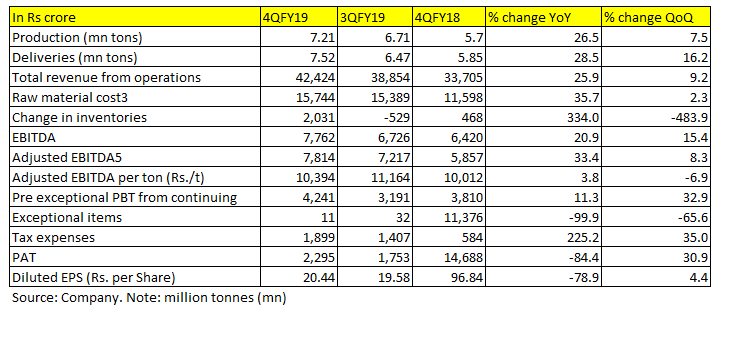

Since January, steel prices softened a bit on account of concerns over growth and global demand. Despite pressure on realisations, Tata Steel during Q4 FY19 reported close to 26 percent year-on-year (YoY) growth in group revenue on strong volume growth.

On a consolidated basis, the company reported overall volume growth of 28.5 percent to 7.52 million tonne, largely on account of the recently acquired company: Bhushan Steel.

Tata Steel India now contributes 63 percent of its volumes and registered a domestic sales growth of 12 percent on a quarter-on-quarter (QoQ) basis. While domestic business saw lower realisations, the group's operating performance was good.

It earned an earnings before interest, tax, depreciation and amortisation (EBITDA) per tonne Rs 10,394 in Q4FY19 as against Rs 10,012 per tonne in the corresponding quarter last year. This was partly on account of Bhushan Steel, which sold 1.14 million tonne of steel during Q4 but reported a sharp reduction in EBIDTA per tonne to Rs 6,911 largely because of lower realisations (due to increase in exports and change in product mix).

The European business, however, reported robust earnings, with higher volumes. It clocked an EBIDTA per tonne of close to Rs 6,591 in the March quarter as against Rs 4,466 year-on-year.

Firm outlook on the back of volume and price Steel prices are expected to remain firm after the elections and may even rise towards the end of FY20 as a result of higher demand. The industry expects over seven percent demand growth for steel in India.

Firm outlook on the back of volume and price Steel prices are expected to remain firm after the elections and may even rise towards the end of FY20 as a result of higher demand. The industry expects over seven percent demand growth for steel in India.

If price environment remains conducive, Tata Steel has many levers to play. Integration of the recently acquired Bhushan Steel will help achieve higher volumes and improve overall India profitability.

The management is hoping that with the help of recent acquisition, like Bhushan Steel, which is producing around 4.1 million tonne and can rise to about 5 million tonne, and about 0.6 million tonne from the newly acquired Usha Martin assets, it can target additional one million tonne of production this fiscal.

Last year, its European operation was hit because of the shutdown of blast furnace, which is now operating at normal rate and can add to overall volumes.

Moreover, the focus is more on profitability and reduction of debt. In Bhushan Steel, there is further scope for improving profitability and the company is targeting an EBITDA per tonne between Rs 10,000 and Rs 11,000. With the divestment of South Asian Business and easing worries over its European business, its debt too should come down. It has already reduced a good amount of its debt through internal accruals. At the end of FY19, its net debt stood at Rs 94,879 core.

Valuation

This is also reflected in its valuations. At its April 25 closing price of Rs 510 per share, its stock is trading at seven times its FY20 estimated price-to-earnings, which is quite reasonable.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.