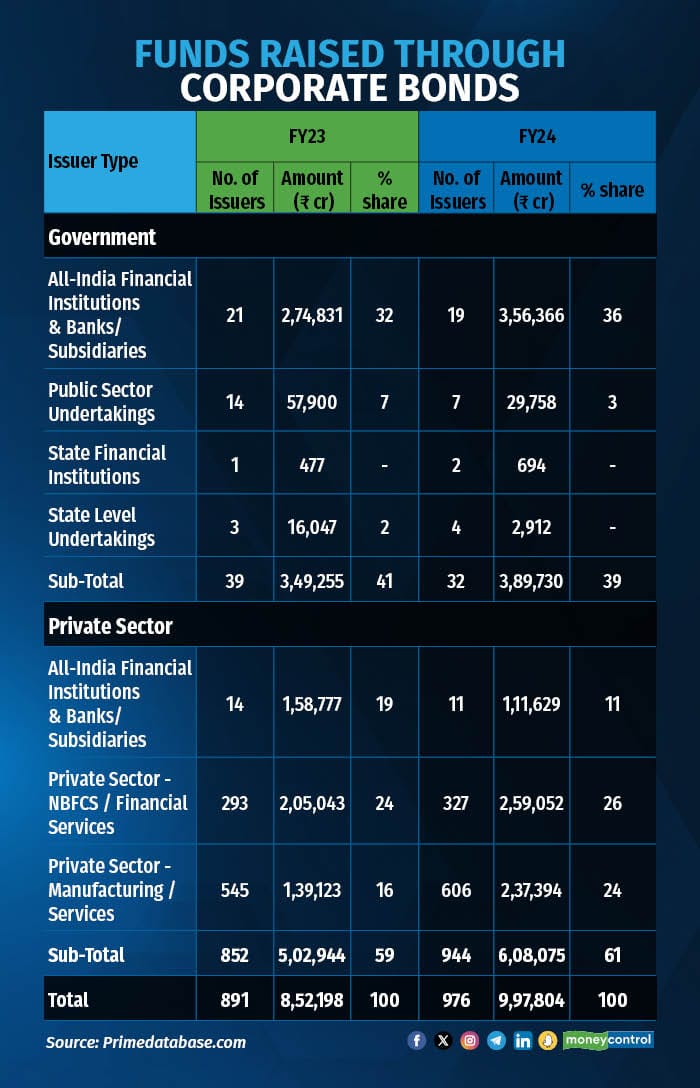

Funds raised through privately placed corporate bonds hit a record high of Rs 9.98 lakh crore in FY24, up 17 percent over the previous year.

“Despite changes in taxation relating to debt mutual funds and expectations of lower borrowing costs, there was a surge in credit demand on the back of strong economic growth,” said Pranav Haldea, Managing Director of Prime Database Group.

A private placement is a sale of bonds to preselected investors and institutions rather than one in the open market. Unlike a public offering, private placement is exempt from filing an offer document with the Securities and Exchange Board of India (SEBI) for its comments.

Financial institutions and banks raised most funds through this route at Rs 4.68 lakh crore compared to Rs 4.34 lakh crore in FY23. The private sector (excluding banks/FIs) also witnessed an increase in mobilisation, up by 44 percent to Rs 4.96 lakh crore.

The highest mobilisation through debt private placements during the year was by NABARD (Rs 65,393 crore) followed by REC (Rs 52,140 crore), HDFC (Rs 46,062 crore), PFC (Rs 45,130) and SIDBI (Rs 38,600 crore).

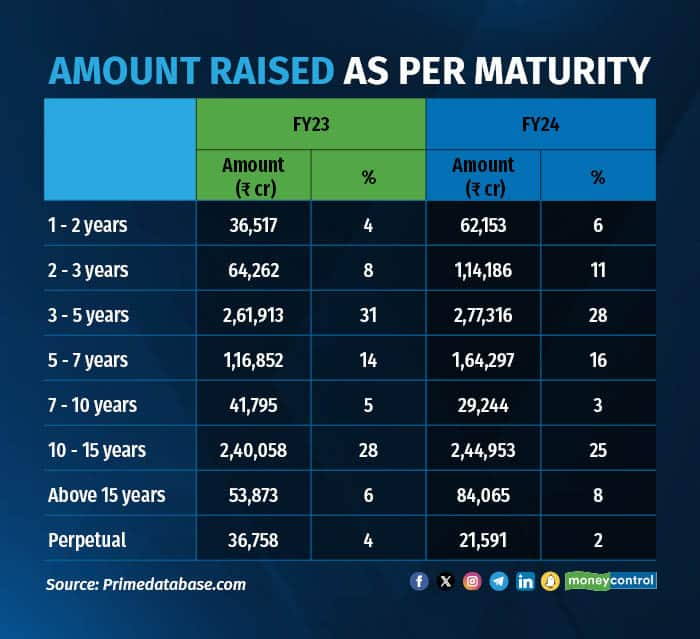

The maximum amount was raised in the above 10-year maturity bucket followed by 3-5 years bucket. Meanwhile, issues of as much as Rs 6.63 lakh crore or 66 per cent of the overall amount were AAA-rated.

The public bonds market saw a 179 percent rise with 48 issues raising Rs 20,787 crore in comparison to 32 issues raising Rs 7,444 crore in the year-ago period. The largest issue was from Power Finance Corp raising Rs 2,824 crore.

In addition, Indian companies also raised Rs 3.79 lakh crore through overseas borrowing (including ECBs), up by 71 percent from Rs 2.22 lakh crores in FY23.

Going ahead, fundraising through corporate bonds is likely to rise by an over 10 percent annualised rate in 2024-25 due to the expectation of lower borrowing costs amid increased demand from foreign as well as domestic investors.

“We expect a 15 percent to 20 percent increase compared to FY24. Trends suggest potential growth driven by increased investor demand and companies issuing bonds to secure lower borrowing costs amid expected rate cuts,” Nagesh Chauhan, Head - DCM, Tipsons Group had earlier told Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.