When Ahmedabad-based accounts executive Sumit Dalal, 35, applied for a home loan from a private bank, he was a bit amazed at the interest-calculation process.

Dalal was sanctioned Rs 75 lakh, but he took the disbursement of only Rs 60 lakh from the bank. He was expecting the bank to charge the interest only on this Rs 60 lakh.

Instead, Dalal says, the bank charged interest on the entire sanctioned amount of Rs 75 lakh. Upon complaining to the branch manager, the bank recalculated and charged the equated monthly instalments (EMIs) based on the disbursed amount.

There are several such instances of banks and financial institutions charging interest on the sanctioned amount, and sometimes on the disbursed amount.

Why do banks charge interest on the sanctioned amount?

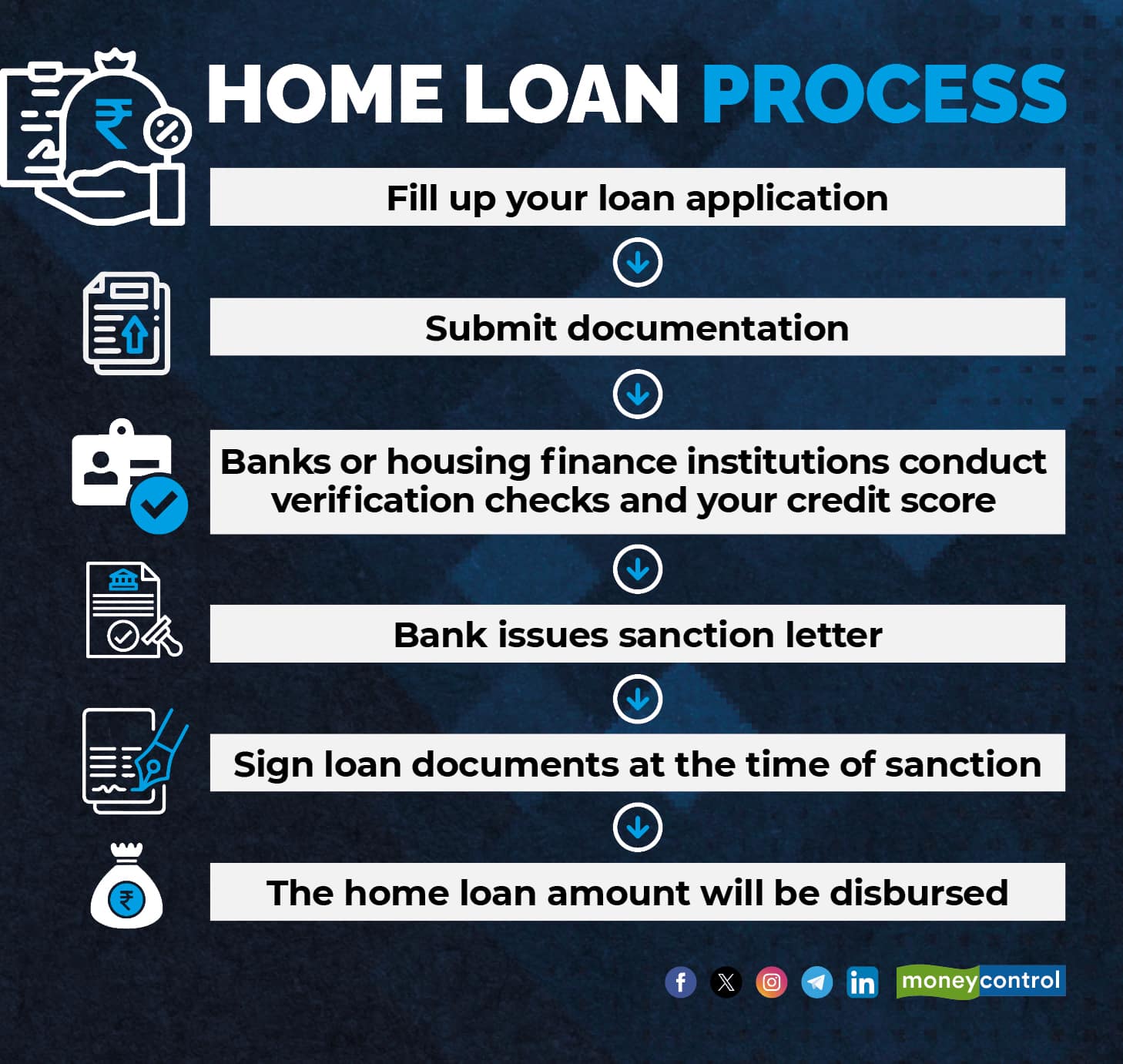

What is a home loan sanction letter?

