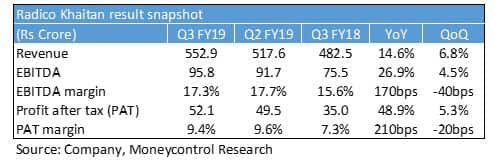

Liquor manufacturer Radico Khaitan continued its earnings momentum gained in the previous few quarters and reported a strong set of earnings for Q3 FY19 as well. Led by volume growth and strong operational performance, the results ticked all major boxes as profit grew around 50 percent during the quarter.

Key positives - Revenue rose around 15 percent year-on-year (YoY) to Rs 553 crore. Strong traction in the premium segment drove overall growth in topline

- Overall volume growth for the quarter under review stood at 7.2 percent on the back of higher sales from its premium prestige & above segment. Volumes for the latter stood at 15.67 lakh cases in Q3 FY19, up 18.5 percent. However, this was offset by the regular segment, which reported a 3.4 percent increase in volumes to 40.97 lakh cases

- Operating profit jumped nearly 27 percent YoY as the company benefited from an expansion in operating margin. Profit after tax increased 49 percent to Rs 52 crore, despite lower other income, as the bottomline benefited from the sharp reduction in finance costs

- Interest expenses continue to be on a downtrend as the company has been deleveraging its balance sheet over the past couple of years. Interest costs in Q3 declined more than 50 percent to Rs 7.6 crore

Key negatives - The company has been a key beneficiary of benign raw material prices (mainly molasses) and has therefore witnessed a significant gross margin expansion in FY18 on the back of a sugar production glut in 2017. However, the recent ethanol policy is having an inflationary impact on raw material prices and pushing input costs higher. The same has been evident through a cumulative 120 basis points (100 bps=1 percentage point) reduction in gross margin over Q2 and Q3 FY19.

- Competitive intensity continues to remain high and therefore the company has upped its selling and distribution expenditure (up 22 percent YoY) to enhance brand visibility and mitigate competitive pressures

Outlook and recommendation - While the sector continues to be under the regulatory ambit of government, the demand prospects seem very exciting as the India has a booming young population. We have a very positive outlook on the liquor consumption space as the per capita consumption in India is far lower compared to western countries and provides huge growth opportunities

- In our view, Radico Khaitan remains well positioned to capitalise on its high brand recall (Magic Moments’ Vodka brand commands a market share of 50 percent in mid-market segment) and strengthening distribution network. The company is trading at a price-to-earnings (P/E ) multiple of 29.8 times FY19 estimated earnings. Considering the huge opportunity size and scope for penetration, we would advise investors to buy stocks on dips with a long-term view

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.