India’s leading food delivery startup Zomato made a stellar debut on Dalal Street on July 23 as the stock opened at Rs 116 on the NSE, a 52.63 percent premium to its final offer price of Rs 76. The listing price on the Bombay Stock Exchange was Rs 115, up 51.32 percent.

The listing gains propelled the market capitalisation of the company to above Rs 1 lakh crore mark, racing ahead of the m-cap of firms such as IOC, BPCL and Shree Cements.

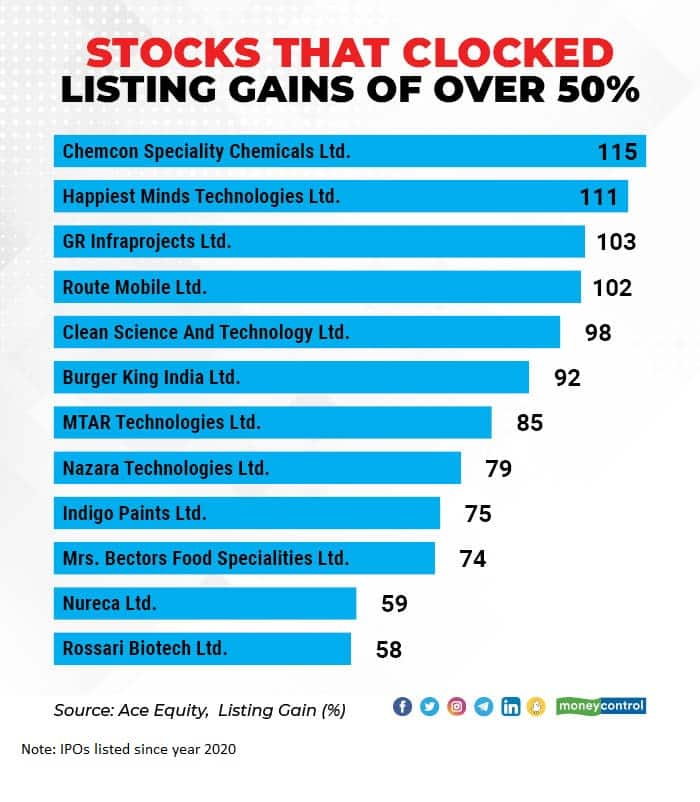

The listing gains of Zomato is not a black swan moment for the Indian market. There have been at least 12 listings since January 2020 that saw gains of more than 50 percent.

There have been four IPOs—Chemcon Speciality Chemicals, Happiest Minds Technologies, GR Infraprojects and Route Mobile—which saw listing gains of more than 100 percent.

Three of them were listed in September-October 2020 when the market was teeming with positivity on ebbing signs of the pandemic.

Zomato's Rs 9,375-crore initial public offering, which opened for subscription during July 14-16, got an overwhelming response from investors with the issue being subscribed 38.25 times—highest in the last 13 years for IPOs valued more than Rs 5,000 crore.

Also read: Zomato founder and CEO Deepinder Goyal: Today is a new Day Zero.The company is in a sweet spot in an evolving market like India. The online food delivery market is at the cusp of evolution and experts say the company has consistently gained market share over the last four years to become the category leader in India in terms of gross order value (GOV).

"Despite the large size of IPO at Rs 9,375 crore and rich valuations, the company saw healthy overall subscription of 38 times. There is a lot of fancy for such unique and first-of-its-kind listing in the market," Sneha Poddar, Research Analyst-Broking & Distribution, Motilal Oswal Financial Services pointed out.

Also read: Zomato IPO listing: What Zomato's bumper debut teaches us

"Zomato enjoys a couple of moats and with the economics of scale started playing out, the losses have reduced substantially. Though predicting the growth trajectory at this juncture is a little tricky, but it’s a good bet from a long-term perspective," said Poddar.

Jyoti Roy - DVP- Equity Strategist, Angel Broking, who had given a subscribe rating to the IPO because of its strong delivery network, high barriers to entry, expected turnaround and significant growth opportunities

in tier-II and III cities, continues to remain positive on the stock from a long-term perspective.

"After the stellar listing, we recommend that short-term investors that were looking for listing gains can exit the stock, while long-term investors can book partial profits," said Roy.

As of March 2021, Zomato was present in 525 cities in India, with 3,89,932 active restaurant listings along with a presence in 23 countries outside India.

The company's orders grew by 7.8 times from 3.06 crore in FY18 to 23.89 crore in FY21 and its GOV grew 7.1 times from Rs 1,334 crore in FY18 to Rs 9,482.9 crore in FY21.

After a 23.5 percent decline in revenues in FY21 to Rs 1,993.8 crore (compared to Rs 2,604.7 crore in FY20) due to the COVID-19 pandemic, analysts expect growth to pick up sharply from FY22.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.