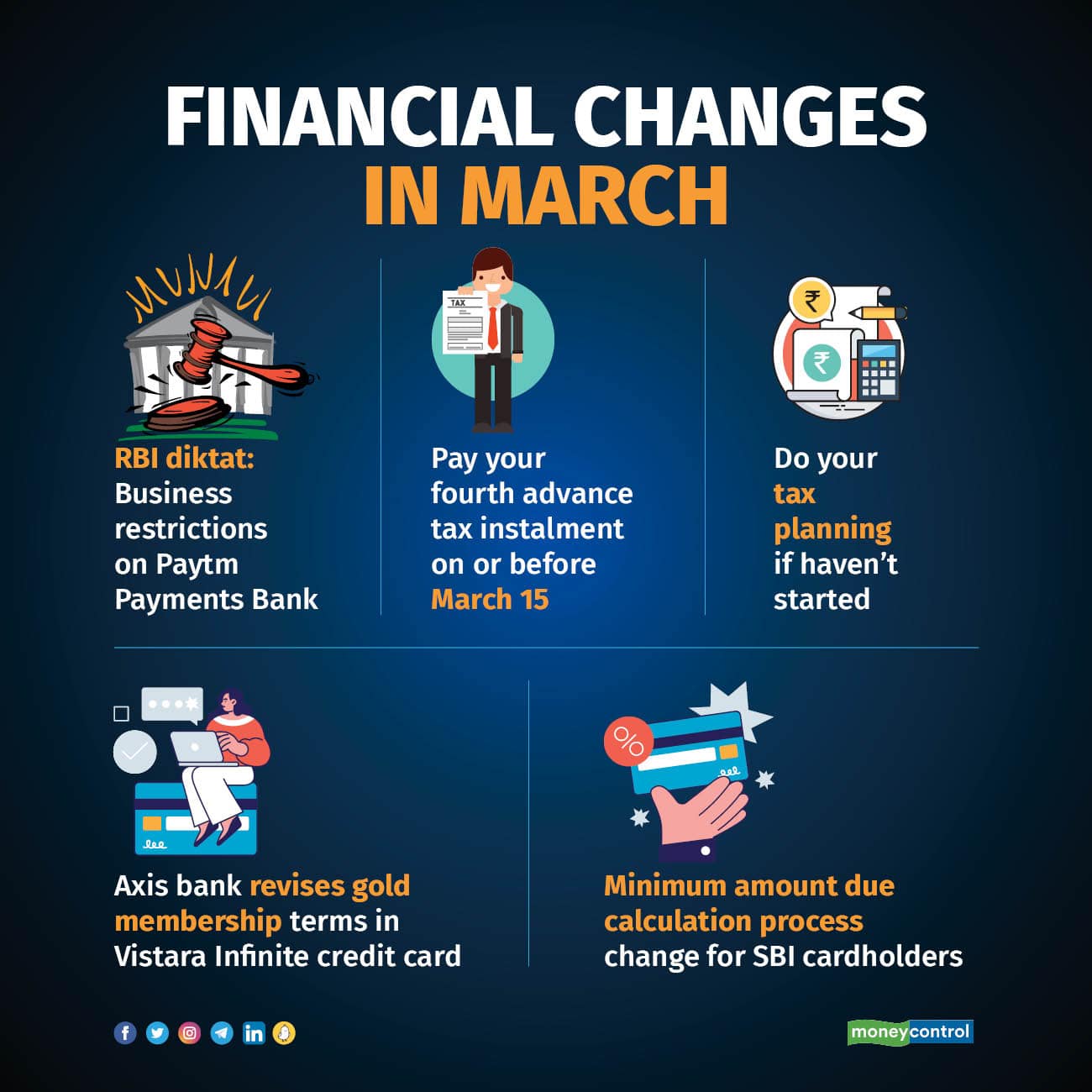

If you are holding a Paytm Payments Bank account, a lot will change this month due to restrictions imposed by the Reserve Bank of India (RBI) which come into effect from March 15. This is the last month in this fiscal for you to invest wisely in tax saving instruments. Further, a couple of banks are changing the terms of their credit cards. Let’s look at some of the most important money changes that’ll impact you during the month.

Will my Paytm Payments Bank account continue after March 15?The RBI on January 31 imposed business restrictions on Paytm Payments Bank, including a bar on accepting fresh deposits and doing credit transactions after March 15. The regulator found major irregularities in KYC, which exposed the customers, depositors and wallet holders to serious risks.

