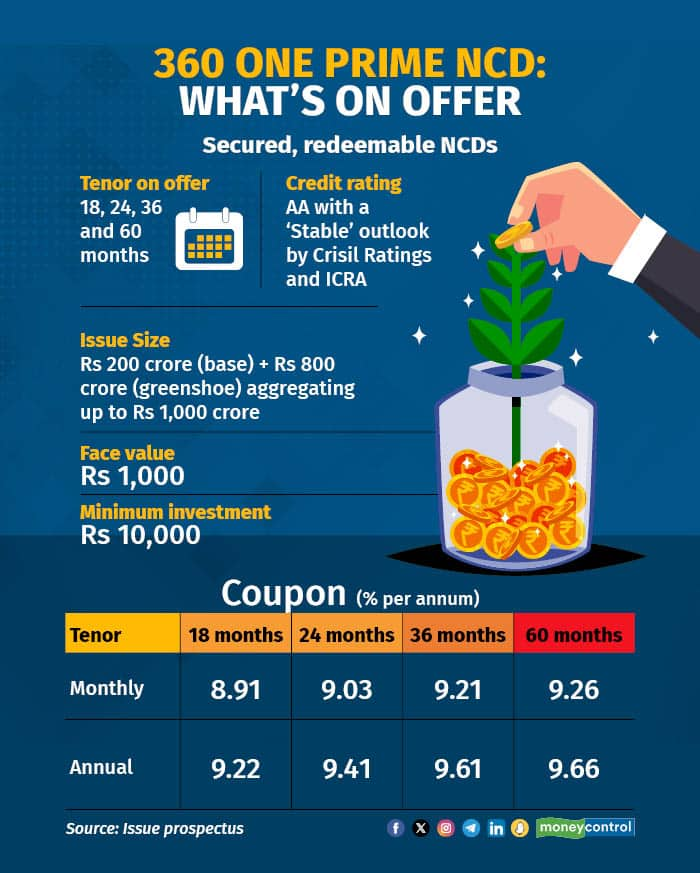

Non-banking financial company (NBFC) 360 ONE Prime (formerly known as IIFL Wealth Prime) has launched its maiden public issue of Rs 200 crore secured non-convertible debentures (NCDs). The NCD comes with a green shoe option of Rs 800 crore, making it a Rs 1,000-crore issue.

A greenshoe is a provision that grants the underwriter the right to sell investors more shares/debentures than initially planned.

360 ONE Prime is a wholly-owned subsidiary of 360 ONE WAM (formerly known as IIFL Wealth Management), operating as a lending vehicle of the 360 ONE group.

AA-rated NCD issue360 ONE Prime’s tranche I of secured NCDs is within the shelf limit of Rs 1,500 crore. The minimum application for the NCD issue will be Rs 10,000 with a face value of Rs 1,000 each.

Also read | Will maverick mid-cap fund manager Kenneth Andrade do an encore with Old Bridge MF?The NCDs offer coupons in the range of 8.21-9.66 percent per annum and are available in tenors of 18 months, 24 months, 36 months, and 60 months, with monthly and annual interest payment options across eight series.

The NCDs proposed to be issued are rated AA with a stable outlook by both Crisil Ratings and ICRA.

The lead managers to the issue are JM Financial, AK Capital Services, and IIFL Securities. The NCDs are proposed to be listed on BSE.

The allotment will be done on a first-come, first-served basis.

Karan Bhagat, Founder, Managing Director (MD) and Chief Executive Officer (CEO), 360 ONE, said, “Our loan approval, administration, collection, and enforcement procedures are designed to minimise delinquencies and maximise recoveries. Further, our processes have been standardised to provide high levels of service quality while maintaining process.”

What works?The NCDs are rated AA with a stable outlook by rating agencies, which indicates a high degree of safety regarding the timely servicing of financial obligations.

Moreover, the interest rates offered are lucrative, at up to 9.66 percent.

In its rating rationale, Crisil Rating said that 360 ONE Group has a strong market position in the wealth management business. “360 ONE Group is one of India’s largest non-bank wealth management payers. Its wealth business assets under management (AUM) grew by 23 percent in the first half of the financial year 2024 to Rs 3.48 lakh crore,” said Crisil.

Also read | Voluntary cancellation of trip to Maldives: Don't expect insurers to pay your claimMeanwhile, ICRA stated that 360 ONE Prime has comfortable asset quality. “360 ONE Prime reported nil gross non-performing advances (GNPAs) on September 30, 2023,” the rating agency said.

What doesn’t work?In terms of credit quality, the issue isn’t rated AAA, which is considered the highest degree of safety. Additionally, NCD issues pale in comparison to debt funds on liquidity grounds.

Also, Crisil has highlighted exposure to regulatory risk in the wealth management business as a key risk. “Unlike lending operations, wealth management is largely a fee-based business, due to which any credit event has a relatively lower impact on the capital base,” it said.

ICRA has said that the rating agency can downgrade the ratings or change the outlook to ‘negative' if there is a material and prolonged erosion in the group’s AUM with high client and advisor attrition.

What should investors do?In terms of interest rate cycles, rates have gone up too much and are expected to soften this year. Given this, investors are looking to lock in rates at the peak of the interest rate cycle for the long term.

Rushabh Desai, Founder, Rupee With Rushabh Investment Services, said, “It's not a high credit-rated issue like AAA-rated. Therefore, it could be risky to take a single-issue exposure in this NCD. Investors would be better off in a medium-to-long-duration fund, which might give little lesser returns but is safer from a risk as well as a liquidity perspective.”

Meanwhile, Vikram Dalal, Founder and Managing Director, Synergee Capital Services, suggests that investors opting for this NCD should only consider tenors of 24-36 months.

Also read | Digital loans: How to avoid scams and predatory lending practices“Interest rates may come down in a couple of years, but then they may shoot up again. Overall, if you see the borrowing profiles of global economies, especially the US and other Western countries, they will not be able to get the cost of borrowing down so easily. That will have an impact on India as well, which may increase the rates here as well,” said Dalal.

Keep in mind that redeeming NCDs before maturity might be a challenge, as the Indian debt market is not that deep. One must also be mindful of taxation, as interest earned on these instruments is taxed at the income tax slab rate.

The NCDs opened on January 11 and will close on January 24, with the option of early closure or extension.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.