Quant Money Managers has expanded its offering in the hybrid fund category, with the launch of an open-ended dynamic asset allocation fund, which will invest in both equity and debt.

Dynamic Asset Allocation (DAA)/Balanced Advantage Fund (BAF) is one of the most popular categories in the Rs 40 lakh crore Indian mutual fund (MF) industry. The total assets under management (AUM) under this category is Rs 1.91 lakh crore, as of February-end.

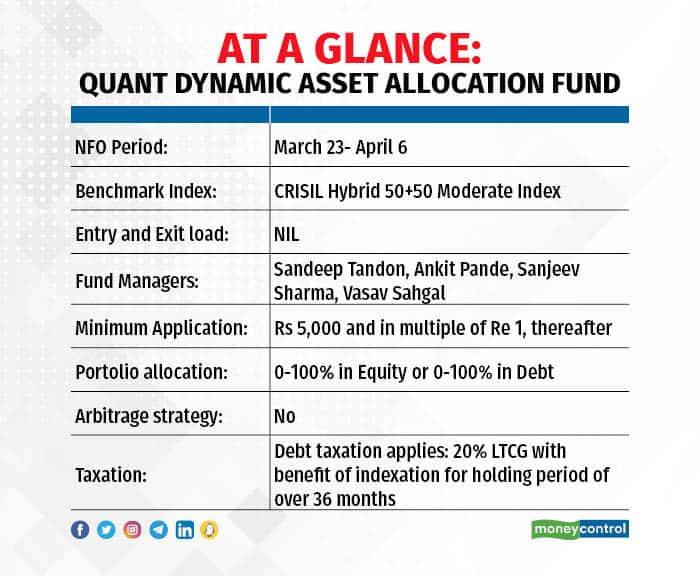

What’s on offer?Called Quant Dynamic Asset Allocation Fund (QDAAF), the scheme will dynamically switch between equities and debt assets based on a risk-on, risk-off environment. The new fund offer (NFO) opened on March 23, 2022, and it will close on April 6, 2023.

Like any other BAF, QDAAF will invest across equity and fixed-income instruments. But QDAAF comes with a twist.

Unlike BAFs, QDAAF will not insist on having a minimal 65 percent equity exposure at any time. “Because of equity taxation, you are forcefully doing arbitrage, though that is not the objective. When you do 65 percent arbitrage, every month you have to roll your positions over and you are unnecessarily increasing transaction costs. What if the market corrects significantly in the future and starts quoting a discount? Then you will have a compulsion to roll over, meaning you have to pay from your pockets,” explains Sandeep Tandon, Chief Investment Officer (CIO), Quant MF.

Also read | Debt funds may lose indexation benefit, be taxed at par with FDs in Finance Bill tweak

The fund house believes that the differential in effective tax rates between debt and equity is insignificant for long-term investors.

There are around 30 DAAs/BAFs in the market, but most keep their equity exposure in the 65-100 percent range and debt exposure up to 35 percent.

According to the fund house, QDAAF is suitable for traditional investors who are inclined towards fixed income-oriented returns and have a low-risk appetite for volatility.

“This scheme endeavours to deliver superior returns than fixed deposits,” Tandon said.

The scheme would try to gauge the prevailing macro environment and try to understand both the quantum of risk appetite and liquidity for various asset classes, and, accordingly, rebalance the portfolio dynamically.

According to Tandon, given the current market conditions, the scheme may look to invest in 100 percent debt, which will be managed “very dynamically”.

“In the current market, the idea would be to focus largely on debt, and then look at short-term opportunities in equities, generate alpha, and then return 100 percent to debt,” said Tandon.

The fund manager is of the opinion that market conditions, like in March-April 2020, would have warranted a 100 percent exposure to equity. “Those opportunities come like two or three times in five years,” he said.

Also read | Why credit cards on UPI is a game changer

When it comes to debt, the scheme would focus on overnight, liquid, shorter-duration bonds and shorter government security funds. Short-term government securities with a maturity of less than a year are called Treasury Bills (T-Bills).