On February 16, RBI issued frequently asked questions (FAQs) for bank account holders of Paytm Payments Bank on what happens after March 15. Here are key takeaways – If you have a savings or current account with Paytm Payments Bank, you can continue to use, withdraw or transfer your funds from your account up to the available balance in your account. Similarly, you can continue to use your debit card to withdraw or transfer funds up to the available balance in your account. Further, you will not be able to deposit money into your account with Paytm Payments Bank. Refunds, cashbacks, sweep-ins from partner banks or interest are permitted credits into your account even after March 15, 2024. In other words, your Paytm Payments Bank account will become mostly useless after March 15.

In case your salary is credited into an account with Paytm Payments Bank. Then after March 15 you will not be able to receive any such credits into your account with Paytm Payments Bank. You should make alternative arrangements with another bank before March 15 to avoid inconvenience.

Also, make alternative arrangements through another bank for National Automated Clearing House (NACH) mandates or auto debit of loan EMIs, before March 15, to avoid inconvenience.

You can continue to use your FASTag to pay tolls up to the available balance. However, no further funding or top-ups will be allowed in the FASTags issued by Paytm Payments Bank after March 15, 2024. It is suggested that you procure a new FASTag issued by another bank before March 15 to avoid any inconvenience.

March 15 is the deadline for the fourth advance tax instalmentIf you’re a salaried individual and think the ‘advance tax’ provision is not applicable to you, you’re mistaken. Advance tax liability may arise for a person having salary as the primary source of income but also having earnings from other sources such as interest from deposits, rental income, capital gains and so on. So, you need to assess your advance tax liability.

According to section 208 of the Income Tax Act 1961, every person whose estimated tax liability for a financial year is Rs 10,000 or more, after taking into consideration tax deducted and collected at source (TDS and TCS), is required to pay advance tax.

Taxpayers are required to pay their annual estimated advance tax liability in four instalments. On or before 15 March, a taxpayer needs to pay 100 percent of the advance tax.

If you miss advance tax payments or delay them, there is penal interest on the taxes due, under section 234C, at the rate of 1 percent per month/part of the month.

Also read | How to use EPF, PPF, and NPS (G+C) to handle the debt side of your long-term portfolioDo not procrastinate tax planning investmentsTax optimisation should always be a part of your financial planning exercise and not a task to be completed towards the end of the financial year. If you haven’t started with your tax planning, then do it now as we are in March, the end of the financial year. Invest wisely, considering your financial goals. You can achieve your tax planning goals by investing in existing commitments, which may include Public Provident Fund (PPF), National Pension Scheme (NPS), Sukanya Samriddhi Yojana (SSY), monthly SIPs in equity linked savings schemes (ELSS), Employees Provident Fund (EPF) or life insurance premiums.

Buy health insurance to get additional tax benefits under section 80D of the Income-Tax Act, up to Rs 25,000 each for self, spouse and children. The same limit of Rs 25,000 is applicable for your parents as well if they aren’t senior citizens yet.

Credit card holders of Axis Bank Vistara Infinite make a note change in terms of complimentary club Vistara gold membership. Effective from March 1, Gold membership will be issued in year one after fee payment, valid for 12 months from the date of upgrade. Gold membership will be credited within 10 working days of fee payment. The cardholders get priority check-in, priority boarding, additional baggage allowance and priority baggage handling on fee payment in the gold membership.

Now, from year two onwards, a cardholder needs to travel at least four times by Vistara flight and accumulate 15,000 tier points in the last 12 months to retain the gold membership. Tier points are earned only on flying with Vistara. If the cardholder is unable to accumulate the requisite tier points and take the minimum number of flights to retain the gold membership status by the end of the 12-month rolling period, the bank will automatically revise to silver membership until the set criteria are achieved within the next evaluation cycle. Upgrade to gold membership will not be considered if the cardholder has achieved the criteria before the completion of the cycle.

Also read | Don't make these five credit card mistakes or you'll be in debt foreverChange in minimum amount due calculation for SBI credit card usersSBI Card is changing the minimum amount due (MAD) calculation process for credit card holders from March, according to its website. The change in calculation method will come into effect from March 15. The bank has communicated this change to cardholders through emails. The MAD will now be calculated as follows, total GST + EMI amount + 100 percent of Fees/Charges + 5 percent of [Finance Charge (if any) + Retail Spends and Cash Advance (if any)] + Overlimit Amount (if any).

In case 5 percent of (Finance Charge + Retail Spends and Cash Advance) is less than Finance Charges, then the MAD calculation will be Total GST + EMI amount + 100 percent of Fees/Charges + 100 percent of Finance Charges + Overlimit Amount (if any).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.