Mutual funds bought HDFC Bank shares worth over Rs 42,000 crore in the first half of 2024 even as foreign investors have marginally cut down their exposure in the country’s largest bank in terms of market capitalisation.

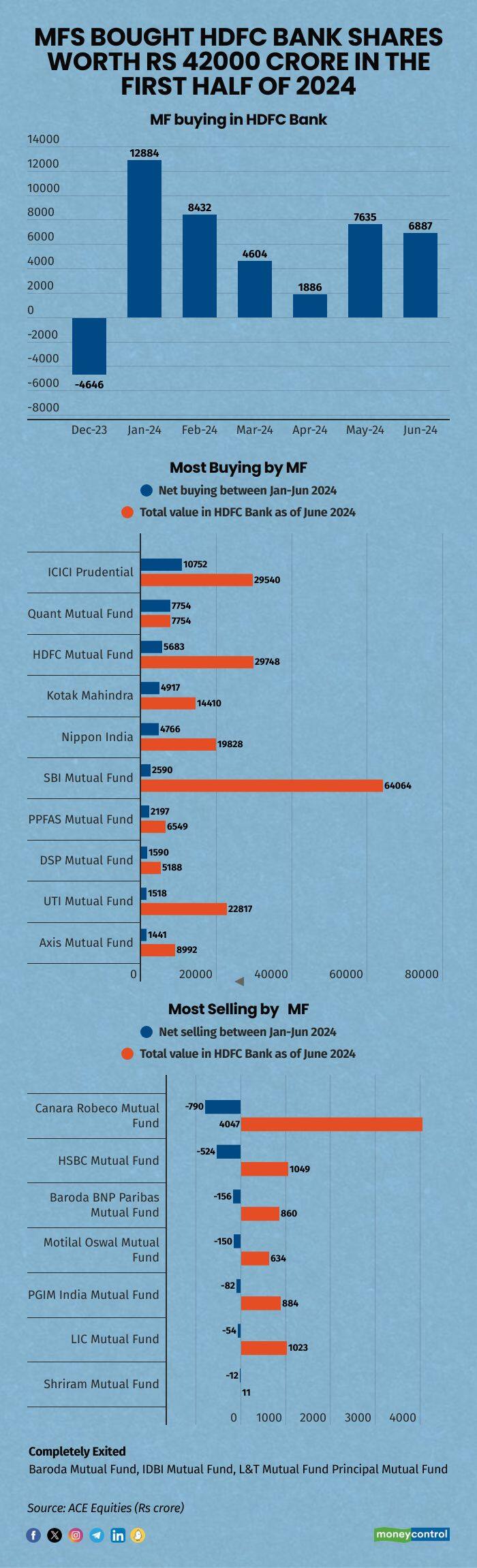

In June, mutual funds bought 4.09 crore shares of HDFC Bank worth Rs 6,887 crore. This marked the sixth consecutive month of significant buying, with previous monthly purchases pegged as follows: May - Rs 7,600 crore, April - Rs 1,886 crore, March - Rs 4,600 crore, February - Rs 8,432 crore, and January - Rs 12,884 crore.

Among individual schemes, ICICI Prudential MF was the biggest buyer of HDFC Bank, purchasing shares worth around Rs 10,750 crore, followed by Quant Mutual Fund and HDFC Mutual Fund at around Rs 7,754 crore and Rs 5,683 crore, respectively. Other significant buyers included Kotak MF and Nippon India MF, which bought shares worth Rs 4,917 crore and Rs 4,765 crore, respectively.

On the selling side, Canara Robeco MF was the biggest seller, offloading shares worth Rs 790 crore, followed by HSBC MF and Baroda BNP Paribas MF, which sold shares worth around Rs 524 crore and Rs 155 crore, respectively.

In 2023, mutual funds bought over Rs 70,000 crore worth of HDFC Bank shares, compared to around Rs 23,800 crore in 2022 and Rs 11,768 crore in 2021.

As of the June 2024 quarter, foreign ownership in HDFC Bank is 54.83 percent, below MSCI's 55.5 percent requirement for a weightage increase. This creates over 25 percent 'foreign room' in the stock, necessary for inclusion at its full market-cap weight.

HDFC Bank's weight in the MSCI EM index is 3.8%, and the drop in foreign ownership opens potential for inflows. MSCI's decision on the weight increase is expected on August 13. Nuvama Research projects that if HDFC Bank qualifies, it could see $3-4 billion in inflows by the end of August.

However, despite the continuous buying activity by mutual funds, shares of HDFC Bank declined nearly 6 percent in the first half of 2024 and 5 percent in 2023 due to weaker earnings.

The stock has underperformed for two years despite a rally in Indian equities, primarily due to consistent EPS downgrades on the back of missed guidance and shifts in rate cycle dynamics.

The management's 'no guidance' policy has received mixed reactions but is seen as favourable amid macro uncertainties. In FY24, HDFC Bank reported a lower NIM of 3.4 percent while the credit deposit ratio stood at 105 percent. Analysts believe the FY25 EPS expectations are low enough to potentially end the downgrade cycle, a key factor for the stock's recovery.

Recently, BofA downgraded HDFC Bank's stock to 'neutral' from 'buy,' lowering the target price from Rs 1,850 to Rs 1,830 per share. BofA expects the stock's risk-reward to remain narrow over the next 12 months. They anticipate potential catalysts to emerge only in FY26, highlighting concerns about a shallow rate cut cycle delaying HDFC Bank's net interest margin (NIM) recovery.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.