This is a document banks issue to borrowers, intimating him/her of the loan approval, sanctioned amount, loan terms, and so on.

“We issue a sanction letter after studying the borrower’s credit history, income source, verification of the property to purchase, and so on,” says Gaurav Mohta, Chief Marketing Officer, Home First Finance Company. Some lenders take just up to 48 hours after the submission of application to issue the letter. Typically, it takes a week.

Federal Bank, for instance, takes between three and 14 days to sanction a home loan. “It depends on various internal processes, verifications, document checks, etc,” says Chitrabhanu K G, Senior Vice President and Country Head, Retail Assets and Cards, Federal Bank.

The sanction has limited validity. You cannot apply for a loan today and then use the money, say, after two years. The validity period varies from institution to institution. HDFC Bank’s sanction letter is valid for three months from the date of issuance. Federal Bank’s sanction letter is valid for 30 days.

At some of the banks, a lapsed sanction letter can be reopened, and it remains valid for additional months as per the terms.

Also read | A check-list to keep in mind when relocating to a new city for a job

I have received a home loan sanction for Rs 1 crore. Can I avail a loan for less than the sanctioned amount?

Yes, you can.

Whenever a home loan is sanctioned for a particular amount, the lending bank or institution expects that the borrower will avail it fully.

“If a borrower opts for a lesser amount, he can communicate the same to the bank prior to the disbursement, so that the banks can make the required amendments in the sanction order, documentation, and the loan account,” says Chitrabhanu.

On the other hand, Ambuj Chandna, President, Consumer Assets, Kotak Mahindra Bank, points out that loans, once sanctioned, can also be cancelled. “If the conditions, on the basis of which the loan is sanctioned, are not met (property checks, documentation, profile of the borrower and builder), the loan can be cancelled,” he says.

What is the loan disbursement process?

Once the loan is sanctioned, the financial institution disburses the amount to the seller’s account or to the builder’s account directly. “In some cases where the customer has already paid the builder or a retail seller, the bank may consider reimbursing the same to the borrower’s account as long as the borrower provides the necessary proof of having paid the builder or seller,” says Chitrabhanu.

If a buyer purchases a property under construction, the bank or financial institution will disburse the loan amount either in stages or in full, depending on the stage of construction.

Also read | RBI Policy Impact on Home Loans: EMIs to stay unchanged as central bank holds repo rate at 6.5%

I am applying for a home loan of less than the sanctioned amount. Will the financial institution calculate the EMI on the sanctioned amount or the disbursed amount?

Generally, banks and financial institutions, such as HDFC Bank, Kotak Mahindra Bank, and Home First Finance, calculate the EMI on the total disbursed value, irrespective of the sanctioned loan amount.

However, there are some banks which calculate the EMI on the sanctioned amount. For instance, at Federal Bank, if a borrower has taken a disbursement of 80 percent, the EMI is to be paid on the full sanctioned amount. “We calculate the interest only on the disbursed portion and adjust the additional amount paid to the principal portion of the loan,” says Chitrabhanu.

Also read | Why pre-paying your housing loans early makes good financial sense

There appears to be some miscalculation in the way my bank has calculated the EMI. What can I do?

Talk to your bank. Register a complaint.

In case your bank branch is unable to resolve the issue, escalate it to a designated Grievance Redressal Officer.

For grievances against housing finance companies, Mohta says that it is best to approach the National Housing Bank (NHB), the apex regulatory body for regulation and licensing of housing finance companies in India, to get the issue resolved.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.