On September 21, the Federal Reserve increased policy rates by 75 basis points (bps) for the third successive time. In the next 10 days, we saw a bloodbath in currency markets as most currencies depreciated significantly against the US dollar.

The pound was battered so badly that it required interventions by the central bank, taking one back to 30 years when the UK faced a similar crisis. One suggestion to prevent a sharp currency depreciation and meeting demand for dollars is to establish swap lines with the Federal Reserve.

The swap lines between central banks have been established quite regularly since the 2008 crisis. This explainer helps understand swap lines.

In case of a global shock, global investors shift their investments to less risky currency assets. The greenback has not just been a global currency for a long time but also been seen as the safest asset. Even if the 2008 crisis was centered in the United States, there was a surge in demand for dollar assets. Investors believe that the probability of defaulting on dollar assets is the lowest compared to other currency assets.

Even during the current global inflation crisis, we are seeing similar trends. The Federal Reserve has been aggressively increasing its policy rates to lower the inflation. Other advanced and emerging economy central banks have also increased policy rates, but either with a lag or with reluctance.

Higher interest rates in the US have also made it more attractive to invest in US markets. The American economy also has stronger economic prospects than other advanced economies. This is leading to concerns that interest rate increases will impact other advanced economies more than the United States.

The inflation fighting credentials, higher interest rates and better growth prospects have led to higher demand for the dollar and dollar-denominated assets.

In a financially globalized world, financial markets and banks need liquidity in both domestic currency and foreign currency. While central banks can readily provide liquidity in their own currencies, they cannot provide liquidity in foreign currencies, typically the US dollar.

For this purpose, emerging economies maintain foreign exchange reserves which are mostly denominated in the dollar. When the times are normal, the central banks buy the dollar and build reserves. In normal times, financial markets also get ready foreign currency liquidity.

The problems start when the economic tide reverses and becomes a crisis as seen recently. In such times, the financial markets suddenly see drying up of foreign currency liquidity. The central banks now sell forex reserves to manage both, a depreciating currency and demand for dollar assets.

The swap lines can be useful to address such crises. A swap line is an agreement between two central banks to exchange currencies to meet foreign currency liquidity. Say there is a swap line between the Federal Reserve and Bank of England. In the current crisis, Bank of England can use the swap line. Bank of England will place pounds at Federal Reserve and get dollars from the Federal Reserve at the prevailing market exchange rate.

Bank of England can then stand ready to provide both pound and dollar liquidity to the financial markets in the UK. When the crisis situation normalizes, the two central banks will swap the currency flows and bank of England will also pay interest to the Federal Reserve for dollar liquidity.

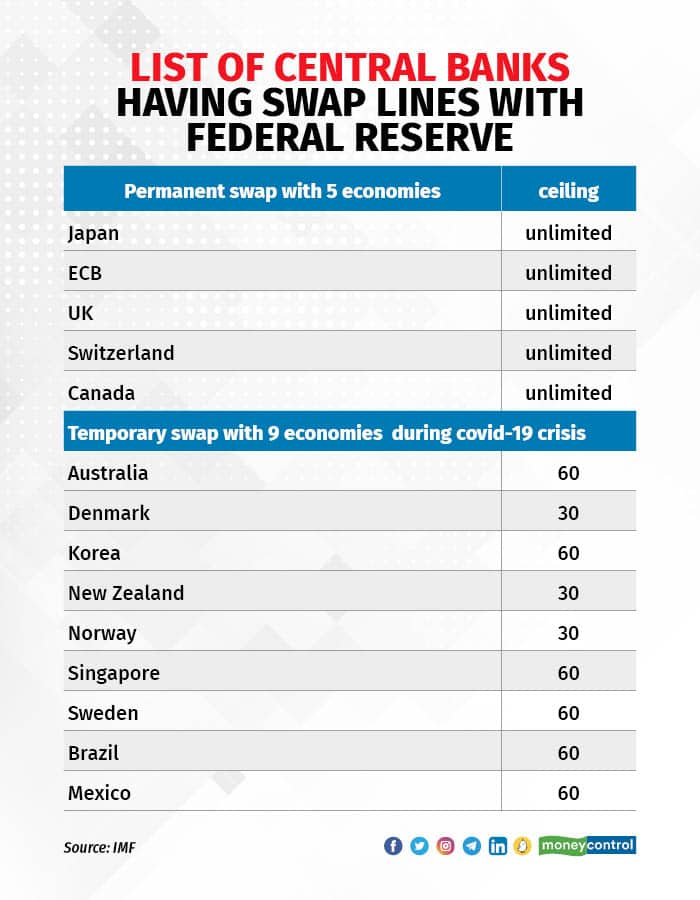

What has been the experience with swap lines?In December 2007, Federal Reserve established dollar liquidity swap lines with European Central Bank (ECB) and the Swiss National Bank, following tightening of dollar liquidity in these markets. In 2013, the central banks of six major advanced economies – the Fed, ECB, Bank of England, Bank of Japan, Swiss National Bank, and Bank of Canada --announced a permanent swap line for providing foreign currency liquidity.

During the global financial crisis of 2008, the Fed established temporary swap lines with 9 advanced economies and emerging economies. These swap lines were terminated in 2010. During the COVID-19 crisis, the swap lines were renewed with 9 central banks, most of which were in the list of 2008.

Apart from the Federal Reserve, ECB also established swap lines for euro for small European economies which traded extensively in the euro. During the global financial crisis, ECB established swap lines with Latvia, Hungary, Poland, Denmark and Sweden. During COVID-19, ECB extended a swap facility with the central banks of Bulgaria, Croatia and Denmark.

Japan had a swap line with India until 2009 and later signed swap lines with South-East Asian nations such as Indonesia, the Philippines, Thailand, and Singapore. During COVID-19, it extended the facility to Malaysia as well.

China saw swap lines as a way to expand the yuan’s influence in the global monetary system. China currently has swap facilities with central banks of 30 other countries.

Overall, global swap network membership has risen from a few members in 2007 to 91 by end of 2020. The total amount of swap line is estimated at $1.9 trillion. While central banks announce establishing swap lines in a transparent manner, they maintain secrecy on usage of the facility for confidential purposes. The data shows that most of the swap facilities remain under-utilized and they provide confidence to the markets.

How should swap lines be deployed in the current crisis?The current crisis and most previous crises have been related to the dollar. Currently, the Federal Reserve has a permanent swap line with 5 major advanced economies and temporary swap facility with 9 advanced and emerging economies.

Data shows that Bank of England, ECB and Swiss National Bank availed of dollar liquidity on September 28, 2022, the day the pound depreciated significantly. Data also shows that other central banks have used dollar swap facility during the COVID-19 crisis.

This Federal Reserve swap facility could be extended to other countries as well. However, extending the swap facility to other countries could pose the risk that the Federal Reserve and the dollar will become even more powerful. But if the swap lines are for temporary purposes and for a limited period, the risks can be minimized.

Should RBI establish swap lines with the Federal Reserve?The Indian rupee has also been under depreciating pressure for nearly 6 months now. The rupee may have depreciated less than other currencies, but it still has been under pressure. Foreign exchange reserves have declined by nearly $100 billion, of which nearly 67 percent is due to depreciation of the rupee.

Given the various reasons listed above for having swap lines, the RBI could consider establishing a swap line with the Federal Reserve for temporary purposes. Most of the time, the swap facilities are not used, but they do lead to confidence in the financial markets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.