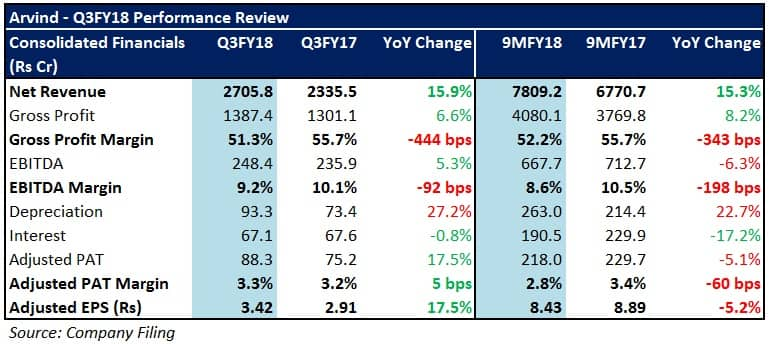

Arvind’s (market cap: Rs 9,817.1 crore) consolidated numbers in the quarter gone by were lacklustre despite strong top-line traction across all its segments. The company’s branded apparel segment was clearly the standout performer on the back of higher profitability and strong year on year (YoY) growth in revenues from power brands.

On the other hand, the textile segment’s numbers were tepid because of lower export sales (attributable to the rupee appreciation in recent times), reduction in duty drawback rates, and a weaker product mix.

An accelerating shift to organised retail will be a major growth catalyst in this segment. Arvind expects most of its brands to break-even by Q4FY18, especially the loss-making licensed ones such as Calvin Klein and Tommy Hilfiger.

Additionally, by virtue of tailwinds such as a favourable demand environment, implementation of store expansion strategies, and increased domestic sourcing of products, the company targets achieving EBITDA margins in the high single-digits from this segment by the end of FY20.

Textile segmentTo facilitate margin accretion, Arvind aims to ramp up the utilisation rate at its garment manufacturing units (to facilitate volume growth) and innovate its product offerings (to fetch better realisations). On other fronts such as fabrics, denim, and wovens, the outlook remains stable.

Demand normalisation in Q4 is likely to revive this segment’s performance. Arvind commenced operations at one of its garment units in Ethiopia (that was set up exclusively to export garments to North America at zero rate of duty) in Q3. The company targets achieving 10 percent margin from the same by FY19 end.

Should you invest?Arvind’s branded apparel segment is on course to deliver high growth because of tailwinds such as margin improvement in its specialty and power brands, optimistic offtake from customers, brand appeal, and network expansion.

In stark contrast, Arvind’s textile segment, the biggest contributor to the top-line, is expected to witness margin pressure in the near-term on account of raw material price and currency fluctuations, lower export incentives, a change in revenue mix towards lower margin garmenting, and initial losses at Ethiopia.

Furthermore, a low capital employed turnover rate, a large portfolio of yet-to-be proven brands, and pending turnaround of ‘Unlimited’ (Arvind’s specialty brand) are some of the other key risks that ought to be addressed by the company.

Arvind has corrected quite a bit in the past few days. In our view, the stock appears to be reasonably valued and offers decent upside potential. However, given the subdued prospects of the textile segment in the immediate future, realistically, a noticeable multiple re-rating may be visible only in the long-term. It’ll be interesting to see how things pan out for the company once its high-growth branded apparels segment is demerged and listed as a separate entity in mid-FY19.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.