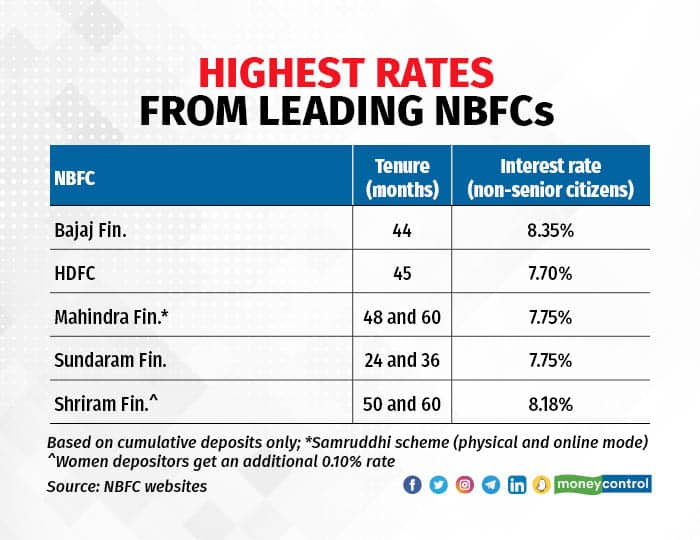

Last week, Bajaj Finance, a non-banking finance company (NBFC), raised its fixed deposit interest rates, yet again. After the latest hike, the NBFC is offering its highest rate of 8.35 per cent per annum on its 44-month deposit (cumulative and non-cumulative with annual interest pay-outs). Senior citizens get an additional 0.25 percent, that is 8.60 percent per annum on these deposits.

So, should you go for these fixed deposits? Their relatively higher interest rates along with high credit rating makes them a good choice. For shorter tenures, though, there are other higher-rate options. Also, remember, NBFC deposits are not at par with bank deposits on the safety front and are therefore, suitable only for those with some risk appetite. For senior citizens, the 5-year Senior Citizens Savings Scheme (SCSS) offering 8.2 percent is an equally attractive no-risk option.

What’s attractive about the Bajaj Finance deposits is that one, they enjoy a AAA rating (Triple A), which indicates a high degree of safety and low risk of default, and two, the rates on them are higher than that on deposits from most other similarly-rated NBFCs. The minimum deposit amount is Rs 15,000. “With a spike in interest rates and taxation at par with debt mutual funds, corporate fixed deposits, especially from well-managed companies with strong balance sheets, such as Bajaj Finance, are a great bet,” says Santosh Joseph, Founder of Germinate Investor Services.

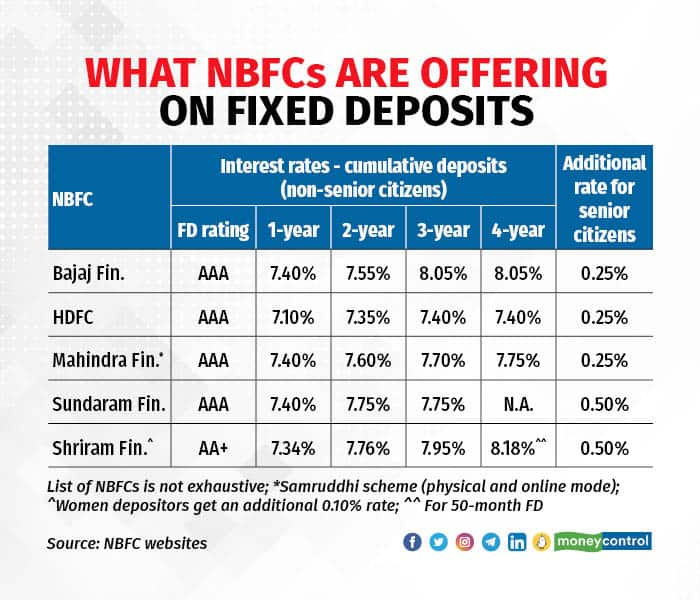

Bajaj Finance’s 8.05 percent on its 36-month and 48-month deposits, for example, is higher than the 7.40-7.75 percent offered by other AAA-rated NBFC deposits. <see table> This is also higher than what most banks offer (excluding small finance banks or SFBs). Data from BankBazaar shows that most leading public and private sector banks are offering 6.5 to 7.2 percent on their three to five-year deposits. A few others such as IndusInd Bank and IDFC First Bank are offering 7.75 per cent on three-year deposits.

