Given the changing macro-economic scenario, gold prices have been highly volatile in recent months due to high inflation, interest rate hikes by central banks, tightening liquidity, and geopolitical tensions surrounding Russia-Ukraine and China-Taiwan.

Prices shot up to $2,071 after the Russia-Ukraine war broke out, and immediately came down after central banks, especially the US Federal Reserve, started firefighting multi-decade-high inflation with a series of aggressive rate hikes and withdrawal of liquidity.

While macroeconomic and geopolitical factors have a bearing on gold prices, let us look at the role demand and supply play in determining gold prices.

Supply of goldGold prices are essentially driven by two elements – mine and scrap supply, and jewellery and investment demand.

Mining and exploration is an ongoing process and there is limited fluctuation in mine production as the costs involved are very high. Therefore, even during the 2020 lockdown when gold demand fell significantly, mine production remained stable at 3,476 tonnes.

Recycling supply, on the other hand, is a reaction to gold price movement. When gold prices increase, people tend to sell their gold to cash in on the profits or ease their financial crunch. Therefore, although supply is one of the drivers, its impact usually wanes as the situation (economic crisis leading to a strain in personal finances) stabilises.

Looking at demand, global jewellery demand stands at about 2,230 tonnes, nearly 47 percent of the total supply. While this is a major demand component, it has little bearing on gold prices as jewellery demand is discretionary and driven by marriages, festivities, and gifting.

In fact, prices impact jewellery demand and not the other way round because jewellery, especially in western countries, is bought for consumption and not investment. However, robust jewelry demand does add some floor to gold prices on the downside.

While these indicators do have a meaningful impact on prices, it is largely in the short term. In the longer-term, we believe changes in the overall level of confidence in the monetary system and the economy drive gold prices. Therefore, to analyze gold over the long term, it needs to be seen as a monetary asset rather than a commodity.

Driven by demand for bars, coinsThe most critical price determinant is the investment demand. Total investment in bars and coins is about 1,000 tonnes, 21 percent of the supply. However, speculative positioning and institutional investment can determine sentiment and serves as that swing factor that can drive prices.

This demand is usually based on the current macro-economic environment, influenced by factors like the yield on the US 10-year Treasury Inflation Protected Securities (TIPS), the strength of the US dollar, and the US 10Y-2Y nominal bond yield spread. The 10 year–2-year spread is widely tracked as an indicator of recession.

A positive 1-year TIPS yield increases the opportunity cost for holding gold as gold is a non-yielding asset. While a negative TIPS yield will entail inflows into gold because of gold’s capital protection characteristic. Similarly, a stronger dollar makes gold, which is denominated in dollars, expensive. This causes the flight of money out of gold thereby impacting prices.

Therefore, when the yield curve is inverted there is usually a flow of money into gold to tide over economic uncertainty.

Watch out for debt market yieldsLet us look at some other indicators, which are not widely tracked but are extremely important to gauge the movement of gold prices – the health of the banking sector and credit spreads.

Banks are an important part of the economy, given that they create capital and provide liquidity. Therefore, a healthy banking sector indicates a healthy economy.

Hence, we considered the ratio of the Nasdaq Banking Index, a benchmark stock index for the banking sector, to the S&P 500.

We found that the banking sector shows strong inverse correlation with gold prices. Whenever the banking sector has suffered, it has had a positive impact on gold prices as investors prepared for economic weaknesses. The health of the banking sector is, therefore, a leading indicator of gold prices.

Currently, we see a weak banking index in the chart below that has given a floor to the gold price. If the health of the banking sector weakens further, we can expect a spike in gold prices going forward.

Chart 1: the banking sector and gold prices

Past performance may or may not sustain in future; Data as of July 2022; Source: Bloomberg

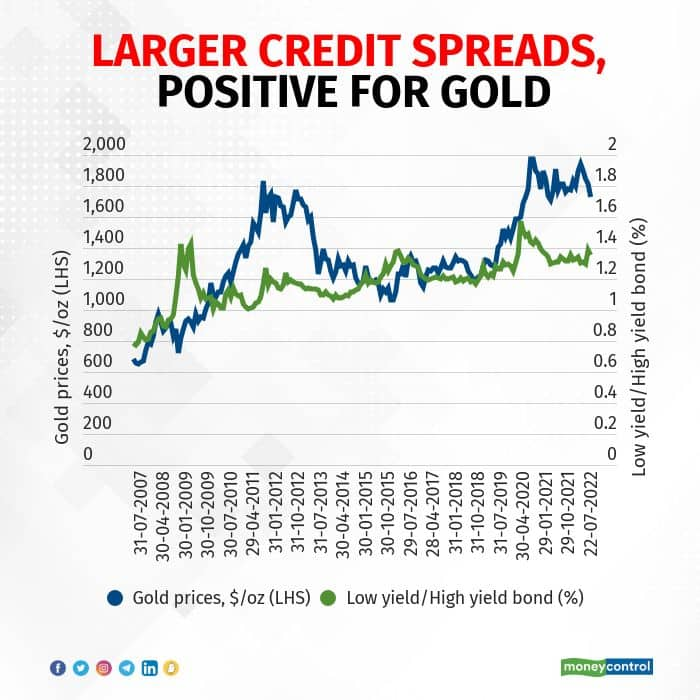

Similarly, credit spreads also are an early indicator of risk, and thereby impact gold price movement.

We considered a ratio of low US bond yields to high US yield bond yields. When credit spreads widen, it indicates investors are moving towards low-yield debt to protect capital from risk.

According to the chart below, spikes in gold prices have been preceded by larger credit spreads and currently, we can see a widening of credit spreads, which is expected to benefit gold prices going ahead.

Chart 2: larger credit spreads a positive for gold

Past performance may or may not sustain in future; Data as of July 2022; Source: Bloomberg

Given the rise in corporate and government indebtedness post-Covid and the current economic backdrop, where governments are struggling with rising deficits and unsustainable debt, and corporates are staring at higher interest rates, it is indeed logical for gold prices to increase.

Therefore, it becomes important to have some allocation to gold to effectively diversify capital from the risk of potential economic weakness, debt crises, and resulting drawdowns in risk assets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.