April 2025 is all set to herald a plethora of money changes that will affect your wallets.

For one, all the big bang tax cuts announced in Budget 2025 will take effect from April 1. The Reserve Bank of India’s (RBI) monetary policy committee (MPC) will meet between April 7 and 9, and take a call on reducing repo rates that will directly impact your home loan EMIs.

Here's a look at the money changes in April that you ought to monitor closely.

New regime to cut tax burden significantly

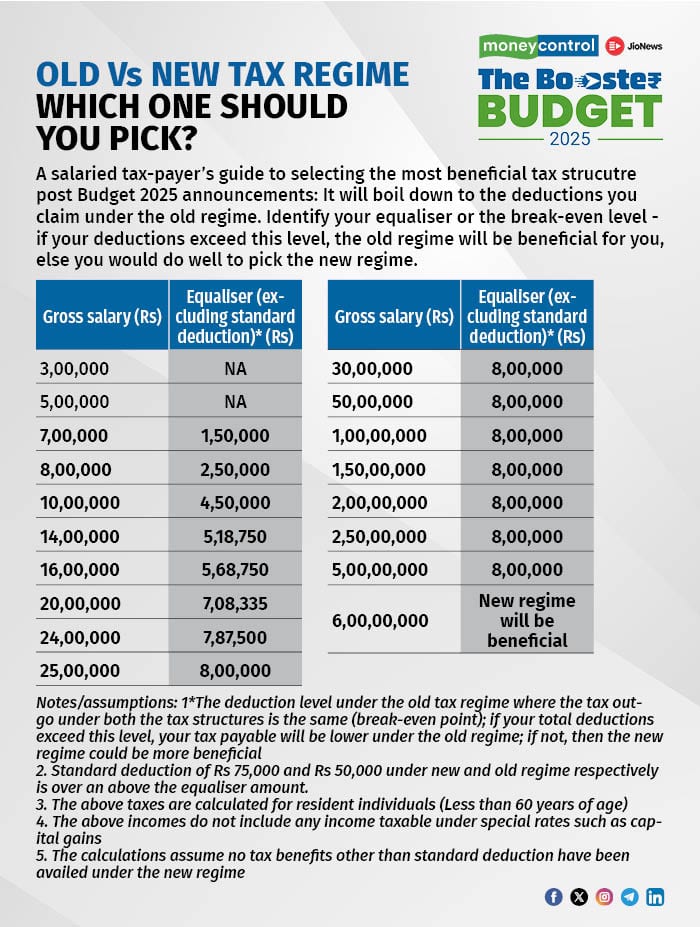

The old, with-exemptions tax regime is set to lose its sheen, as Finance Minister Nirmala Sitharaman’s Budget 2025 announcements take effect from April 1. As per Finance Ministry data, 72 percent of taxpayers moved to the new tax regime in FY24 and tax concessions in Budget 2025 will drive the numbers further up.

The new, simplified regime has now become significantly attractive for taxpayers across income tax slabs. Those earning up to Rs 12 lakh per annum (Rs 12.75 lakh in case of salaried individuals due to standard deduction) will not have to pay any tax under the new regime, though they will have to file returns to get rebate of up to Rs 60,000.

Those in the higher brackets, too, will benefit from the new tax regime. As per Deloitte India’s calculations, those earning more than Rs 24 lakh will have to claim deductions of Rs 8 lakh or more, for the old tax regime to be beneficial to them. Put simply, popular deductions under Section 80C (Rs 1.5 lakh for tax saving investment), 80D (maximum Rs 1 lakh for health insurance premium), 24b (Rs 2 lakh for home loan interest) will not be adequate to offset the benefits offered under the new regime.

Will RBI cut the repo rate further?

The Reserve Bank of India (RBI) slashed its repo rate by 25 basis points (bps) to 6.25 percent in February 2025– a first in nearly five years.

With retail inflation dipping to a seven-month low of 3.61 percent in February, below the RBI's 4 percent target, economists are optimistic about an additional 25-bps rate cut in April.

