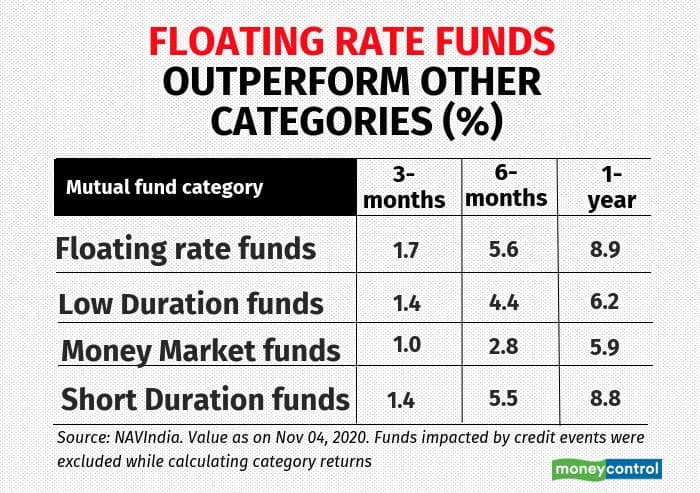

Among the short-term debt fund categories, floating rate bond schemes have managed to deliver outperforming returns. For instance, over the last one year, floating rate funds delivered a compounded annualised growth rate (CAGR) of 8.9 percent, while comparable debt fund categories such as money market and short duration funds have generated a CAGR of 5.9 and 8.8 percent returns, respectively.

As the name suggests, floating rate bond funds invest at least 65 per cent of their portfolios in floating-rate instruments. These also include fixed-rate instruments converted to floating-rate exposures using swaps/derivatives. The balance assets are invested in fixed-rate papers and money-market instruments.

Currently, there are eight funds in the category. Floating-rate bonds are debt instruments issued by the Central and State governments, corporates, and PSUs with interest rates that are reset periodically, say monthly, quarterly or with any other periodicity. The rates are reset with respect to a reference rate. In India, some floating bonds have a coupon rate of the Mumbai Interbank Offer Rate (MIBOR) plus 50 basis points.

Adopting derivative strategiesIssuance and trading of floating-rate bonds have been limited in India. Many companies do not prefer issuing such bonds since they expose them to rate risk. According to industry sources, issuance of floating-rate bonds comprises around 5-7 percent of the entire universe of the Indian bond market.

So, how do floating-rate debt funds meet the mandate of investing at least 65 per cent in such bonds? Under most circumstances, the exposure to actual floating-rate bonds in these funds is limited to 10-20 per cent (barring Franklin India Floating Rate Fund that held around 55 percent in floating rate bonds) in their portfolio. To meet the 65 per cent threshold limit, these funds adopt derivative strategies.

The fund managers of these schemes enter into swap contracts in the debt market to convert their fixed-interest securities into floating-rate instruments. Interest Rate Swap (IRS) is a derivative product used to convert fixed-interest instruments into floating-rate ones. IRS also helps in managing interest-rate risk.

Put simply, assume a fund manager holds a fixed-rate bond paying 5 per cent annually. She expects the interest rate to rise going ahead. As you might be aware, the value of a bond decreases if the interest rates rise. This will result in a drop in NAV value.

So, she enters into an IRS contract with another market participant (mostly large banks) and agrees to pay, say, 4 per cent annually, while the counter party agrees to pay the fund manager a floating rate of, say, MIBOR + 100 basis points. These interest rates are arrived at using some metrics.

When the interest rates rise in the economy, the MIBOR rates also move up and thus the fund manager ends up getting a higher rate. Note, if the fund manager had a fixed rate bond, the value of the bond would go down which, in turn, would lead to drop in NAV. But since she holds a floating rate bond, the interest income she receives increases the NAV value.

As per their latest portfolios, Aditya Birla Sun Life, ICICI Prudential, Kotak, Nippon India and HDFC floating-rate funds have allocated around 48 percent, 53 percent, 40 percent, 52 percent 60 percent and 57 percent, respectively, to swap strategies.

Outperforming other categoriesMany of the funds in the category delivered more than 8 percent return over the last one year.

Deepak Agrawal EVP & Fund Manager-Fixed Income, Kotak Mahindra AMC says, “during the last eight months, RBI has continued to cut rates and infuse liquidity in the system to support growth and mitigate COVID-19. There has been ample liquidity and credit off-take has been weak. We have taken advantage of steep yield curve and through bond SWAP strategy. We have managed the duration of the fund in the 2.5-3 years over the course of last one year. This strategy has helped us outperform other short-term debt categories over six-month and one year periods. The SWAP strategy has definitely contributed to the fund performance”.

Amit Tripathi - CIO - Fixed Income - Nippon India Mutual Fund explains the technical aspect: “A couple of factors helped these funds. One, the spreads between cash and SWAP markets which were high earlier are now compressed. These funds made gains from the spread compression when cash bond yields fell more than the SWAP rates due to good liquidity condition in the market. Second, the relatively higher average maturity of the portfolio also contributed.”

True to this, funds managed with relatively higher average maturity such as Nippon India Floating Rate Fund (2.8 years compared to the category average of 2.1 years) and Kotak Floating Rate Fund (3.6 years) delivered more than 10 percent over the past year.

All floating rate funds mostly hold high-quality portfolios, with holdings in G-secs and AAA and AA+ rated bonds. This mitigates the credit risk. Counterparty risk is minimal as these funds enter into SWAP contracts mostly with large banks. SWAPs are mostly over-the-counter (OTC) contracts.

The efficacy of the fund manager matters in SWAP contracts. Any mispricing or improper valuation and the inability of derivatives to correlate perfectly with underlying assets, rates and indices may not provide desired results.

Can investors bet on these funds?Says Amit “whether they be fixed rate or floating rate assets, both get impacted by interest rate risk. Floating rate bond funds too have mark-to-market risk. In a rising rate scenario, these funds have a better position vis-à-vis fixed rate bond funds to give protection against rate risk. SWAP strategy, on the other hand, restricts the profit in case interest rates decline. However, volatility in floating rate funds as compared to similar maturity fixed rate bonds is slightly less.”

Hence, you cannot expect superior return from these funds. These schemes are suitable especially during rising-rate scenarios. But even in volatile markets, such as the one now, such funds offer the comfort of stable returns.

The head of treasury of a PSU bank who didn’t want to be quoted says, “eventually, these floating rate funds generate returns similar to that of fixed rate funds matching their net duration. In a rising rate scenario, the return generated by SWAP is offset by the capital depreciation that happened in the fixed rate bonds in the portfolio and vice versa”.

Investors with a low to medium risk profile wanting to park money for more than a year can consider investing in these funds. These funds can also be considered as a source scheme to park lump-sum amounts in STP (systematic transfer plan) transactions.

Looking at their performance during various rate cycles over the past four years, it can be seen that floating-rate funds have managed to outperform (though marginally) comparable short term categories.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.