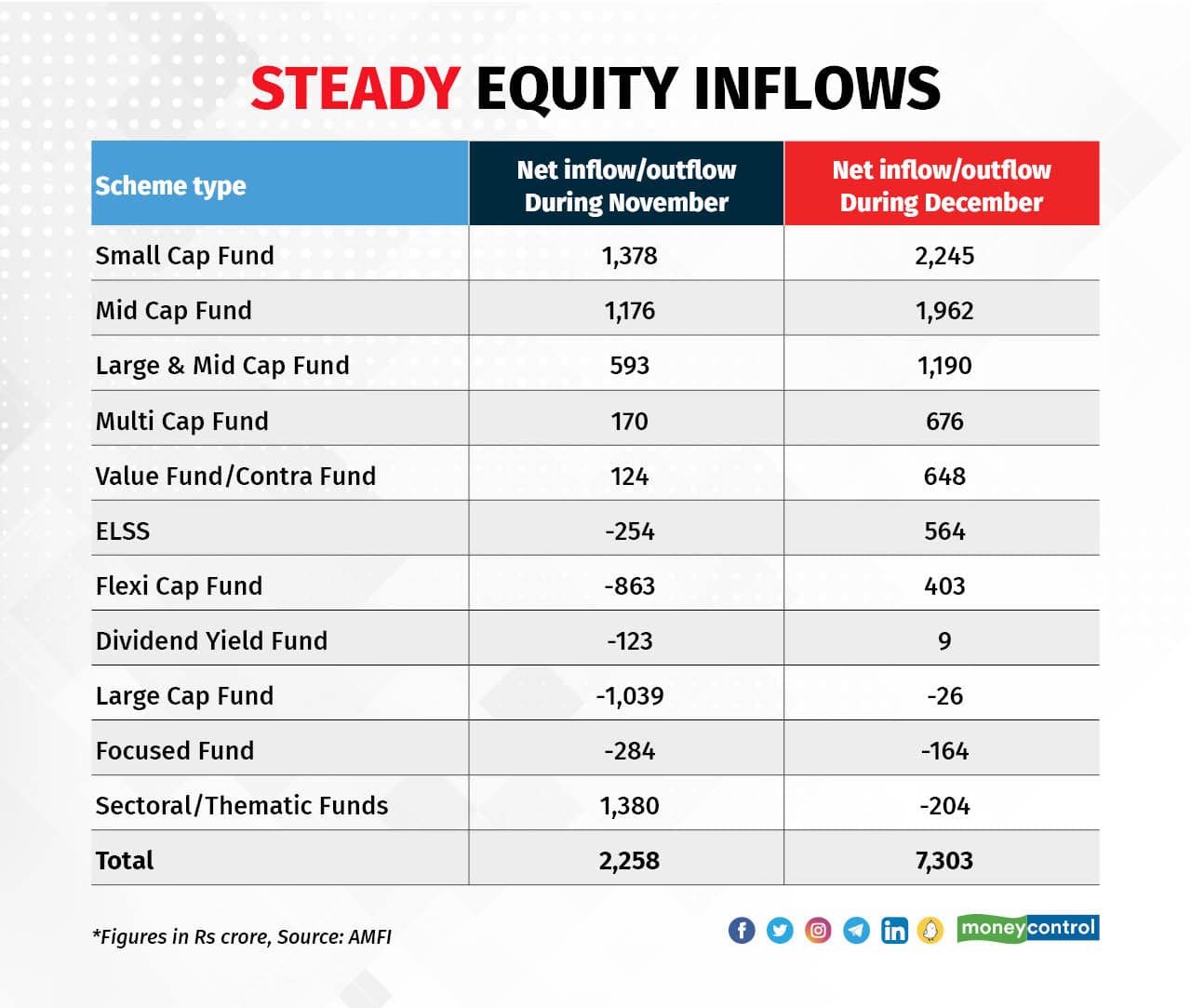

Inflows into open-ended equity mutual funds jumped three times to Rs 7,303.39 crore in December from the previous month, as investors added to positions amid weakness in the market, data provided by the Association of Mutual Funds in India (AMFI) shows.

This is the 22nd straight month when the inflows into equity funds remained positive. The Sensex slipped close to 4 percent in December.

“Essentially, investors believe that India story is intact and they feel that markets will go up ahead, so they are getting ahead of the curve and investing money,” AMFI chief executive NS Venkatesh said.

“Investors will continue to invest in the India growth story through the mutual fund route over the near future. Investors are looking forward to a growth-oriented budget, which should have a positive impact on the markets," he added.

In November, investors were a bit jittery about pricey valuations and inflows into the equity funds slumped to Rs 2,258 crore against Rs 9,390 crore in October.

In growth or equity-oriented schemes, small-cap funds got the highest inflows at Rs 2,244.77 crore followed by Rs 1,962.26 crore in mid-cap funds, AMFI data shows.

Sectoral or thematic funds saw selloff to the tune of Rs 203 crore and outflows from focused funds stood at Rs 163 crore.

Inflows through systematic plans (SIPs), too, increased in December to Rs 13,573 crore against Rs 13,306 crore in the previous month.

Quarterly trend in debtThe income or debt-oriented schemes saw net outflows of Rs 21,946.73 crore in December. The biggest selling was in liquid funds at Rs 13,852.00 crore followed by Rs 2,239.78 crore in floater funds.

Also read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemesThe debt scheme outflows were on account of December being the quarter end when corporates usually take out money to pay tax, Venkatesh said.

In the debt category, ultra-short duration funds saw inflows of Rs 1,737.01 crore.

The flavour of the month from the hybrid schemes was the multi-asset allocation category with net inflows of Rs 1,711 crore, followed by arbitrage fund inflows at Rs 883 crore.

In the other schemes category, index funds saw inflows of Rs 6,736.52 crore. Gold exchange-traded funds (ETFs) continued to see outflows of Rs 273.19 crore as investors booked some profits amid a rise in bullion prices, the data shows.

For the calendar year 2022, the total net flows into all mutual funds stood at Rs 71,443 crore, with positive inflows into equity schemes (Rs 1.61 trillion), index funds and ETFs (Rs 1.65 trillion) and negative inflows into debt schemes (Rs.2.5 trillion) collectively from the open and closed-ended categories.

During the calendar year, SIP inflows averaged more than Rs 12,500 crore per month, helping investors to stay in the stock market and benefit from rupee cost averaging.

"Assets under management (AUM) by end of December stood at Rs 39.88 trillion, an increase of 5.7% in calendar year 2022. This low change can be attributed to uncertainty in stock markets, and changing interest rate scenarios affecting the business environment at large. Understandably, investors have been in step with these changes by reallocating their investments between equity, debt and hybrid schemes,” said Gopal Kavalireddi, Head of Research at FYERS.

During December, a total of 36 schemes were launched, out of which 24 schemes were open-ended and 12 closed-end schemes, introduced in various categories with total funds mobilised at Rs 8,486 crore.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.