Owning a home in the right locality is a dream for many Indian families. If the earlier generations built their homes brick-by-brick, the millennials are owning their homes in equated monthly instalments (EMIs). But before a housing finance company steps in to help you own a home, you have to bring your contribution to the table – down payment as the industry terms it.

As the houses in metro cities are priced in the range of Rs 50 lakh to Rs 1 crore, the down payment amount is in the range of Rs 10 to Rs 20 lakh. And arranging for that is an up-hill task for many.

A Pune-based couple – Kaivalya Kulkarni (33) a scientist with a pharmaceutical company and Ketaki Hallur (28) a civil engineer employed with a construction chemical company — decided to buy a property two-and-half years ago. They started from scratch.

Rather, they already had a car loan running and buying a home availing a loan appeared to be a cumbersome task. “A lender is willing to extend home loan only when you bring in your own contribution. Though we were in a position to service EMI, the challenge was to bring in the initial money – down payment,” says Kaivalya Kulkarni.

They decided to save money by starting systematic investment plan (SIP) in mutual funds. The money so accumulated over two-and-half years, they used to make the down payment for their home. “The accumulated money was not enough for banks offering the best rates. So we chose a non-bank finance company that was willing to extend the maximum loan amount though it charged a bit higher rate of interest," he adds.

The high price point is not the only reason why home purchase becomes difficult. Many millennials are rather used to swiping their cards for everything they purchase and pay later in instalments. But while buying home they have to bring in their contribution first and then go for home loan which makes it a tough call. Arranging for down payment can be easy if you look at it as a financial goal, say financial planners.

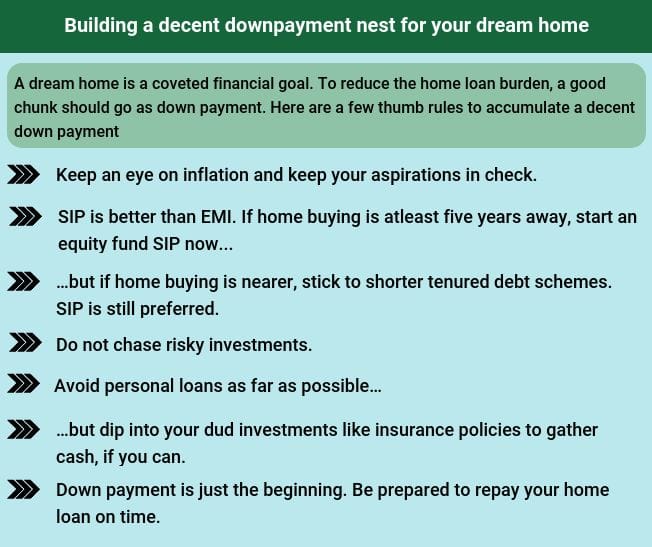

You should know two things very well. When you intend to buy a house and what is the price range you are looking at. If you intend to buy a one bedroom hall kitchen (BHK) unit that is currently priced at Rs 50 lakh, two years from now, then one should adjust it for inflation and then calculate down payment amount.

The house at 5% inflation would cost Rs 55.12 lakh two years from now. The down payment works out to Rs.11.02 lakh at 20%. “While accounting for down payment one should take into account the inflation, stamp duty & registration costs,” says Rohit Shah, founder and CEO of Getting You Rich.

Rates of stamp duty and registration are subject to change. Keep some provision in your estimates for the same.

Also, as a rule of thumb, all financial advisors ask you to restrict your EMI payments per month to be kept below 40% of your net take home income. Let’s understand this with an example, if you are taking a home loan of Rs 40 lakh on a property priced at Rs 50 lakh and the rate of interest is 9.25% for a tenure of 20 years, then EMI works out to Rs 36,635. In such a situation you should have a minimum salary of at least around Rs 90,000 to not stretch yourself completely.

The lesser you borrow, the better it is, as you can repay it with ease. If you have income constraint or you have some other goals as your priority then you should postpone your home buying decision. You may also choose to enhance your income or cut allocation to other goals if you have home purchase as priority.

Where to investOnce you decide to accumulate the money for down payment for your home then you should be focussed on the target amount, time on hand and your risk profile. “If you have more than five years on hand, you should consider investing in equity mutual funds or aggressive hybrid funds,” says Pankaj Mathpal, founder and CEO of Optima Money Managers.

For shorter tenures, it is better to be in fixed income options such as fixed deposits, recurring deposits and bond funds.

