In the current high interest rate regime, deposit rates have also gotten pushed upwards. While your savings bank (SB) account interest rate may not look any different, there is one type of bank deposit which has become fairly lucrative. That’s the recurring deposit or RD. Here, a deposit is made into an account once every month, and the interest compounded quarterly.

RDs can be opened with any bank where you have a running SB account. The interest rates on offer now for RDs are definitely better than your SB account rate, and in some cases tops the FD rates too. You can choose the tenure you want to invest for and automate your investment with a standing bank instruction to move money from your SB account to your RD account.

This tool is an efficient way to plan for short-term goals, keeping capital safety as a priority. What makes it attractive today is the relatively higher interest rate you can lock in.

Also read | Spark Asia's Krishnan says these three sectors have come to life after 15 years

What’s on offer?

According to Nisha Sanghavi, Certified Financial Planner and Co-founder ProMore Fintech, “RD works best for clients who have a traditional mindset because for them safety is the key word that comes to their minds while choosing a short-term investment product.”

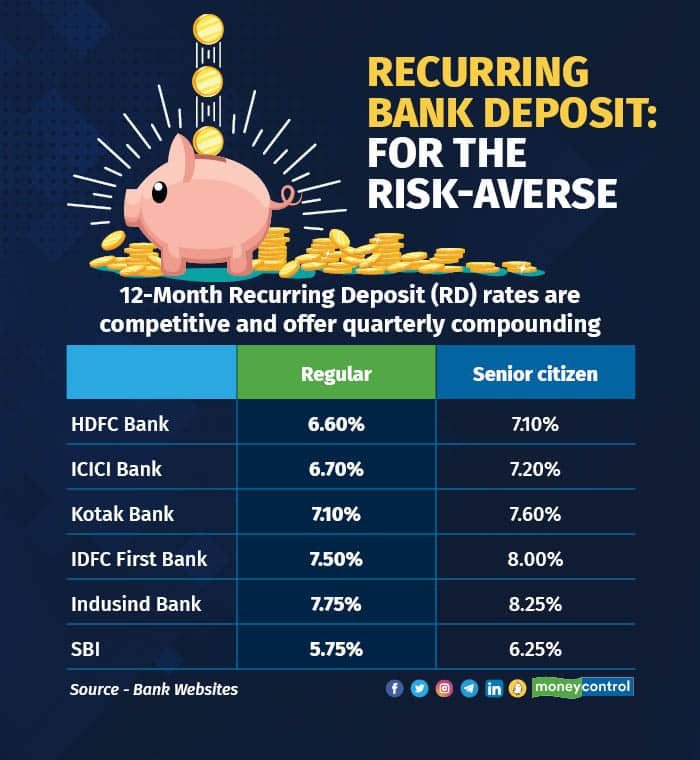

Private sector banks are now offering as high as 7.75 percent on a 12-month RD. A Rs 10,000 monthly RD for 12 months, will fetch you around Rs 1,26,000 at maturity. A 10 percent default tax deducted at source is applied. “Someone in the 30 percent tax bracket will pay tax on interest income as per income tax slab rates, and should be mindful,” says Sanghavi.

“You cannot extend the tenure later at the same interest rate. Hence, define your investment period at the time of account opening,” she adds.

RDs can be a useful tool, where one doesn’t have the choice of making large lump sum investments. Here, small monthly savings are at play. “In an RD investment, the goal is not really to earn major returns. The idea is to accumulate the capital for a particular goal. Ideally, the RD can be opened in any bank where one has a savings account, it’s not worth the hassle of opening a fresh account for an RD, as long as it is a digital process,” says Khyati Mashru Vasani, Founder, Plantrich Consultancy LLP.

The table below shows how different banks stack up on their RD offer.

How can you benefit from an RD?

Firstly, RDs help in automating your regular investments. You define the monthly surplus you want to put away and start investing. This amount is deducted automatically every month and gets invested. Left to manual handling, monthly surpluses usually get spent.

Unlike an FD, the RD gives quarterly compounded interest. This means that the interest you earn in the earlier months, also gains value towards the end. The two are not entirely comparable though.

“It’s not an alternative to short-term fixed deposits or a good short-term debt fund, because those can accommodate lump sums and allow you to remain invested for as long as needed,” says Vasani.

You can start your RD account with as little as Rs 100 a month. It’s like a forced saving.

Also read | Retiring in a few years? Don’t skip de-risking your retirement corpus for sequence-of-return risk

More options

However, it’s not your only alternative. Many advisors prefer a short-term debt fund or a liquid fund, where you can invest small amounts through a systematic investment plan (SIP). Moreover, if eventually you don’t need the entire sum or if circumstances change and you don’t end up using the funds, they can be left untouched for returns to compound.

If you are looking to accumulate funds for a goal which is six-18 months away and are uncomfortable with the volatility in market-linked investments, RDs are a reasonable alternative. The interest offered is comparable to the current one-year short-term debt fund return of 6.5-7.5 percent, and at the same time you have capital safety.

Vasani finds that RDs work best for creating short-term emergency funds or short-term goals. “Recently, a client who wanted to have a grand fifth birthday celebration for their child found it useful to plan using an RD. It works well for things like planning travel goals, paying large insurance premiums, and other such short term goals.”

Locking in rates when the interest rate cycle is on the uptrend and you have capital safety, can help you make efficient returns.

More than one RD can be opened to meet multiple short-term goals. The minimum tenure is six months, and you can lock it in up to 10 years in some banks. Plus, there is no penalty for pausing your RD. An RD can be opened online or via mobile banking. However, be mindful that most banks allow an RD to be opened only if the customer has an SB account running in that bank.

Though an RD may sound like a boring investment option, at current rates, it provides a smart tool to plan short-term goals, even as it provides high capital safety.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!