Oral chemotherapy as a cancer treatment has become increasingly common over the years, but many non-life insurance companies were not open to reimbursing expenses incurred by policyholders until 2019.

This is because many considered it an experimental or unproven procedure. Health insurance contracts exclude such procedures from the scope of coverage. In 2019, however, the Insurance Regulatory and Development Authority of India (IRDAI) asked insurers to pay for some listed procedures that hadn’t been covered earlier.

All health insurance policies in place today have to reimburse the cost of these advanced treatment methods. And expectedly, policyholders are making use of the changed rules.

“As such, in case of modern treatment methods, we do not expect too many claims to come in (due to lack of widespread availability). For instance, robotic surgeries are not easily available everywhere in the country. On the other hand, oral chemotherapy is. So, those claims have gone up,” says Bhabatosh Mishra, Director, Underwriting, Products and Claims, Niva Bupa

Health Insurance.

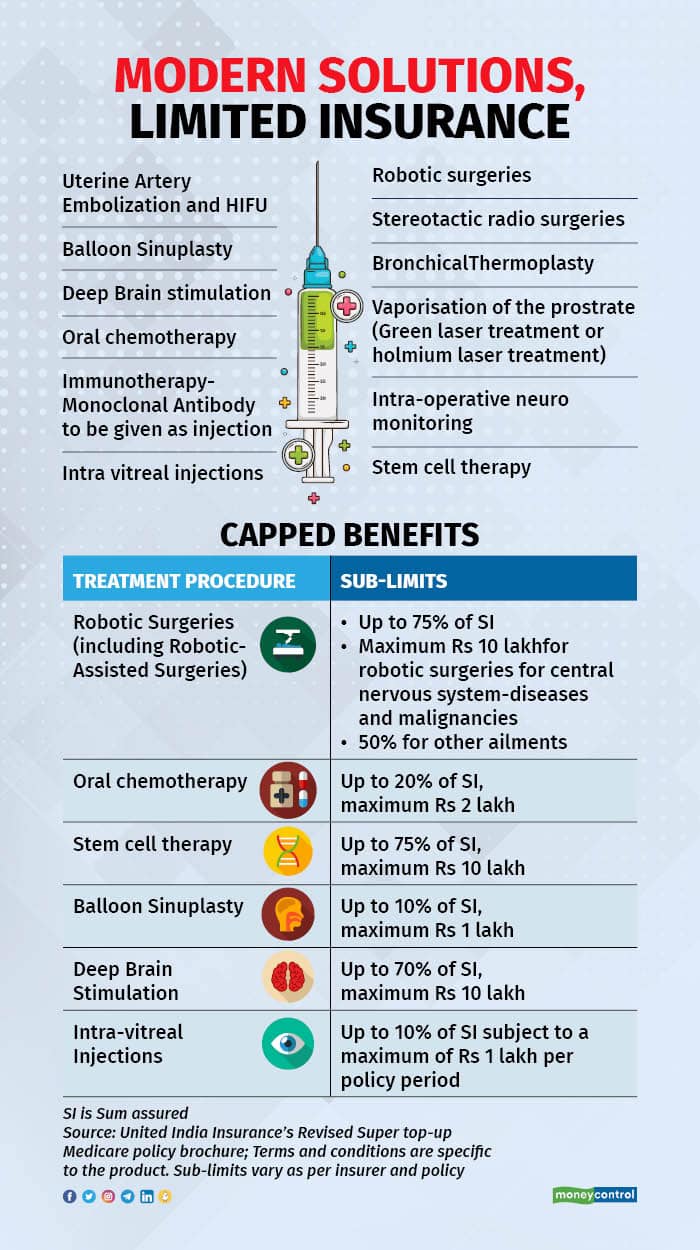

What are ‘modern’ treatments in insurance parlance?At present, IRDAI has specifically named 12 ‘modern’ procedures that insurers have to mandatorily cover as part of hospitalisation, home treatment and day care claims.

These include uterine artery embolisation ( a procedure to treat fibroids without surgery) , balloon sinuplasty (a type of endoscopic nasal surgery), deep brain stimulation, oral chemotherapy, immunotherapy-monoclonal antibodies given as injections -intra-vitreal injections, robotic surgeries, stereotactic radio surgeries, bronchical thermoplasty, vaporisation of the prostrate (green laser treatment or holmium laser treatment), intra-operative neuro monitoring and stem cell therapy.

In addition, insurance companies have the option of covering other modern treatment procedures too.

Also listen: Simply Save podcast | New-look health insurance policies: Advantage for customers, but premiums could rise

Why were these procedures not covered earlier?Many insurers saw these procedures as experimental in nature. IRDAI’s standardisation of exclusions circular also allows insurers to exclude ‘unproven’ treatment procedures.

“Expenses related to any unproven treatment, services and supplies for or in connection with any treatment. Unproven treatments are treatments, procedures or supplies that lack significant medical documentation to support their effectiveness,” the regulator’s 2019 circular notes.

However, many effective therapies, too, got a short shrift due to some insurers’ rigid stance. For instance, oral chemotherapy for cancer patients.

“It is increasingly becoming a widely-used, easy-to-access therapy for cancer patients across the country, even in smaller cities. Yet, some insurers were not willing to cover the cost of the oral chemotherapy medication,” says Abhishek Bondia, Co-founder and Principal Officer, SecureNow Insurance Brokers.

This is why the IRDAI stepped in and asked insurers to cover certain treatment procedures. “A lot of claim disputes were coming in on account of denial of coverage to the treatment procedures that IRDAI has listed in its circular. This is why IRDAI specifically named these as procedures that have to be covered,” says Bondia.

Also read: Mental health: What does your health insurance policy cover?

Why do insurance companies impose sub-limits on the treatment costs?For one, the cost of some of these advanced therapies is high. Secondly, the insurance regulator has permitted insurers to put ceilings in place on the expenses that can be reimbursed. For instance, United India Insurance’s revised super top-up policy will admit oral chemotherapy claims of up to 20 percent of the sum insured, with Rs 2 lakh being the maximum amount that can be claimed.

Now, this is bound to work to the disadvantage of policyholders in many cases. “Many insurers are coming up with workarounds to deny coverage. Imposing caps in policies with higher sums insured defeats the purpose of buying such products. If the sub-limit for an advanced procedure is lower than the cost of a regular surgery, for instance, the insurer is practically denying coverage to the modern method,” points out Bondia.

Insurers, on the other hand, emphasise the need to weigh costs and benefits of advanced surgeries before opting for them. “Do not look at sub-limits in isolation. Healthcare is not a luxury. Policyholders should do their own research and ask the right questions before choosing a more advanced procedure. They might realise that the regular therapies could work better. Ascertain the impact of the newer method on the outcome. For instance, it is not necessary that, say, fibroid removal through a robotic surgery is better than following the conventional method. In fact, it could be worse,” says Mishra.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.