Highlights: - Double-digit sales growth aided by 19 percent volume growth - Mainly helped by growth in value-added products - Good traction in protein products business – expected to touch seven percent of sales in FY21 - PEG of less than one offers an attractive entry opportunity -------------------------------------------------

Parag Milk Foods, one of the largest private sector dairy companies, continues to witness volume-led growth. In recent times, there has been an improvement in milk demand-supply balance, which augurs well for pricing power. At the same time, increasing trend for value-added products, higher distribution reach and foray into north India should help in high teen earnings growth in the medium term.

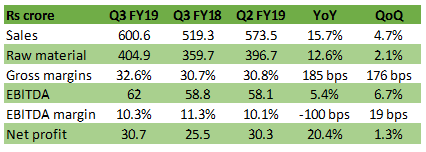

Result snapshot

Key positives The company posted a healthy volume-led revenue growth of 15.7 percent in the quarter gone by. Volume growth was about 19 percent, implying an adverse pricing impact. This is interesting as Q3 FY19 marks the fifth such quarter of double-digit revenue growth largely led by volumes.

In terms of product categories, sales growth was backed by value-added products (19 percent year-on-year), which constitutes 67.5 percent of sales.

Gross margin improved 190 basis points (100 bps=1 percentage point) on account of better product mix, lower milk prices and better export margin.

Key negative Earnings before interest, tax, depreciation and amortisation (EBITDA) margin (10.3 percent), however, contracted 100 bps due to higher other expenses and employee cost. Other expenses increased due to higher investment in distribution expansion and increased advertising expenditure.

Key observation One of the company’s most differentiated product, i.e. whey protein Avvatar, is expected to garner higher sales in FY19 compared to management’s earlier guidance of Rs 25 crore. It is noteworthy that Avvatar product was launched five quarters back, targeting the sports nutrition category. It said its health and nutrition segment, of which protein products are a part of, currently constitute 3.5 percent of sales and is expected to improve to around seven percent by FY21.

The balance sheet is on the mend. Net working capital cycle has improved to 60 days, which is a marked improvement from 72 days in FY18. Inventory of skimmed milk products (SMP) has moderated, leading to lower working capital investment. The management doesn’t have any huge capex plans in the foreseeable future, which should translate to higher free cash flow in medium term and help reduce its debt. Its debt-to-equity ratio stands at 0.4 times and is expected to moderate to 0.2 times in the next two years.

Outlook Domestic demand-supply balance of milk has been restored and management expects a normal milk procurement inflation of 5-7 percent. Recently, there has been an uptick in both domestic and global SMP prices. On account of this, the management plans to reduce trade promotions to start with and then increase product prices.

The company’s aggressive distribution expansion, new product launches and acquisition in north India (Danone facility) is expected to help double revenue growth in the next two years. We pencil in at least high single-digit volume growth in the medium term. The management has guided at a revenue of Rs 2,700-3,000 crore in FY20, which translates to 17 percent sales growth at the lower end of its guidance.

Value-added product share trend

We expect to see an improving trend for both product mix and operational efficiencies. However, due to higher milk procurement prices, EBITDA margin expansion would be gradual in the near term. Here we expect it to stabilise around 10.5 percent in the near term, though the management is hopeful of clocking 11-12 percent EBITDA margin in FY20.

As far as the stock is concerned, it has corrected by 38 percent from its 52 week high and currently trades (16 times FY20 estimated earnings) at a significant discount to the consumer staple universe (around 42 times). As we currently expect earnings CAGR of over 20 percent in the next two years, Parag Milk Foods offers an interesting opportunity (PEG of less than one) on the dairy consumption theme.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!