On its 100th year of operation, Britannia is getting all set to position itself as a total food company (increasing focus on dairy and macro snacking) from a largely biscuits company. At the same time expanding manufacturing footprints and increasing geographical presence are also helping company in increasing market share.

Repositioning of the company has not gone unnoticed, as evident from the stock movement for last one year. Regardless of the increase in execution risk for the company, as it forays into new territories, stock price bakes in lot of optimism. Further, intensified competition in some of the sub-segments of food & beverage sector like Cheese and Premium biscuits, keeps us on sideline.

Q1 FY18: double digit volume growthBritannia’s Q1 FY19 consolidated sales grew by 12 percent, aided majorly by double digit volume growth in domestic business. Domestic business benefitted from ramp up of distribution network with focus on direct reach, improved demand in rural market and higher growth in northern states.

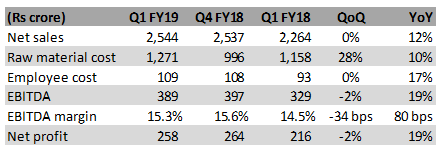

Gross margin expanded 130 bps yoy on benign commodity cost (price decline for sugar and milk). However, EBITDA margin improvement was restricted to 80 bps on account of higher other expenses and employee cost.

Britannia’s consolidated financials

In next few quarters, company would commence various re-launch campaigns. This along with the push for new launches would inch up marketing, advertising and promotional spending. On the raw material front, prices of most of the ingredients are not concerning except for the MSP hike in wheat. Management, however, says that the company has assured raw material supply and covered on the pricing side till Jan’19. However, it has indicated a price hike in the last quarter of FY19.

Further, increased emphasis on cost efficiency along with the continuing premiumisation is expected to support margins in the context of intensified competition.

Improved retail reach and innovation

Company’s distribution expansion has been solid, particularly, its direct reach has increased by more than 2.5 times in over the past four years. Current direct reach is about 1.84m outlets (vs. 1.55 million in FY17) which is 37 percent of the total outlets.

Company has a series of new product innovation and launches on anvil. Center filled croissants, macro snacking (Cake and Rusk) to name a few. In case of croissants, a joint venture with the Greek based baker, Chipita is expected to be operational in couple of months. It’s noteworthy that new products are gross margin accretive.

Strong push in dairy expectedIn the dairy business, company targets cheese, yogurt, whitener and drinks, wherein new launches are expected later this fiscal. Currently company procures about 20,000 litres of milk which is likely to be scaled up to 3 lakh litres per day.

International foraysCompany plans to add one geography per year starting with Indian subcontinent and Africa. Nepal unit is expected to operationalize in current year. It is also looking for a new unit in Bangladesh wherein it is imperative to have a local unit as the import duty is elevated at 150 percent.

OutlookOverall takeaway for the snacks industry is positive as double digit growth in rural areas continue with accelerated growth seen in northern states. While company’s attempt to expand its portfolio and focus on high margins products is commendable, increasing competition in the premium biscuits category and cheese categories needs to be watched carefully.

Further, in last one year, stock has run up by 53 percent and now trade at a multiple of 53x of FY20e earnings which is well ahead of the sector average and prices in near term growth prospects, in our view.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.