Retail, risk-averse investors who prefer fixed deposits (FDs) as savings instruments now have a reason to cheer.

Leading banks, including the State Bank of India (SBI) and Bank of Baroda (BoB), have launched special tenure deposit schemes, offering higher interest rates.

For instance, Bank of Baroda (BoB) launched a BoB Monsoon Dhamaka Deposit Scheme offering higher interest rates for 399 days and 333 days. Subsequently, SBI unveiled the Amrit Vrishti term deposit scheme for 444 days.

What is the offer?The BoB Monsoon Dhamaka Deposit Scheme is available in two tenure buckets – offering interest rates of 7.25 percent per annum for 399 days and 7.15 percent per annum for 333 days.

The scheme opened on July 15, 2024. Senior citizens earn an additional interest rate of 0.50 percent per annum -- 7.75 percent for 399 days and 7.65 percent for 333 days.

Similarly, SBI’s Amrit Vrishti offers an interest rate of 7.25 percent per annum on a deposit of 444 days, effective from July 15, 2024. Senior citizens earn an additional interest rate of 0.50 percent (7.75 percent per annum) for 444 days. Investors can invest in this FD scheme till March 31, 2025.

“The interest rates offered under the special tenure schemes are higher, compared to regular tenure FDs, while comparing a similar term of deposit,” says Akshar Shah, Founder and CEO of Fixerra, a banking technology platform.

For instance, for one-year FDs, BoB offers 6.85 percent interest per annum to resident Indians and non-senior citizens. It is lower, compared to the special tenure FD of 360 days, offering 7.1 percent interest per annum to resident citizens and non-senior citizens.

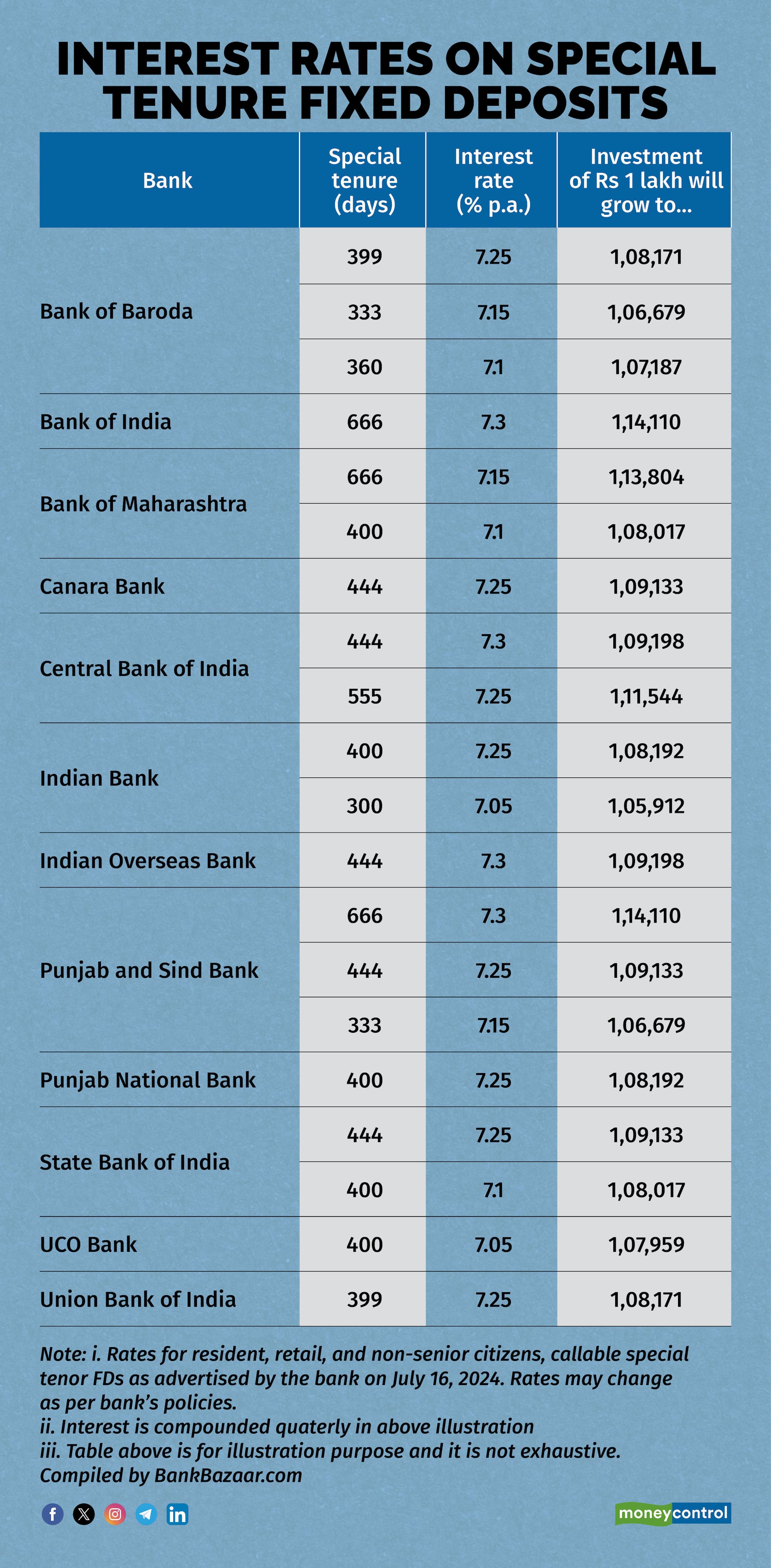

Some banks offering special tenure FD scheme have extended the last date to invest and have raised interest rates (see graphics).

