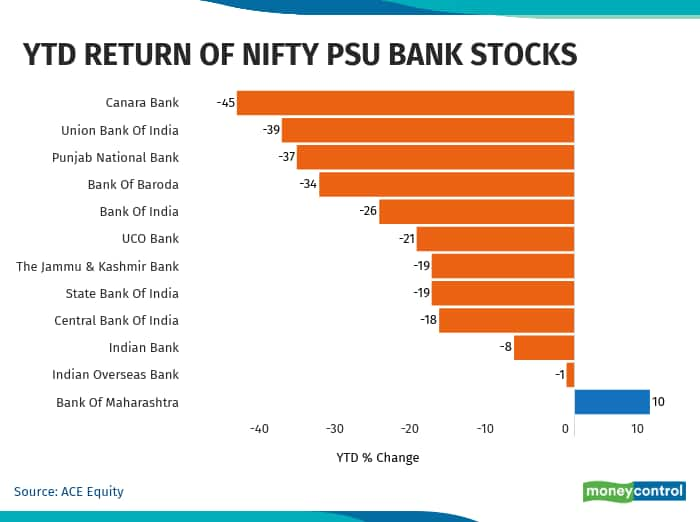

The Nifty PSU Bank index looks set to end the year 2020 as one of the top laggards among sectoral indices

As of December 15 close, the Nifty PSU bank index was down 27 percent against a nearly 12 percent gain in the benchmark Nifty during the same period.

The year 2020 has been a volatile year for not only the PSU bank stocks but for the entire financial space as well. The coronavirus outbreak hit the sector hard but the resilience shown by the large private sector players in the second half of the year helped pare losses.

The PSU banks were recovering from the bad loan crisis when the coronavirus pandemic hit.

"During the pandemic, the government announced extensive credit schemes and stimulus policies and therefore PSU banks were compelled to lend under these schemes, mainly to MSMEs, reducing the confidence of the market participants and therefore contributing to the fall of this segment," Gaurav Garg, Head Research, CapitalVia Global Research Limited, pointed out.

Uncertainty over asset quality, higher slippages and loss of market share were the reasons that kept PSU bank stocks under pressure.

"Concern over asset qualities, higher slippages, deterioration in capital ratios and persistent market share loss to private banks were the key reasons for PSU banks to underperform for the longer horizon. Additionally, a slowdown in asset resolution progress under IBC post-COVID-19 also dampened investors’ sentiments," said Binod Modi, Head-Strategy at Reliance Securities.

Rajiv Mehta, Lead Analyst–Institutional Equities, Yes Securities, said while many financial stocks were still under pressure, some large private banks and NBFCs/HFCs with resilient business models (robust customer segment, underwriting, collections and distribution) had either surpassed or were trading near their pre-COVID price levels.

"The likes of HDFC Bank, Kotak Mahindra Bank, ICICI Bank, HDFC, Bajaj twins and Cholamandalam Finance have led the recovery in financial sector stocks. The second rung banks and NBFCs are still trading significantly below their pre-COVID prices, with lingering uncertainty on the impact on their asset quality," said Mehta.

The road aheadThe new year is expected to be good for the equity market. JPMorgan expects the Nifty to cross 15,000 by December 2021, while BNP Paribas foresees the Sensex hitting 50,500. However, the expected rally will not be even for all the sectors. While analysts are positive on large private sector banks, they look less convinced about the prospects of the PSU bank stocks.

"We are not very much fond of PSU banks baring few large banks. The key tailwind for PSU banks is valuations as they still trade at substantial discounts. Further, improvement in collections, improving credit cost trajectory along with the possibility of lower slippages and visible chances of resolution of assets under IBC should bode well for banks," said Modi of Reliance Securities.

Garg said PSU Banks managed to come up with impressive quarterly results, thereby generating a positive view. The pending NPA and restricting requests, the effect of which could be seen in December and March quarterly results, and would be the deciding factors.

"The majority of the PSU banks are trading below their book values and therefore there is a high probability of retracement. If the NPAs and restructuring do not pull down the quarterly results, recovery is very much possible," Garg said.

He suggested Punjab National Bank, Canara Bank and Bank of India from a medium-term perspective.

While the road ahead for PSU bank stocks look bumpy, analysts are positive on large private sector players.

Mehta of Yes Securities said sustained recovery, improving income scenario for salaried and business classes, instrumental liquidity interventions by the Reserve Bank of India and the government and a low-interest rate regime offered a conducive backdrop for lenders.

"The rally and recovery in stock prices should continue in 2021. However, in the first half of the year, it may remain dominated by the strong lenders and then followed by a steep catch-up of mid and small-sized financial companies which can demonstrate asset quality resilience to COVID," Mehta said.

"In our coverage, we believe HDFC Bank, ICICI Bank, RBL Bank, Mahindra Finance, Repco Home and Spandana could be strong performers of 2021," Mehta added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.