Oxyzo Financial Services said on March 23 that it has raised $200 million in Series A at a valuation of $1 billion, making it the largest ever fundraise in the first round by an Indian startup.

The unicorn round was led by Alpha Wave and co-led by Tiger Global, Norwest Venture Partners, Matrix Partners and Creation Investments.

Oxyzo started as the lending platform of OfBusiness, providing cash flow and matched working capital financing for buying new materials for SMEs in sectors such as manufacturing and sub-contracting.

It diversified its product suite and widened the customer base to include SMEs, mid-corporates, as well as new-economy companies. It has assets under management of $350 million and says it has been profitable since inception.

"Both OfBusiness and Oxyzo have a strong borrowing profile enjoying confidence across 50+ financial institutions," Asish Mohapatra, OfBusiness Group CEO, said.

His wife and co-founder Ruchi Kalra, who is the CEO of Oxyzo said, "With the emergence of the digital economy, we see a marked shift in the emerging needs and servicing approach in the B2B segment. We want to be at the forefront of this as a diversified financial services company, differentiated through its innovative financial products and digital platforms on the back of strong credit and origination capabilities."

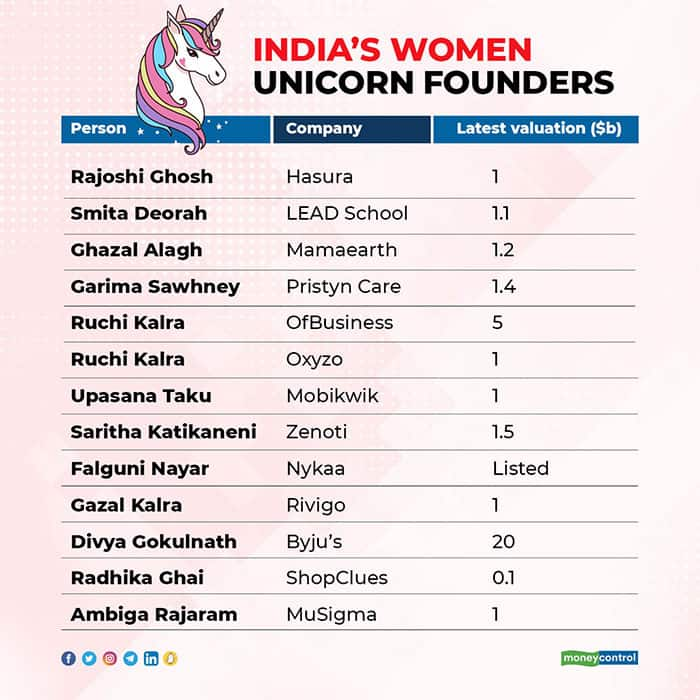

With this, Kalra will also be one of the rare Indian female founders of a profitable fintech unicorn. An alumnus of IIT-Delhi and the Indian School of Business, she has been running the financing business at OfBusiness and looking to go for an IPO this year.

She was a partner at management consulting giant McKinsey before co-founding OfBusiness with husband Asish Mohapatra and others in 2015.

Mohapatra too was an Engagement Manager at McKinsey and also served as the Healthcare Investments Lead at Matrix Partners.

The funds will be used to expand Oxyzo’s broader digital financial services organically and inorganically, scaling the supply chain marketplace, launching innovative fixed-income products for the SME space, and scaling other fee incomes business lines, including debt capital markets and securities.

This will also make it a rare instance of two unicorns being created by a husband-wife duo in India.

Business-to-business commerce and lending platform OfBusiness had last raised $325 million led by existing investors Alpha Wave Global, Tiger Global Management, and SoftBank. At $5 billion, OfBusiness’ valuation has more than quadrupled in the last year, led by an unprecedented funding boom. It was valued at $800 million in April, followed by $1.5 billion in July, $3 billion in September, and $5 billion in December 2021.

Following the pandemic, the Reserve Bank of India (RBI) pushed liquidity into the economy through interest rate cuts and other tools. As small businesses recovered with the Indian economy making a comeback, lending to SMEs picked up pace.

The pandemic also spurred the adoption of digital financial services in India and SMEs are happy to spend less time on managing their money by using online tools on fintech platforms. With small loans sanctioned in just about a day, more small business owners are turning to fintechs for working capital and other loans.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.