Five of the six Franklin Templeton (FT) schemes that are being wound-up have exposure to debt papers of the financially troubled telecom major Vodafone Idea (VIL). The payments are due for interest payments in September 2021.

These securities mature in September 2023.

The telecom company has been working to prevent a financial collapse, amid mounting debt burden.

Kumar Manglam Birla, who acted as non-executive chairman of Vodafone Idea, in a June 7, 2021 letter to cabinet secretary Rajiv Gauba, said, “I want to emphasise that without immediate and active support from the government on these issues….VIL’s financial situation will drive its operations into an irretrievable point of collapse.”

Also read: Read full text of Kumar Mangalam Birla’s letter to govt on ‘looming crisis’ before Vodafone India

To be sure, Vodafone Idea’s securities lie in the segregated portfolios of the five debt schemes. In other words, this money will only come to you provided Franklin Templeton recovers it from the company. These securities are not part of the portfolios that SBI Mutual Fund can sell.

Other fund houses -- Nippon India Mutual Fund (MF), UTI MF and Aditya Birla Sun Life MF -- have exposures to Vodafone Idea’s debt securities in certain schemes, according to data from Morningstar. These securities mature in January 2022 and February 2022, when their next payment is due.

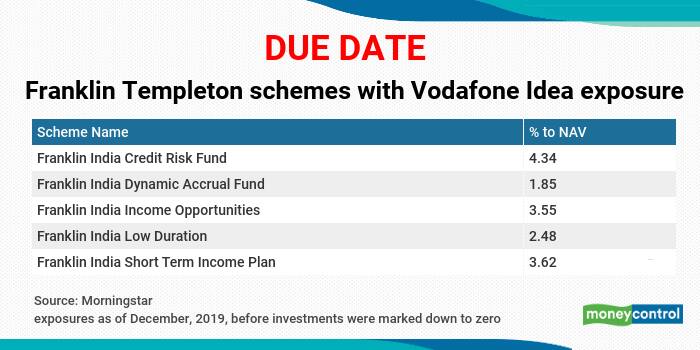

Franklin India Credit Risk Fund, Franklin India Dynamic Accrual Fund, Franklin India Income Opportunities, Franklin India Low Duration and Franklin India Short Term Income Plan are the schemes with exposures to Vodafone Idea debt securities.

The debt investments in Vodafone Idea were marked down to zero by FT MF schemes in January 2020, after the Supreme Court had dismissed the telecom firm’s review petition on Additional Gross Revenues (AGR) liability of over Rs 44,000 crore.

Subsequently, the debt papers were downgraded to below investment grade and FT MF schemes put these debt securities in a side-pocket or a segregated portfolio on January 24, 2020.

Status on recovery in FT MF schemesWhile recovery from the segregated portfolio can take time as these Vodafone Idea’s debt papers may be difficult to sell in markets given company’s financial situation, the recovery in the main portfolios of the schemes under wind-up has been steady so far.

Franklin India Ultra Short Bond Fund and Franklin India Low Duration Fund have distributed 95 percent and 99 percent of the scheme’s assets to investors.

Franklin India Dynamic Accrual Fund and Franklin India Credit Risk Fund have distributed 76 percent and 83 percent of the scheme’s assets to investors.

Franklin India Income Opportunities and Franklin India Short Term Income Plan have distributed 62 percent and 67 percent of scheme’s assets to investors. If cash available for distribution is added to this, the ratio goes up to 88 percent for Income Opportunities and 78 percent for Short Term Income Plan.

Remember, any default from Vodafone Idea’s side will not have any impact on NAVs, as the securities are already marked down to zero by FT MF. The segregated portfolios would just continue to exist.

If Vodafone Idea makes the interest payment, the funds will be credited to unitholders who were around when the segregated portfolio was created.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.