If you go for investments in equity mutual funds when you have a year or two in hand and the markets fall in the interim or remain volatile, then you may be left with much less money than you invested.

Markets are unpredictable in short term. If you do not have long term on hand then simply avoid equity funds. Even if you have five year timeframe on hand, prefer to stay with multicap or largecap equity funds over small cap focussed funds though the later offer far superior returns given high risk they entail.

The motive here is not to create wealth but to accumulate money and hence one should weigh capital preservation more than the wealth creation. As you move closer to your desired amount or the deadline, shift your money to relatively less risky fixed income option if you are investing in equity funds.

If you assume 6% rate of return on bond investments, then you have to invest Rs 78,250 per month to reach the target of Rs 20 lakh (assuming that is the down payment you’re aiming at) in two years. This is a task in itself. But if you are a double income no kids household and you are disciplined in terms of your expenses, then this is possible. We assume an investment in bond funds here, because you need to pay the down payment in two years time.

For a five year time frame, assuming 12% rate of return on equity funds, you have to invest Rs 24659 per day. For a double income family this is very much achievable with some deft planning.

For seekers of instant gratification this may sound boring. But there are many disciplined takers for that. Mumbai-based Ketan Pandit (37) is a marketing professional working with a technology company. He aspires to buy a 2BHK house in a standalone building from a reputed builder in suburbs of Mumbai two years from now. He does not want to compromise on his needs. On the brighter side, he doesn’t aspire to live in plush housing society to ensure he sticks to his budget.

He has been investing for various financial goals including down payment for home using systematic investment plans in a mix of equity and debt mutual funds over past fifteen years. “Regular investments in mutual funds are expected to help us to achieve our financial goal of owning a house in Mumbai,” says Ketan Pandit.

Why personal loans is a bad ideaHowever, not all are as patient as Pandit. There is a tendency to go for personal loans while arranging down payment. However, not all financial planners support this idea.

Instead, they ask you to relook at your balance sheet. There are some low yielding investments you would have made in the past without considering your financial goals. You can also look at some of the investments you have inherited and does not fit into your financial plan.

For example, you may choose to liquidate your fixed deposit offering you 6% post tax return. If you have bought a high premium life insurance policy with very low sum assured that has finished the minimum locking in period then the same can be surrendered to avoid the burden of premium and generate some free cash.

A word of caution, before taking such steps, you should not ignore the amount of life cover you have. If you do not have adequate life cover then you may want to buy adequate cover taking into account your needs and loans you may raise, but preferably through a pure term life insurance cover.

Personal loans, if taken, can cost you a lot on two accounts – first they charge high rate of interest in excess of 14% per annum and they eat into your borrowing capacity when you go for home loan. Since home purchase is a large transaction and could call for a high EMI, keep your other borrowings- other loans, if any- to the bare minimum. Repay your existing loans in time and avoid unpaid credit card dues. This ensures a good credit score, which also helps you get a good home loan deal.

A bad credit score can mess up your home purchase process, especially if you come across your poor credit score after you have made down payment. “Before making a down payment, ask your home loan eligibility and ensure that you are paying all your credit card bills and existing loans on time,” says Sukanya Kumar, founder and CEO of RetailLending.com

Though one should avoid taking personal loans, not all of us have the time on our hand. Sometimes a good deal comes your way and you may not have accumulated enough money by then. In such cases friends and relatives too can come to your help. If you are disciplined then you can go for personal loans for small gaps.

“Loans can be considered sparingly. It is better to raise money against securities such as national saving certificate, illiquid bonds or gold if you already have it. These are available at cheaper rates. And raise such loans if and only if you foresee strong cash flows in near future,” says Pankaj Mathpal. You may have large bond investments maturing by end of the year. Make use of your ESOPs, if any. In simple words, make use of what you already have. And keep personal loans, as far away as possible.

“People are usually in a rush to buy the house and we recommend that they use their own savings to fund down payment. Other than the amount of down payment, they should have at least half of it as savings with them additionally. Things could go wrong anytime which people don’t want to think about,” says Shweta Jain, founder of Bengaluru based Investography, a wealth management firm.

While most individuals are focussed on crossing the down payment hurdle, they do ignore the fact that making down payment is just one step in the direction of owning that house.

“When you make a down payment and rest 80% is funded by lender, your own equity in the house is very low. Till you pay the last rupee back to the lender, you cannot call it your own home,” says Suresh Sadagopan, founder and CEO of Ladder 7 Financial Advisories. Be reasonable with your quantum of borrowing. It will ensure that your repayment of loan takes place without much stress.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.