Nitin Agrawal Moneycontrol Research

Highlights: - Strong volume growth across segments in Q3FY19 - Tractor segment outlook weak for short-term, positive for long-term - Construction equipment and railway segments continue to do well - Reasonable valuations --------------------------------------------------

Escorts, the fourth-largest tractor player in India, posted a decent set of numbers in an environment of multiple macroeconomic challenges. The strong performance was driven by volume growth and an improvement in realisation. Operating margin also expanded marginally on operating leverage though raw material prices continue to weigh on profitability.

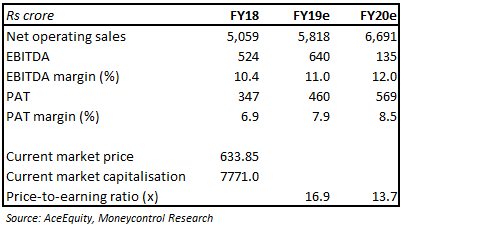

A strong position in the domestic market, new product launches, focus on exports and reasonable valuation (13.7 times FY20 projected earnings) make it a long-term buy.

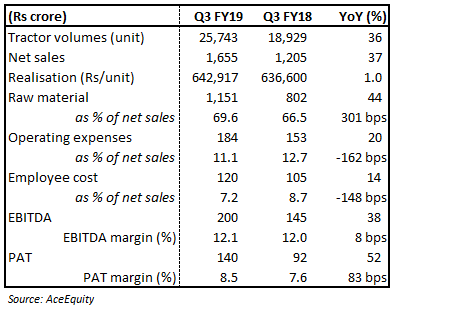

Quarter in numbers:

Key positives Volume – all segments are firing In Q3FY19, Escorts posted a strong year-on-year (YoY) revenue growth of 37 percent driven by 23.9 percent growth in the tractor segment’s revenue (contributes 78.1 percent to total sales). The growth in tractor segment was led by 36 percent growth in tractor volume (34.2 percent in the domestic market and 99.8 percent growth in exports). Escorts also posted a 30 percent growth in construction equipment volumes that led to 44.1 percent growth in segment’s net revenue. Railway segment witnessed net revenue growth of 34.1 percent.

Key negatives – RM continues to put pressure RM prices continue to exert pressure limiting the YoY expansion in earnings before interest, tax, depreciation and amortisation (EBITDA) margin to 8 basis points (bps). The impact of rise in RM was arrested by operating leverage and cost optimisation.

Outlook New product launches Escorts has been aggressively focusing on revamping its product portfolio and continuing to launch new products. In fact, its new launches in the last three years contribute nearly 75 percent of the volume. New product launches have helped market share grow 130 bps in Q3FY19. Focus on continuous innovation and new products will help it grow presence and strengthen its topline.

Focus on export markets Escorts is now focusing on the overseas market, where it is currently a very small player from India but growth opportunities are huge. In FY18, it exported only 2,000 units as compared to 87,000 units exported from India. In order to fill the gap, Escorts collaborated with Kubota Corporation, Japan’s biggest manufacturer, to leverage Kubota’s technological prowess and distribution network to expand its presence in international markets.

Industry opportunities – sluggish in near term Multiple macroeconomic challenges are expected to have a negative impact on the tractor industry in the near term and in light of this, the management has cut the industry guidance to 10-12 percent (12-15 percent earlier). But, we believe Indian farm equipment and tractors is poised to grow in the long term on the back of the government’s focus on rural areas ahead of elections, increasing usage of tractors to improve productivity, farm loan waivers, rising rural income and a favourable monsoon.

Construction equipment has started to add value Strong demand for material handling equipment, backhoe loaders and compactors coupled with cost optimisation and improvement in product mix have led construction equipment business to improve its margins (3.5 percent EBIT margin in Q3 FY19, up 130 bps YoY). We believe the strong demand coupled with operating leverage is expected to benefit construction equipment business in future.

Valuation at reasonable levels The valuation of Escorts is at reasonable levels and it is currently trading at 13.7 times FY20 projected earnings. We advise investors to buy this for the long-term.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.