Around Valentine’s Day, Berkshire Hathaway’s filing at the exchange showed that they had slashed their position in Taiwan Semiconductor Manufacturing Company (TSMC) by 86.2 percent.

The stock opened 3.3 percent lower on February 15.

The holding/investing company cut it down to 8.29 million sponsored American depository shares--worth $618 million at the time of the filing—only three months after buying $4.1-billion worth of shares of the semiconductor maker. This action seemed to go against the widely held perception of Warren Buffett’s investing philosophy—of buying and holding. In fact, the Oracle of Omaha has once said, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes”.

Also read: Why Buffett should love Robinhood

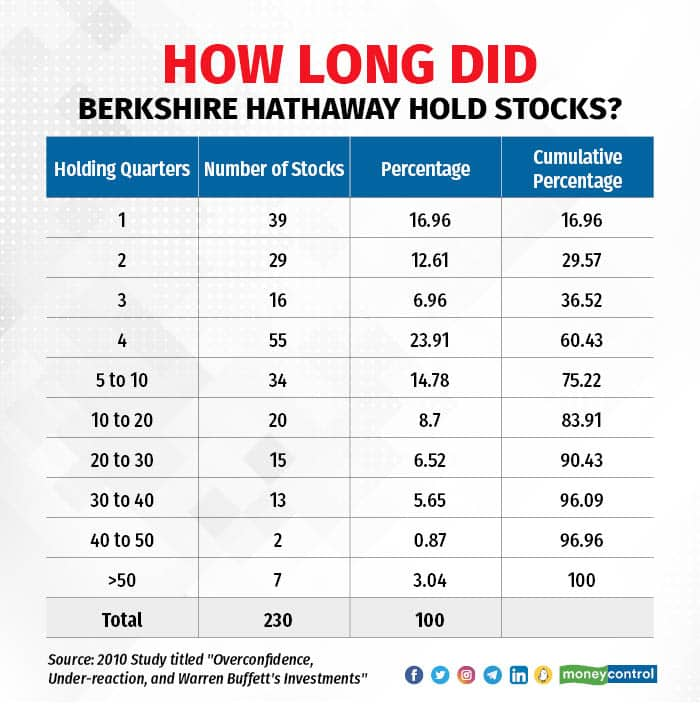

But, buy-and-hold for years really isn’t Buffett’s style. In 2010, researchers from University of California, The Cheung Kong Graduate School of Business and Hong Kong University of Science and Technology, after studying the ace investor’s holdings for nearly three decades (1980 to 2006), found that the median holding period was a year.

Though the study was geared towards behavioural finance--to understand why financial analysts and institutions bet against Berkshire Hathaway’s bets--a section of it looked into investing patterns of Buffett’s company.

The study found that approximately 30 percent of Berkshire Hathaway’s holdings were sold within six months and only around 20 percent of the stocks were held for more than two years.

Another finding of the study, which went contrary to popular belief, was that the low book-to-price ratios of Berkshire Hathaway’s holdings. This wasn’t in line with the widely held notion that Buffett is a value investor, though it was in line with his statement that he had switched from “cigarette butts” (cheap buys that still have a few puffs left) to “great companies at a fair price”.

'Forever' is half the story

Ace investor and founder/fund manager at Helios Capital, Samir Arora today tweeted a news report on Berkshire Hathaway’s reducing its holding in TSMC with a quote, “Out (sic) favorite holding period is forever”.

A Twitterer responded, “He (Buffett) said favorite not only”, and Arora replied, “That is what I tell people. If it is justified hold otherwise no. Which means there is no rule-it all depends”.

Also read: Three investment lessons to take from Warren Buffett's mistakes

In fact, the holding-forever bit is only a part of Buffett’s quote. In his 1989 letter to the shareholders, Buffett had written, “when we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever”. That is, buy-and-hold only if the business and its management are worth that kind of commitment, and not buy-and-hold blindly.

In the very next sentence in the letter, he had elaborated on it a little bit more, by writing, “We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint.” Therefore, Buffett did not advocate unquestioning tenacity but intelligent tenacity.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.