The National Pension System (NPS) has grown to be a formidable retirement investment vehicle and one that also gives you tax benefits. It allows investments in equity, corporate debt, government securities and alternative asset schemes. These are managed by seven pension fund managers – LIC Pension Fund, UTI Retirement Solutions, SBI Pension Fund, ICICI Prudential Pension Fund, HDFC Pension Fund, Kotak Pension Fund and Birla Sun Life Pension.

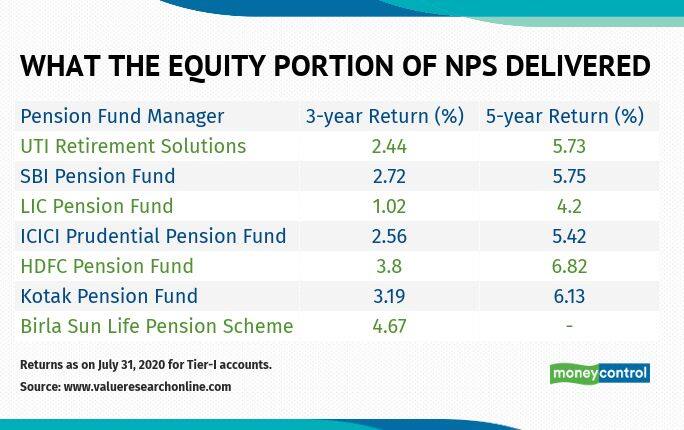

In the last five years, fund managers have delivered 4.2-6.8 per cent annually on the equity portion, according to data from Value Research. HDFC and Kotak’s pension funds were the ones that delivered in excess of 6 per cent over this period. This compares favourably with the large-cap mutual funds category, which delivered 5.5 per cent on an average in the last five years. The Sensex has delivered about 6 per cent during this time.

The options available

You can choose between active choice and auto choices. In the active option, you get to decide how your funds should be allocated across asset classes. If your age is under 50, you can allocate up to 75 per cent of your investment to equities. If you are over 60, the level is capped at 50 per cent. In the auto choice, your allocation will be pre-determined by the scheme, in line with your age. As you grow older, your exposure to equity and corporate debt will shrink, with government securities drawing a bigger share.

At present, the scheme offers deduction under section 80C of up to Rs 1.5 lakh when you invest in the scheme, besides an additional deduction of Rs 50,000 under section 80CCD (1B). If your employer contributes to NPS, you can claim a deduction under section 80CCD (2) of up to 10 per cent of your basic and dearness allowance. While the new, alternative tax regime will not offer most of these tax concessions, the deduction under section 80CCD (2) will continue. In the days to come, the scheme could get investor-friendlier, with proposals such systematic withdrawal option from the NPS corpus, besides annuity purchase, on the cards.

You can withdraw 60 percent of your corpus when you turn 60, without paying tax. The remaining 40 per cent must be used to purchase annuities from designated life insurers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.