According to a Reuters poll of economists between March 18- and 27, 54 out of 60 expect the RBI to reduce its benchmark repo rate by 25 basis points to 6 percent on April 9. Existing borrowers with repo rate-linked loans will see an equivalent reduction in their home loan interest rates. New borrowers also stand to gain, but as per BankBazaar data, some private sector banks have not passed on the entire rate cut benefit to fresh home loans.

Also read | MC Poll: RBI likely to cut repo rate by 25 bps in April policy

SEBI’s stricter norms for new fund offers

Starting April 1, 2025, Asset Management Companies (AMCs) must adhere to stricter guidelines for deploying funds raised through New Fund Offers (NFOs), promoting transparency and investor protection.

As per a Securities and Exchange Board of India (SEBI) circular, funds must be invested within 30 business days from the unit allotment date. If an Asset Management Company (AMC) misses this deadline, it can request a one-time 30-day extension, but only with the approval of its Investment Committee, which must review and justify the delay.

If an AMC fails to deploy funds within 60 business days, SEBI mandates that the AMC take corrective measures. Specifically, the AMC must halt fresh inflows into the scheme until the funds are fully deployed. Additionally, investors will be allowed to withdraw their investments without incurring any exit load. The AMC will also be required to notify all investors via email or SMS, informing them of their right to exit the scheme without penalty.

SIFs: A new investment category combining mutual funds and PMS

High networth individuals seeking higher returns can explore Specialised Investment Funds (SIFs), a new category that combines elements of mutual funds and portfolio management services (PMS). With a relatively lower entry point of Rs 10 lakh. SIFs allow up to 25 percent allocation to derivatives, unlike traditional mutual funds, which currently only use derivatives for hedging and rebalancing purposes.

For instance, its equity long-short fund strategy will invest at least 80 percent in equities, allowing up to 25 percent short positions via derivatives. Another strategy, ex-top 100 long-short fund can invest at least 65 percent in stocks outside the top 100 by market cap. Similarly, up to 25 percent short exposure is permitted in non-large-cap stocks via derivatives. Additionally, sector rotation long-short funds can invest up to 80 percent in up to four sectors, with 25 percent short exposure permitted at the sector level.

Investors can store holding statements on DigiLocker

Beginning April 1, 2025, investors in the stock market and mutual funds will be able to fetch and store their holding statements from demat accounts and consolidated account statements (CAS) directly on DigiLocker. This initiative, introduced by SEBI, aims to reduce unclaimed assets and provide investors with easier access to their investment details.

Users can appoint data access nominees within the application. In the event of the user's demise, these nominees will receive read-only access to the account, ensuring that crucial financial information is readily available to legal heirs.

To facilitate a smooth transition, the DigiLocker system will automatically notify the nominees upon receiving notification of the user's demise from KYC Registration Agencies (KRAs), regulated by SEBI, enabling them to initiate the transmission process with relevant financial institutions.

SBI Card revises reward points structure

SBI Card is revising its reward points structure for select transactions. Specifically, SimplyCLICK SBI Cardholders will now earn 5X reward points on Swiggy, a reduction from the previous 10X reward points. However, the 10X reward benefit will remain unchanged for transactions with other partner brands, including Myntra, BookMyShow, Yatra, Cleartrip and Apollo 24x7.

Cardholders of the Air India SBI Platinum Credit Card will see a change in their reward points earnings. Previously, primary cardholders earned 15 reward points for every Rs 100 spent on Air India tickets booked through the airline's website or mobile app. This benefit will now be reduced to 5 reward points per Rs 100 spent. Similarly, Air India SBI Signature Credit Card holders will see their reward points earnings drop from 30 points to 10 points per Rs 100 spent on Air India tickets booked through the same channels.

Also read | Starting your first job? Here are 5 personal finance tips to start your wealth journey

Axis Bank revises vistara credit card terms amid Air India merger

Following the merger of Vistara with Air India, Axis Bank is revising the terms and conditions of its Vistara Credit Card. As part of this change, the bank has announced an interim measure that will take effect on April 18. From this date, all Vistara Credit Card renewals will no longer incur annual fees. However, several benefits associated with the card will be discontinued, including complimentary Maharaja Club tier memberships, renewal benefits in the form of ticket vouchers, and milestone rewards that previously offered free tickets or vouchers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.