Highlights:

- Top line lacked muscle, but EBITDA margin grew strongly - Overall slowdown, longer monsoon and market capacity top drag - Online gaming moved at a fast clip - Cruise offers significant opportunity - Sikkim and Nepal casinos may boost net revenue - Buy the stock for long term --------------------------------------------------

Delta Corp (Delta), the only listed player in the casino gaming industry -- live, electronic and online -- in India, has played its cards with care with a decent set of numbers for the September quarter of 2019-20. Though top line lay low, operating margin expanded markedly. With multiple growth drivers at play, we advise investors to pick the stock during this weakness with an eye on the long term.

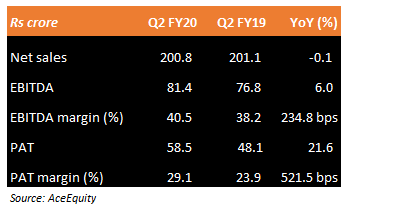

Quarter at a glance

Top line – Muted

During Q2 FY20, Delta posted a flat year-on-year (YoY) top line, mainly because of factors such as an overall slowdown, increase in market capacity by 20 percent and an extended monsoon.

Segment-wise, casino revenue declined 1 percent whereas online gaming contributed a good 17 percent to the overall kitty.

Better than expected operational show

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin rose 234.8 bps YoY during July-September, on the back of 2,150 bps margin expansion in the online business. Casino EBIT margin, on the other hand, contracted by 370 bps due to negative operating leverage.

Though the quarter gone by was in-line, there are multiple growth levers for the company, going forward.

Cruise casino – A new growth driver

Delta had made a strategic investment of $10 million to acquire 25 percent stake in Jalesh Cruises, a luxury cruise, which started its operations in India from April 2019. We see this generating revenue of Rs 25-30 crore annually for the company and in fact, scaling up of operations by Jalesh would lead to significant revenue upside for Delta. During the quarter gone by, Delta hardly saw any revenue from Jalesh due to a prolonged monsoon where the cruise was not operational. However, coming days hold promise for Delta.

Sikkim and Nepal casinos – Revenue builders too

The Sikkim casino is another growth driver, especially after the opening of an airport that led to more tourist arrivals. Nepal Casino has been delayed due to issues being faced by the hotel which is supposed to house it. The management expects it to commence operations soon.

Aggressive focus on online gaming

Focus on online gaming continues to be very strong as it is expected to be the next big driver, given growing Internet penetration and availability of online payment options. Delta had acquired Adda52.com, a poker website, which is clocking strong growth. It has now made an investment of Rs 15.5 crore in Halaplay, the platform which provides leagues in international and domestic cricket, T20s, the World Cup and kabaddi.

The company has started reaping the benefits of investments that it has made, as is evident from September quarter numbers.

Goa’s casino land policy

The Goa government’s new casino land policy, which is in the works, is expected to bring in structural changes. It could lead to creation of gaming zones and thus formalise the industry. Delta, being the leader, is well placed to benefit from the likely move. The policy is likely to be taken up during the winter session.

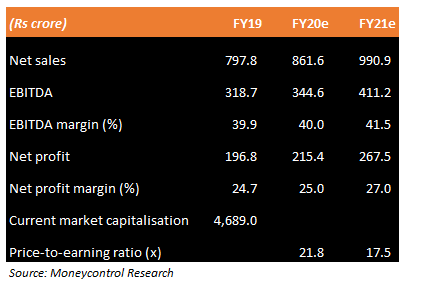

Valuation

At the current price, the stock trades at a valuation of 17.5 times FY21 projected earnings, a strong hook, given its solid growth outlook.

For more research articles, visit our Moneycontrol Research page.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.