e-book, we prepared this table for the year 2018-2019.

As you can see some insurers have a very high claim settlement ratio number, but not an equally good claim settlement ratio in value. So, it is possible that the insurer has settled several claims of very low value – and rejected those with a high value. So, this ratio will not account for that disparity.

Does not reflect the quality of claim experienceFinally, the claim settlement ratio doesn’t indicate the quality of the claims experience itself, or the time taken to settle claims.

-What if a company has a ratio of 99 per cent, but has taken an average 30 days to settle a claim, while another has a ratio of 98.5 per cent, but the average turnaround time is seven days. Which insurer has a better claims service here?

-An insurer with a high ratio might still be extremely difficult to deal with and the processes might be too complex.

So, basically, the claim settlement ratio is not really a wholesome indicator of a good insurer.

What can you do?The only way to assure yourself that your nominee does not face issues at the time of claims is to ensure you provide best-effort declarations when buying the insurance. Ensure that you fill the proposal form diligently; do not guess answers to questions; don’t take any shortcuts on the assurance of the agent who is in a hurry to get the policy issued. Keep records of all communication and share it with your family members.

After all, this whole effort is to make sure that your family will face no trouble when they need this support the most. You might not be around then. But, right now, it really is up to you to choose the right insurer to depend upon.

(The writer is founder, Beshak.org, an independent consumer awareness platform for Insurance)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.