“We are not taking the duration call currently because the idea is to have low volatility,” the CIO of Quant MF said.

The fund managers of the scheme would be Sandeep Tandon, Ankit Pande, Sanjeev Sharma and Vasav Sahgal, and the benchmark would be the CRISIL Hybrid 50+50 Moderate Index.

Further, there will be zero exit load on the scheme, and the expense would be starting around 50 basis points plus taxes in the direct plan.

What works?Quant MF’s proprietary model to pick stocks -- which works a bit differently from most traditional fund houses -- has worked well for the fund house in the last five odd years. Many of its schemes have a good track record over 1-3 years.

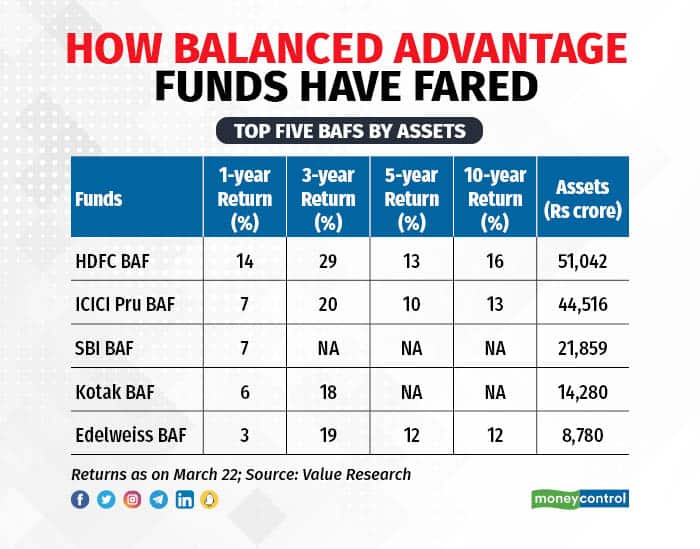

Given that dynamic asset allocation funds have delivered around 3 percent returns on a one-year basis, (data by Value Research), QDAAF may look at 100 percent in fixed-income securities, at this juncture, that might even work well for the fund. High equity exposure for other BAFs has pulled down their returns.

“This may work in QDAAF’s favour as the scheme is launching in a scenario where debt looks attractive and may do well over the next year or so. At the same time, uncertainty in the stock market may also give them opportunities to deploy in equities at some point,” said Harshad Chetanwala, co-founder, MyWealthGrowth.com.

What doesn’t work?Apart from DAA/ BAF, there are options such as conservative hybrid and aggressive hybrid funds for those looking to invest in equity and debt in the same scheme.

Data shows that while aggressive hybrid funds have as high as 80 percent exposure to equities today, conservative hybrids are in debt in the same proportion.

Therefore, investors looking at higher or lower risk in the hybrid category already have options with a proven track record.

Further, no specific model may make the fund a little risky and prone to fund managers’ bias. Debt-like taxation might also prove to be a dampener to many investors.

Quant MF schemes typically come with a high churn ratio. Experts believe that higher turnover rates mean increased fund expenses, which can reduce the fund's overall performance.

Also Read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemes

Note that while the fund house is targeting traditional investors who are inclined towards fixed income-oriented returns and have a low-risk appetite for volatility, the scheme document mentions that QDAAF carries a very high level of risk.

Further, recent amendments in Finance Bill 2023 has proposed that investments in mutual fund where not more than 35 percent is invested in equity shares of Indian company i.e. debt funds, will now be deemed to be short-term capital gains. This may have negative impact on the new fund.

What should investors do?Not all DAAs/BAFs work the same way and it remains to be seen how QDAAF will move between equities and debt over a period of time, especially in volatile markets.

Experts believe that funds in this category are best assessed only after seeing their track record. It’s not just stock selection, it’s also how well the model reads the markets and allocates between equity and fixed-income markets.

Investors would be better off looking at existing DAA/BAF schemes in the market with a proven track record before considering a new scheme.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.