Bank credit grew 14 percent, as of June 28, while deposits grew 11 percent year on year (YoY), highlighting concerns over asset-liability mismatches for the central bank. Recently, the Reserve Bank of India (RBI) governor Shaktikanta Das held a meeting with bank CEOs and emphasised the need to address the gap that leads to asset-liability mismatches.

“So, special tenure FDs are mobilised by banks to neutralise asset liability mismatches in the balance sheet,” says Amol Joshi, Founder of Mumbai-based Plan Rupee Investment Services.

“Higher interest rates for specific tenure FDs are also a way for banks to manage their liquidity,” says Adhil Shetty, CEO of BankBazaar.com. Banks also may have specific needs, such as filling gaps in their maturity ladder, he added.

Who should invest?Short-term new tenure special FDs are ideal for conservative or risk-averse investors looking for assured returns within a relatively short period. If the interest rate is above 7 percent, then risk-averse investors can look at investing in these schemes, says financial advisors.

“These FD schemes benefit senior citizens who can take advantage of the special rates and ensuring good, fixed returns,” says Krishan Mishra, CEO, FPSB India, the Indian subsidiary of the US-based Financial Planning Standards Board Ltd.

Individuals who want to diversify their asset portfolio while maintaining liquidity options may also consider these schemes.

However, investors in FD should note that some banks don’t allow premature withdrawals or early withdrawals lead to penalties, and some may have higher minimum deposit requirements, Shavir Bansal, Founder and CEO of Kifaayat, a FinTech start up, pointed out.

Also read | Fixed deposits or debt mutual funds: Which one is better for you?Key things to look for before investing in special FDsIt’s your hard-earned money, so you must compare rates offered by different banks for the special tenure FD schemes to ensure you get the best return.

“Look for additional features that are available to you along with your preferred investments, like loan against fixed deposits, secured credit card offered against FD and ease of premature liquidation,” says Mishra.

“Special tenure FDs are generally represented in days, so you must convert them to months to easily track your maturities (tenure),” says Shah. Make sure that the tenure is right for you as per financial goals. The extra 25 or 50 basis points will not make much difference, if you end up with a liquidity crunch.

Also explore: High-return FDs offered by trusted banks and NBFCs on the Moneycontrol app.Investment strategyBanks are offering different interest rates for different tenure. “Diversifying across banks remains the golden rule, stemming from the ideology that you should not put all your eggs in one basket,” says Shah.

To optimise the latest hike in interest rates on special tenure FDs, investors should lock in their investments now to benefit from higher interest rates, before any potential future rate cuts. “If you believe that the rates have peaked and may start falling soon, then lock your FDs for a longer tenure,” says Shetty.

“One must choose investment terms that align with their financial goals and liquidity needs,” says Mishra. Further, consider laddering the fixed deposits by investing in multiple FDs with different maturities. This will help manage interest rate risk and ensure liquidity, he added.

In a laddering strategy, you invest in bank FDs with different maturities. This creates a "ladder" of maturity dates, so you have some money maturing every few months or years. This gives you regular liquidity, and you can access your money whenever you need it. It also gives you the opportunity to reinvest your money at potentially higher interest rates in the future.

For short-term deployment, one can choose between FDs and liquid funds. “For individuals with higher tax brackets and who don't mind a longer maturity of five to seven years, one can invest in hybrid funds in line with your risk appetite to benefit from some equity exposure and better taxation,” says Joshi.

Also read | MC Explains: Which is the best bank FD in a rising interest-rate scenario?Limitations of investing in FDsYour money is locked in for the chosen tenure, limiting liquidity options. In case of an emergency, accessing these funds may become costly.

“While FDs are good tools for capital protection and slow growth, they are not the best for long-term wealth creation as the returns after tax and inflation can be negative,” says Shetty.

Just for a few basis points more, one should not choose a shorter tenure FD. “In case of shorter maturity, it is likely that you will choose to not renew for the remaining duration and forgo interest for that period by virtue of the amount remaining in savings account at a lower rate,” says Joshi.

There are other limitations for these special and regular FD schemes, and depositors must know the terms and conditions before investing in FDs.

For example, BoB Monsoon Dhamaka Deposit scheme offers callable and non-callable options to investors. Under callable options, FD investors can withdraw the money before the end of the tenure, while under non-callable schemes, there is no option of premature withdrawal from the FD.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.