Recent earnings from amine manufacturers adds to our conviction on improved business dynamics in the amine sector. Improved exports aided by China, sustained margin profile despite volatile raw material cost (methanol), vertical integration and improving product portfolio keeps us positive on this segment.

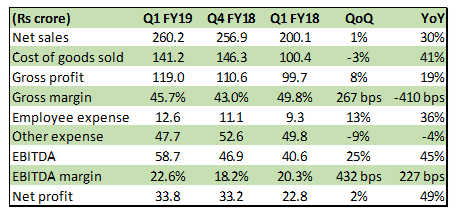

Quarterly result: Elevated methanol prices Balaji Amines exhibited 30 percent year-on-year (YoY) sales growth led by the amines division (98 percent of sales). The latter exhibited 18.8 percent volume growth. Exports (21 percent of sales) saw a remarkable performance, up 91 percent YoY. On a quarter-on-quarter (QoQ) basis, sales were marginally up. While gross margin contracted YoY due to higher methanol prices (raw material cost up 70 percent YoY), there was an improvement on a sequential basis.

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin improved 227 basis points YoY, reversing the contraction witnessed in the prior quarter (Q4 FY19) due to lower other expenses.

Balaji Amines Q1 FY19 result snapshot

Source: Company

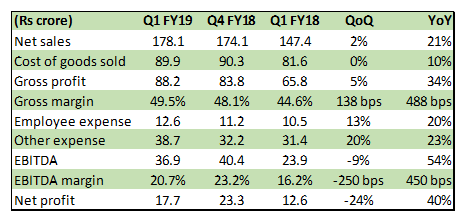

Sales growth in Alkyl Amines had a similar trajectory as Balaji Amines. Gross margin, improved due to better realisation and product mix. EBITDA margin, which improved YoY, sequentially contracted due to higher other expenses. This could be transient in nature and related to Dahej plant, which has been recently commissioned.

Growth in net profit growth was lower than operating profit on account of higher depreciation expense (commissioning of Dahej plant).

Alkyl Amines Q1 results at a glance

Source: Company

Balaji Amines: Beneficiary of import substitution opportunities Among new product capacities, Balaji Amines has already started morpholine production. In case of acetonitrile, it is awaiting some value addition in the process before ramping up utilisation.

Subsidiary Balaji Speciality Chemicals is hopeful of starting operations in October and expects around Rs 100 crore revenue in FY19 itself.

Construction work on the greenfield mega project in Solapur is expected to start by the last quarter of CY18. Capex outlay for first phase remains around Rs 300-400 crore and is focusing on four products (50,000 tonne) - mono isopropylamine, isopropyl amine and additional capacities for methyl and ethyl amines. At present, there is heavy import dependency in India for mono isopropylamine and isopropyl amine.

Additionally, anti-dumping duty imposed on mono isopropylamine in March also aids the pricing scenario. In Phase II of expansion, the company plans to look at products like methyl isobutyl ketone (MIBK) and diphenylamine. The plant is expected to contribute to revenue from FY20 onwards.

Alkyl Amines: Volume growth from new methylamine capacity Alkyl Amine’s Dahej facility was commissioned in Q4 FY18, wherein methylamine capacity of 33,000 MT is now available and expected to reach 70 percent utilisation rate by FY19-end. While this brings some cost savings due to proximity to major raw material sources, its current methylamine (15,000 tonne) capacity in Patalganga may now be used for higher margin derivative products.

Anti-dumping duty protection positive for Balaji Amines In case of dimethylformaldehyde (DMF), the anti-dumping investigation is expected to be completed in a month. Balaji has an installed capacity of 30,000 tonne. Capacity utilisation can ramp up from the current sub-30 percent utilisation rate on a favourable decision. Interestingly, the improved pricing environment has already improved utilisation.

Early this year, on account of anti-dumping duty on dimethylacetamide (DMAC, 6,000 tonne capacity), capacity utilisation has gone past 70 percent and margin has normalised.

Methanol sourcing issues can further perk up material cost The US trade policy with respect to containment of Iran is impacting key raw material - methanol - sourcing in two ways. Frist, about 20-25 percent of amine manufacturer’s methanol requirement is sourced from Iran. So, there is a volume impact if Iran is completely isolated. Second, there is a difficulty in dollar payment.

Balaji Amines’ management said the current developments have contributed to a price premium of about 25 percent, which can ease as these developments subside. However, complete cut off of Iran would mean methanol sourcing from other locations like Saudi Arabia, Malaysia, Qatar as well as the local market (Deepak Fertilisers & Petrochemicals Corporation). The management expects another 10 percent increase in methanol prices because of that, but is also hopeful of passing on the price increase to end customers.

Stock price to move in tandem with earnings growth Both Balaji Amines (15.3 times Fy19e earnings) and Alkyl Amines (19.2 times FY19e earnings) are well placed for growth in the near duopoly market of aliphatic amines. Amines companies benefit from new product capacities, improving end markets, product pricing scenario and technological capability.

Near term challenge with respect to methanol sourcing and related price volatility. However, strong end markets suggest companies should be able to pass on moderate increase in raw material prices.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.