The market regulator SEBI has allowed mutual funds to launch Silver ETFs. According to industry sources, mutual funds are already working out the finer details that would go into running these Silver ETFs.

As with Gold ETFs, mutual funds will have to tie-up with custodians to store the silver equivalent of the ETF units that investors will buy. For some mutual funds, it would just be an extension of their existing agreements for Gold ETFs. But, what can investors expect from this new asset class?

Silver vs goldFor MF investors wanting to exposure to commodities, gold ETFs have been the only option so far. But silver prices tend to behave somewhat differently than gold prices. For example, silver prices are a lot more volatile than gold prices. This is because gold is held in large amounts by institutional investors all over the world: central banks, governments, pension funds, etc.

“As large amount of gold is held by these investors for long periods, it gives stability to gold prices,” says Kishore Narne, head of commodity and currency at Motilal Oswal Commodity.

However, silver prices do get influenced by gold prices, as the former is seen as an alternative to gold.

“When gold prices shoot up, the demand shifts to silver and then silver prices start to go up. Similarly, when gold prices go down, the demand switches back to gold from silver and silver prices start to decline,” points out Rahul Kalantri, vice-president (commodities), Mehta Group.

But keep in mind that this might not always be the case. For example, during periods of economic slowdown, gold prices can go up due to gold’s safe-haven status and silver prices can still go down due to low industrial output.

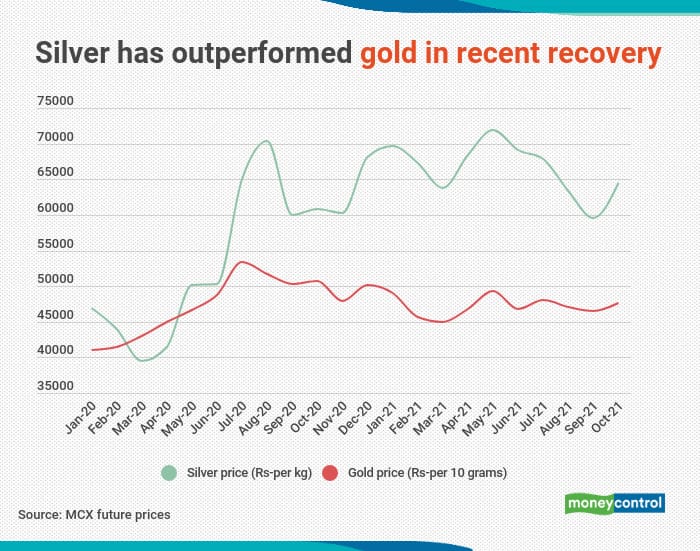

The much lower price of silver compared to gold, makes it lot more affordable for retail investors. One kg of silver is trading at Rs 62,779 in MCX futures market, while 10 grams of gold costs Rs 47,955.

A tactical assetApart from being a precious metal, silver also has several industrial uses. So, it can be a tactical bet on economic recovery and growth.

Silver is used in several electronic components – electrical circuits, batteries, LED chips and RFID chips. It is also has uses in photovoltaic cells (for solar energy), medicine, nuclear reactors, electronic gadgets, electric vehicles, etc.

Due to its price volatility, silver is preferred by traders for their short-term strategies.

Since 2020, silver prices have outperformed gold prices (see: table), but over a 10-year period, gold has fetched better returns for investors.

Today, trading in silver is possible only on the futures market of Multi Commodity Exchange (MCX). However, the rollover costs are high.

“Typically, the annual rollover costs are 8-12 percent of the value of the futures contract,” Narne points out.

Rollover is carrying forward of the same futures contract from one expiry to another.

“A Silver ETF from mutual funds can potentially reduce the cost of trading in silver,” he adds.

According to SEBI norms, the maximum total expense ratio (fees borne by investors) cannot be more than 1 percent for an ETF.

Can it be a hedge against inflation? In a recent report, foreign brokerage Morgan Stanley argues that silver can be a better hedge against inflation than even gold.

“Historically, both gold and silver have made solid gains when US inflation is rising. Both metals are valued in US dollars, so when the dollar falls in value, gold and silver typically rise as they become less expensive to buy using other currencies. Given greater industrial demand, silver tends to rise more than gold amid rising inflation and a falling dollar,” Morgan Stanley says in its report.

Analysts say that if global economic growth is not supportive, silver may not add value to investors’ portfolios.

“Historically, investors have preferred gold over silver to hedge against inflation, as its prices are more stable,” says Hareesh V Nair, research head (commodities), Geojit Financial Services.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.