Ruchi Agrawal Moneycontrol Research

A favourable domestic demand-supply situation aided performance of hotel companies in a seasonally weak Q2 FY19. The quarter gone by saw better occupancies. With limited rooms entering the system and sustained uptick in demand, room rates improved, enabling an uptick in revenue per available room (RevPARs) across companies. We expect the momentum to continue and strong growth to follow, leading to a healthier growth in Q3, given H2 is seasonally the stronger half for the leisure industry.

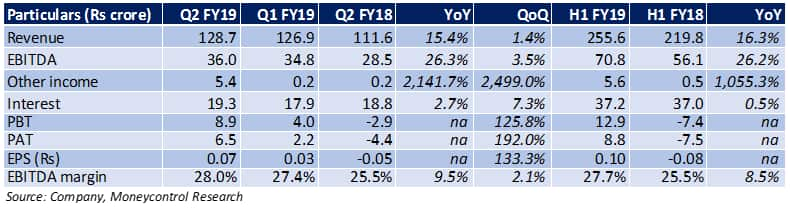

The company posted a steady performance, led by a 9 percent year-on-year (YoY) improvement in room rates and 230 basis points (100 bps = 1 percentage points) uptick in occupancies along with a 3 percent uptick in the number of rooms. Controlled power and fuel costs and rental expenses helped improve operating margin, which saw a250 bps uptick. Higher other income contributed to the improved net profit.

The company is now strategically moving away from large corporates, where price hikes remain limited, and focusing more on the retail segment and mid-corporates, where there is a more dynamic pricing. The company has a healthy pipeline of new rooms in major cities, which would support growth rates and occupancies in the coming term.

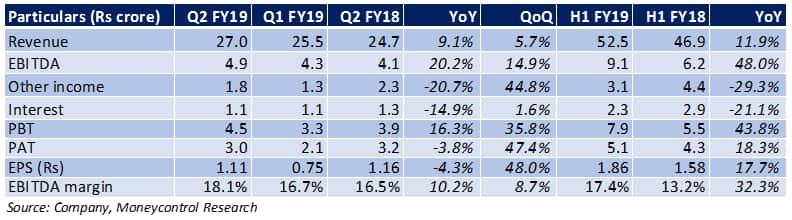

The company reported a healthy 9 percent uptick in revenue, with an improvement in both occupancies and average room rate (ARRs). With a noticeable uptick in margin (160 bps), it managed to record a 20 percent growth in earnings before interest, tax, depreciation and amortisation (EBITDA). Lower other income and higher other expenses led to a 3 percent contraction in net profit. Losses at the subsidiary level have started to trim. With reduced debt, it reported reduced interest cost. It plans to add around 15 more properties in FY19, which would lead to an additional 600 rooms in the portfolio and would provide a boost to topline in coming quarters.

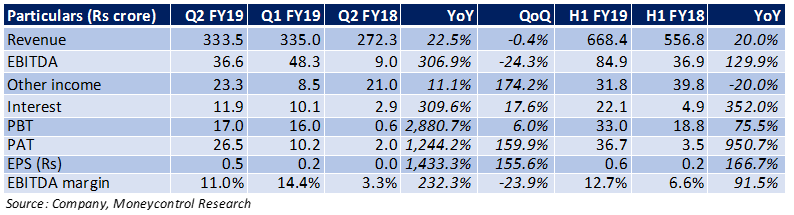

After opening of the prime Oberoi Hotels & Resorts’ property in Delhi in January, EIH (formerly East India Hotels) has seen a steady growth in revenue and profitability. With traction in operations, the quarter gone by saw a strong 22 percent growth in topline. Boost in occupancies and room rates across properties, coupled with cost optimisation, enabled 670 bps uptick in margin. Proceeds from the sale of investments in associate companies led to the abnormal boost in net profit.

The company has a strong pipeline of rooms, which will help drive growth in the longer run. The debt-to-equity ratio at 0.2 times is lower than its peers. With an interest cover of 9.8 times, the company has a cushion for raising funds for development of new upcoming properties.

Outlook The sector had suffered in the past on account of low occupancies and suppressed room rates due to strong supply. However, the overall demand-supply situation is improving, with slowdown in supply and a rapid uptick in demand leading to improvement in rates. With a concomitant increase in occupancy, we expect revenue and profits to improve in the coming year. Most industry players are benefitting from this upcycle.

Owing to higher disposable incomes, deeper technology penetration, and awareness and reach, there has been a flight of customers from unbranded to branded segments globally. This is leading to improved demand for branded hotels and providing pricing power to companies.

Companies are now strategically concentrating on expanding the retail and mid-corporate segment, where there is more pricing power. This would help to improve margin, given the upcycle phase in the industry.

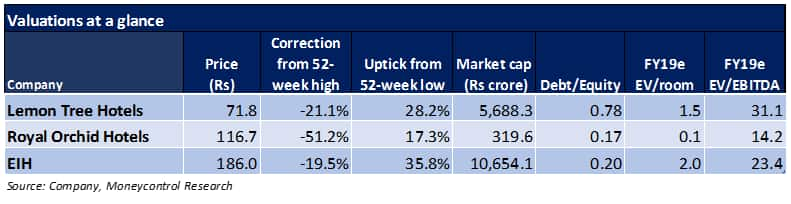

Royal Orchid Hotels is a relatively smaller hotel chain, but is better placed than peers on the valuation front. The hotel chain is growing rapidly and the stock has corrected substantially from its 52-week high.

Lemon Tree Hotels and EIH are both quality stocks, but at their current price it seems a tad expensive. We would like to see a better entry point in these, although they should be kept on the radar as the tourism sector as a whole is positioned for growth.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.