But if you are looking for shorter tenure deposits, Bajaj Finance may not be the NBFC with the best rates. Take, for example, two-year FDs. Mahindra Finance and Sundaram Finance currently offer 7.60 per cent and 7.75 percent respectively, compared to Bajaj Finance’s 7.55 percent. FD rates from some of the non-leading banks may also beat Bajaj Finance’s FD rates for below three years.

Senior citizens usually get an additional 0.50 percent and 0.25 percent (or sometimes higher) respectively from many banks and NBFCs over their usual FD rates <see table>. Even after this extra interest is taken into account, longer-tenure (three-year and five-year, for example) FDs from Bajaj Finance beat most bank deposits on interest rates. Given that Sundaram Finance offers senior citizens an extra 0.50 percent, its deposit rates surpass those offered by most banks on their shorter and longer tenure deposits.

But it’s worth remembering that unlike bank FDs that are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) for up to Rs 5 lakh, NBFC deposits do not enjoy such protection. Under the DICGC Act, a failed bank’s customers have to be paid their money (of up to Rs 5 lakh) by the DICGC within 90 days of deposit withdrawal restrictions being placed on the lender.

Importantly, senior citizens must note that the SCSS, which is backed by government guarantee, can fetch them 8.2 percent. This is only 10 basis points (bps) lower than Bajaj Finance’s five-year FD rate of 8.3 percent. But they can invest only up to Rs 30 lakh in SCSS.

Also read: Small-saving schemes turn attractive after March-end rate hike: Here’s what you should doFDs versus debt fundsFor those willing to take on market risk, debt funds can be another possible fixed income investment option. Debt fund returns fluctuate in line with interest rate changes.

A simple comparison that one can make is between AAA-rated FDs and corporate bond funds that invest at least 80 percent of their money in bonds rated AA+ or higher. Currently, corporate bond funds with an average maturity of three to five years offer a yield to maturity (YTM) of 7.3 -7.7 percent. While the YTM is not a perfect return indicator for debt funds where the portfolio undergoes changes (instead of being largely held till maturity as in the case of target maturity funds or TMFs), it provides some indication on what return to expect.

Compared to the current YTM of corporate bond funds, Bajaj Finance’s three-year to five-year FDs can fetch a higher 8.05 percent. Returns from both FDs and debt funds are taxed at one’s income tax slab rate. There is one point to note, though. If you do not need regular income and can remain invested for longer, then corporate bond funds (or any debt fund) can be used to effectively postpone your tax-liability till you redeem your investment. For more details, read this.

Commenting on the Bajaj Finance FDs, Ravi Saraogi, Co-founder, Samasthiti Advisors, says you can use them where you want to match their maturity with some of your goals. “These FDs are good for locking into rates because debt funds, even when they are short-term, do have some interest rate risk. But for someone who wants to take advantage of rates falling in the future, they can go for debt funds for some capital gains (rise in bond prices as interest rates fall),” says Saraogi.

Also see: MC30 List of FundsMoneycontrol’s takeThe Reserve Bank of India (RBI) has been on a rate hike path ― the repo rate has been raised by a total of 250 bps since May 2022. While further rate hikes cannot be ruled out, the expectation is that the central bank may keep rates at current levels for a prolonged period of time before initiating any cuts. This makes it a good time for those with a longer investment horizon to lock into higher interest rates. Bajaj Finance’s FDs make for a compelling choice, especially for non-senior citizens, given their attractive rates.

That said, to avoid concentration risk, try not to park all your FD money with one entity. Also, given that NBFC deposits are not backed by any DICGC guarantee, they rank behind bank deposits on safety. That makes NBFC deposits suitable only for investors with some risk appetite.

Do remember to check the pre-mature withdrawal terms of FDs. If you are not sure about your ability to hold till maturity, make multiple FDs. For example, instead of making one FD of Rs 10 lakh, make five FDs of Rs 2 lakh each. This can come in handy in case you want to encash them before maturity. You can break the deposits to the extent of funds needed and the rest can keep earning the contracted rate.

Also read: In 7 charts: How long-term holding mitigates interest-rate risk and ensures higher returns in debt fundsDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.