When Delhi-based HR professional Shivasishh Daas moved to Japan in 2022, he had put up with seemingly endless procedural hitches while managing his banking affairs.

This, despite having opened non-resident ordinary (NRO) accounts with two leading Indian private banks. Managing NRO accounts proved to be challenging as these banks did not have branches in Japan. He had a particularly tough time while updating his daughter’s account status from ‘minor’ to ‘major’ once she turned 18.

"Despite advancements in technology, banks still require physical branch visits for various operational tasks, which makes the process complex for NRIs (non-resident Indians)," Daas said.

Kolkata-based software developer Supratim Chowdhury, settled in Dubai since September 2023, faced a different challenge when he relocated. For someone used to the convenience of using the Unified Payments Interface (UPI) facility to make payments in India, not being able to carry out such transactions after moving base was a dampener. Although the National Payment Corporation of India (NPCI) has enabled it for NRO and non-resident (external) or NRE accounts, his bank does not support the feature, a fact that he was not aware of. “My bank is not part of the list of banks that support linkage of NRE/NRO accounts with international mobile numbers to facilitate UPI payments,” he said.

Lack of adequate physical presence of Indian banks can create hurdles in the path of smooth savings, investment and payment transactions for NRIs, especially those who may have moved in the recent past. “While Indian banks have established offshore branches in major cities worldwide, their presence is limited and often restricted to select locations,” pointed out Pranav Mishra, head of distribution at Kotak Mahindra Bank's consumer bank division. Additionally, these branches operate under limited licences, constraining their product and service offerings.

“NRIs should consider international banks overseas and Indian banks domestically for their NRE, NRO or FCNR (B) (foreign currency non-resident bank) accounts,” advised Mishra.

Also read | Here's why buying term insurance from India is more beneficial for NRIs

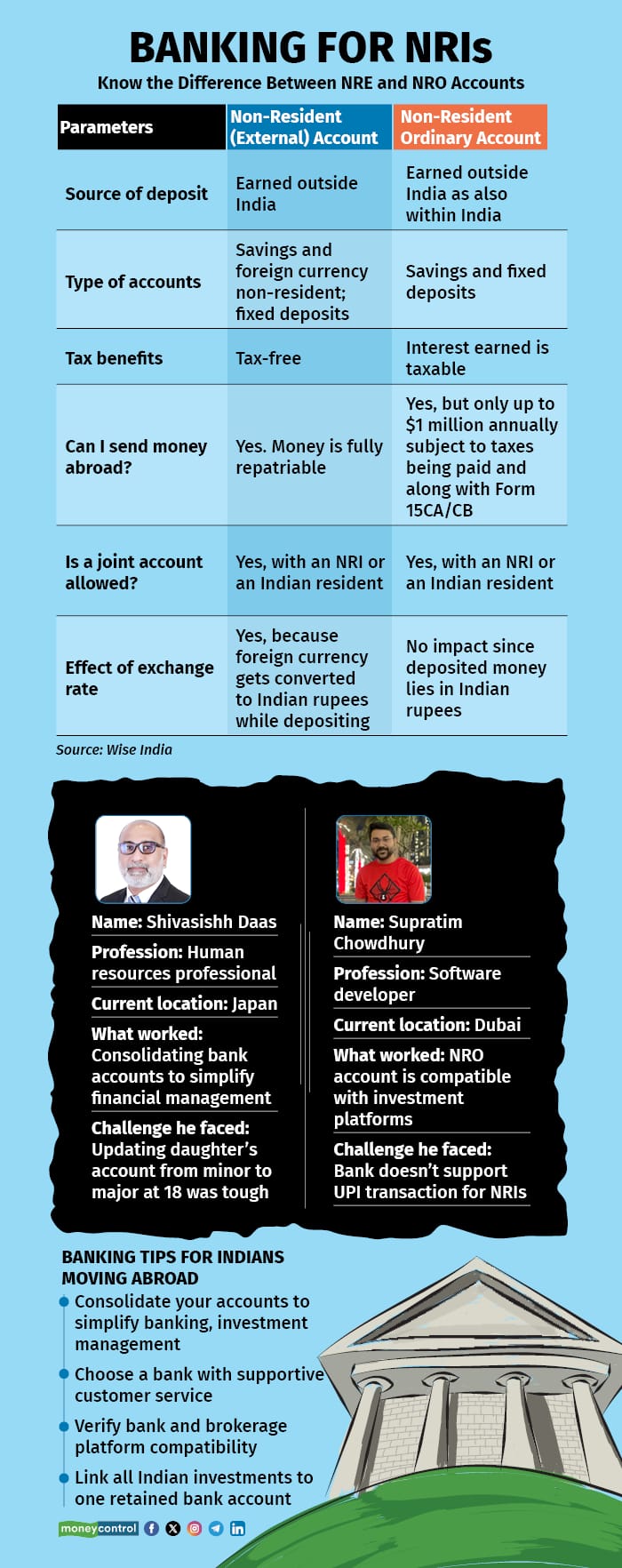

The need for NRE and NRO accountsAs per Foreign Exchange Management Act guidelines, an NRI cannot have a local savings account in his or her name in India. You must convert all your savings (money earned abroad) into an NRE or NRO account.

“It is prudent to declare the change of residential status to the bank to ensure adherence to regulatory guidelines. Further, the NRI can choose to set up NRE savings accounts or FCNR (B) deposits in India to park their overseas earnings in India in a repatriable form,” said Mishra.

NRE accounts offer high liquidity, complete repatriation of funds and tax-free interest, which makes them ideal for parking income earned from foreign sources.

“On the other hand, an NRO account is meant for managing income generated within India, such as rent or dividends, with a yearly repatriation limit of up to $1 million post-tax,” said Amit Suri, founder of AUM Wealth. Here, both non-resident and resident Indians can be joint account holders. With an NRO account, you can receive income in rupees and foreign currency that is then converted to rupees.

Daas believes that individuals working abroad should open foreign bank accounts as these are essential for receiving local income, and employers often do assist with the setting up such accounts. He suggested prioritising employer-facilitated foreign bank accounts, which typically offer English-speaking staff, enabling ease of transactions and communication in foreign countries.

“For instance, in Japan, many banks' mobile apps are in the local language, making it essential to choose a bank that also offers an English-language banking application,” Daas said. It’s important to do due diligence and research when choosing a foreign bank.

“However, opening an account with an Indian bank with branches abroad offers familiarity,” said Arnika Dixit, president and head, branch banking, Axis Bank. For example, many Indian banks have set up representative offices/branches overseas to manage NRIs' needs and to offer cohesive banking experience across bank accounts overseas as well as in India.

“Indian banks that have branches abroad can also provide personalised service tailored to Indian expatriates. Also, you’d be dealing with a bank whose policies and services you already understand,” Suri added.

Also read | What NRIs must keep in mind when investing their money

Do’s and don’ts while relocating overseasDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.