India’s central bank has been buying gold steadily over the past four years, showing it is serious about diversifying the assets in which it holds the country’s foreign exchange reserves.

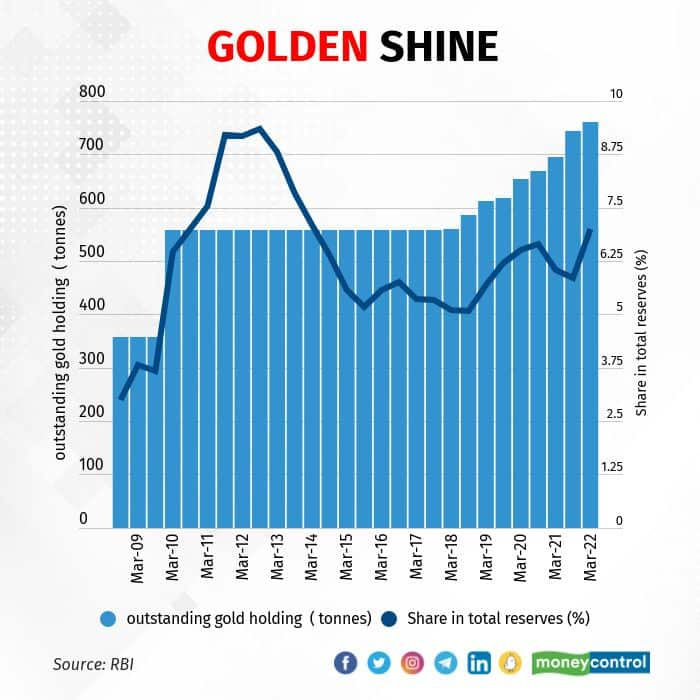

The Reserve Bank of India (RBI)’s purchase of gold is not a new trend. As the adjoining chart suggests, RBI has been buying gold in small quantities over several years.

That said, the purchases in FY22 stand out in terms of size. During the year, the central bank added 65.11 tonnes of gold to its pile. This is the highest purchase in a single fiscal year, second only to the 200 tonnes of gold bought in FY10 from the International Monetary Fund (IMF).

There are some reasons behind the central bank’s gold purchases. To be sure, the RBI is not alone in its gold buying spree. Central banks across the world have been loading up on gold over the past several years, data from the IMF shows.

Diversifying assetsOne of the key reasons for the RBI buyin gold could be diversification of assets in which the country’s foreign exchange reserves are deployed. Diversification of forex assets, away from the dollar, has gained popularity after Russia’s invasion of Ukraine invited international sanctions against the former.

Countries belonging to NATO also decided to severely crimp the Russian central bank’s ability to use its forex reserves. Considering that Russia’s central bank had a large proportion of its reserves in dollar assets, sanctions imposed on the country severely curtailed its ability to use reserves and cushion the rouble’s fall.

As such, having a diversified portfolio of assets is a prudent practice. Further, the RBI is guided by its SLR principle while investing forex reserves. SLR stands for safety, liquidity and returns. Essentially, the central bank’s priority is safety of the assets and their liquidity. Gold fulfils both these criteria comfortably. As such, gold is considered the most liquid asset among financial assets.

Hedge against uncertaintyIn the aftermath of the financial crisis in 2008 that triggered widespread insolvencies in the US, the dominance of the dollar has been questioned. Although the dollar remains the main currency in both cross-border trade and investment, ideas of an alternative currency have time and again been proposed.

China has also been pushing the use of its currency in world trade. Its inclusion in reserve currency is a major goal of the country. The yuan’s share in foreign exchange reserves has gone up dramatically over the past four years. but is still far lower than the dollar.

In the aftermath of the Russia-Ukraine war, central banks, especially those in Asia, have been focusing on reducing the dollar’s share in reserves. The Chinese currency has been a popular choice as an alternative. The RBI does not provide a disaggregated currency-wise share of foreign exchange reserves.

Among friendsAs stated earlier, the RBI is not alone in loading up gold. In 2021, countries such as Brazil, Thailand, Japan and a host of others bought gold, data from World Gold Council shows. In fact, Thailand added 90 tonnes of gold to its kitty, one of the highest purchases among emerging markets.

Russia too has been loading up on gold for more than a decade now. India was the third largest gold buyer in 2021 and during January-March period in calendar 2022, it was the fourth largest gold buyer. It is the ninth largest holder of gold in the world. Countries that were sellers of gold during the period include Kazakhstan, Uzbekistan, Qatar, the Philippines and Poland.

Gold purchases by central banks may make news but they don’t necessarily move the needle in terms of the market price of the yellow metal. Gold has been on a downswing recently owing to the dollar’s steady appreciation but inflationary pressures globally have kept buying interest strong too.

As geopolitical uncertainties remain elevated, central banks will continue to beef up their gold reserves to safeguard financial and economic stability. Gold, after all, is the third largest reserve asset globally.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.