Investors in popular small saving schemes such as Public Provident Fund (PPF), Sukanya Samriddhi Account (SSA) and Senior Citizens Savings Scheme (SCSS) can heave a sigh of relief.

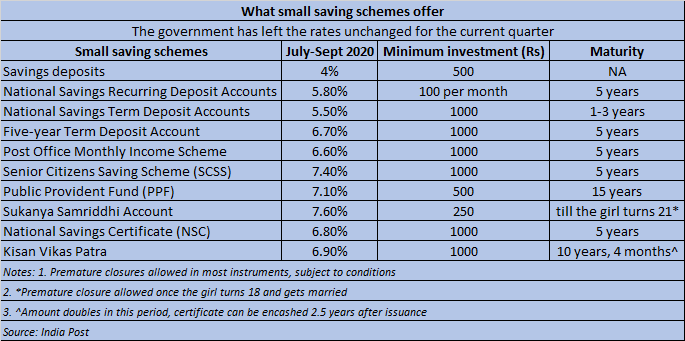

Despite talk of reducing interest rates on these popular schemes, particularly on PPF, due to prevailing benign interest rates, the department of posts has decided to not tweak rates for the July-September 2020 quarter. In March, the interest rate on the highly popular PPF was slashed by 80 basis points to 7.1 per cent, while SCSS saw an even steeper cut of 120 bps, from 8.6 per cent to 7.4 per cent.

Attractive rates retainedEven though small saving schemes’ interest rates have been linked to government security yields since 2011 and are reviewed every quarter, rarely do they move in tandem with market realities to protect small savers’ interests.

These schemes remain attractive not only due to their rates of return, which are higher than those on other comparable debt instruments, but also because of the sovereign guarantee-backed security they offer. Banks have been reducing their fixed deposit rates in line with the Reserve Bank of India’s policy action on slashing repo rate by 115 bps cumulatively since March 27. Currently, the State Bank of India’s (SBI) deposits (less than Rs 2 crore) with tenure of five to ten years carry an interest rate of 5.4 per cent. Senior citizens are offered a higher rate of 6.2 per cent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.