Apple, Facebook and Microsoft, Amazon, Alibaba, Pfizer and Merck: these world-class companies have weathered the COVID-19 storm and their shares have soared. No wonder then that the rally in these stocks has helped a select band of international equity mutual funds (MFs) that invest in overseas markets deliver robust returns.

International equity MFs rank second only to pharma sector funds, which invest only in shares of domestic pharmaceutical firms, in the performance sweepstakes so far in 2020.

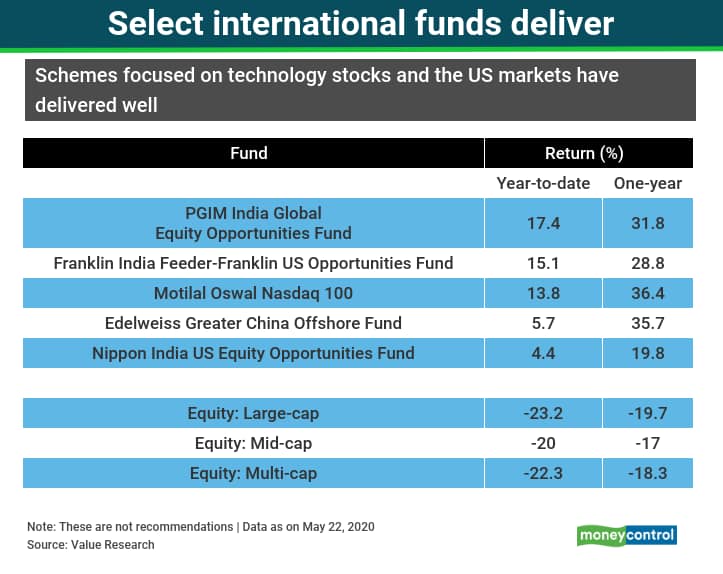

While several international funds have posted marginal declines during the year, a select few have delivered handsome gains, in an otherwise rapidly falling market. In contrast, all domestic equity MF categories (except pharma) have recorded steep double-digit falls in value, as markets declined by than 20 per cent following the halt in economic activity caused by the COVID-19 pandemic.

Tech, ecommerce and pharma themes workMotilal Oswal Nasdaq 100 invests in the Nasdaq-100 ETF (exchange traded fund) and has delivered 36.4 per cent returns over the past one year and gains of around 13.8 per cent so far in 2020. It is the second-best performer among international funds in the one-year timeframe. Only a fund that invests in shares of gold mining companies has done better.

PGIM India Global Equity Opportunities Fund, is another outlier, having surged 31.8 per cent in the last one year returns and 17.4 per cent so far in 2020. The fund counts Netflix, Shopify and Alibaba among its investments.

Edelweiss Greater China Offshore, Franklin India Feeder - Franklin U.S. Opportunities, Nippon India US Equity Opportunities and ICICI Prudential US Bluechip Equity funds are among the best performers in the category.

International MFs investing in tech companies have done well as their businesses have not been adversely affected by the COVID-19 pandemic. In fact, companies such as Netflix have seen a surge in demand for their services, making their stocks an attractive proposition for investors. Ecommerce companies’ shares soared as online ordering surged during the lockdown. Pharma companies too rallied on hopes of their finding a vaccine or a cure for the pandemic.

In addition to creating an opportunity to invest globally, these funds help individuals achieve geographical diversification and at times serve as a hedge against a falling domestic currency. When the local economy or the stock markets don’t do well, like we haven’t in the recent past, investing in these funds makes a lot of sense, say experts. Since Indian investors’ returns are in rupee terms, any depreciation of the local currency against the US dollar will amplify returns and, to that extent, provide a natural hedge to the investment corpus.

“These funds reduce portfolio volatility. They help investors to buy stocks of companies that are otherwise not available,” says Rajeev Thakker, chief investment officer, PPFAS Mutual Fund. “Indian markets represent only a small portion of the global market capitalisation,” he says.

Picking the winnersNot all international funds delivered. For instance, a fund that invests exclusively in Brazilian stocks (HSBC Brazil), has slumped about 33 per cent in the last one year. The country is an oil producer and also an exporter of many commodities. Faced with falling commodity and crude prices, as well as sharply rising COVID infections, the shares of companies listed in Brazil slumped.

So, you have to analyse the funds in the category carefully before making a choice. “Investors should not look at specific countries. They should opt for global diversification,” says Srikanth Bhagavat, managing director, Hexagon Capital Advisors .

While investing in international equity MFs, an investor is also exposed to geo-political and country-specific risks. Their returns are also affected negatively by any appreciation of the rupee.

Several funds in the category, which invest in companies engaged in commodities businesses, have also seen huge volatility in the past—with sharp gains being followed by huge fall in returns. These funds have exposure to a wide basket of companies engaged in commodities businesses including agriculture and energy, which have seen a slump in their fortunes. Investors have to bear these factors in mind while committing money to these funds. “They may look attractive for a while. But investors may end up losing a lot of money as well,” says Vikas Gupta, CEO and chief investment strategist, Omniscience Capital says.

Allocating to international fundsUse international funds for overall portfolio diversification.

“The focus of the investor should be on developed markets, especially US and Europe, as they account for a large proportion of the global market capitalisation and economic output,” says Gupta. “You need to build a (US) dollar based kitty. Such investments would help you build a substantial corpus in the long-term that would be able to meet bigger expenses such as overseas education costs,” he adds.

“If you spread your investments geographically, you have a better chance of withstanding volatility,” says Bhagavat. He suggests that investors deploy 10-15 per cent of their portfolio in such funds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.