The S&P BSE Information Technology index, which hit a fresh high of 34,061.08 on August 23, has already rallied about 40 percent so far in 2021.

Seven IT stocks hit 52-week highs on the same day – HCL Technologies, Larsen & Toubro Infotech, L&T Technology Services, MindTree, Tata Consultancy Services, Mphasis and Tech Mahindra.

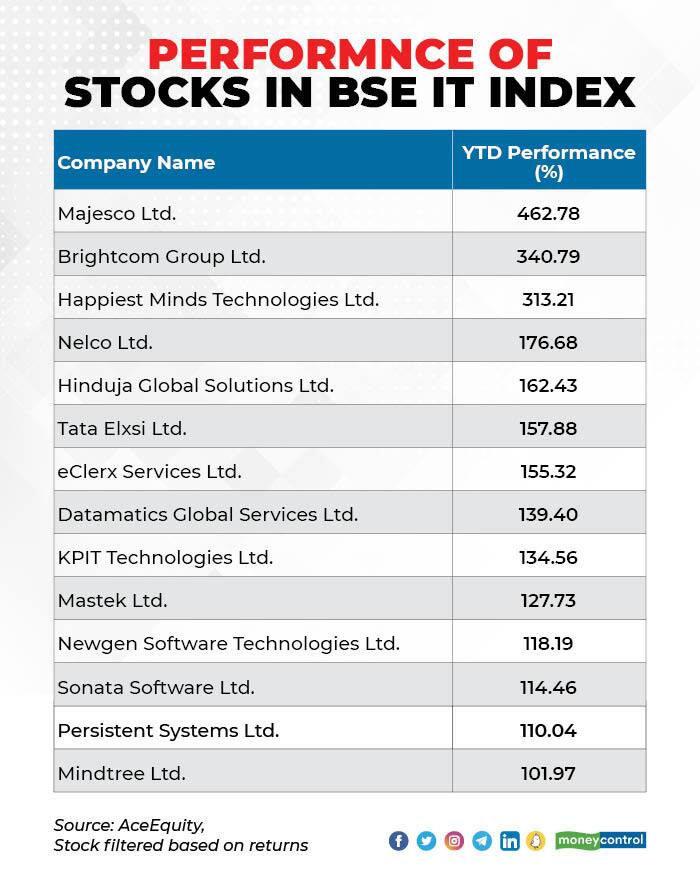

On a year-to-date basis, as many as 14 stocks, mostly from the midcap IT segment, registered gains ranging from 100 percent to 400 percent – among them, MindTree, Persistent Systems, Mastek, Tata Elxsi, Nelco, Happiest Minds, Brightcom Group and Majesco.

What’s powering the rally and will it continue? The momentum in the IT index comes from the June quarter results, the pipeline of confirmed deals and sustainable margins, which are positive for IT companies. “IT stocks have been witnessing strong traction on the back of a shift to digital and cloud technology because of the Covid situation, which led companies to adopt the work-from-home culture,” said Ajit Mishra, VP – research, Religare Broking Ltd. “Further, IT companies’ order books grew healthily as there is a noticeable increase in technology spending and demand also continues to rise in the global as well as domestic markets.” Mishra said cost control, better-than-expected earnings and an optimistic outlook by managements have boosted investor confidence. “Digitalisation technology, new orders, cost control and management support will continue to drive growth for the sector,” he added.

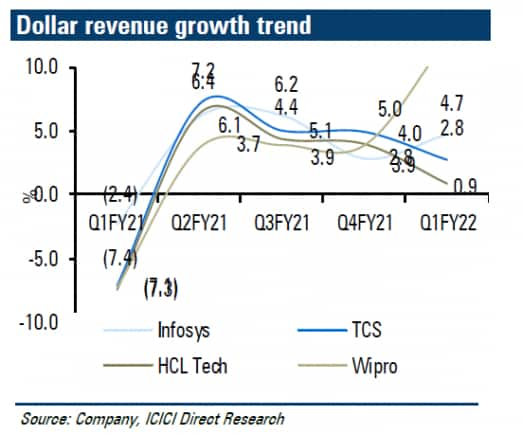

What’s powering the rally and will it continue? The momentum in the IT index comes from the June quarter results, the pipeline of confirmed deals and sustainable margins, which are positive for IT companies. “IT stocks have been witnessing strong traction on the back of a shift to digital and cloud technology because of the Covid situation, which led companies to adopt the work-from-home culture,” said Ajit Mishra, VP – research, Religare Broking Ltd. “Further, IT companies’ order books grew healthily as there is a noticeable increase in technology spending and demand also continues to rise in the global as well as domestic markets.” Mishra said cost control, better-than-expected earnings and an optimistic outlook by managements have boosted investor confidence. “Digitalisation technology, new orders, cost control and management support will continue to drive growth for the sector,” he added.  Tier-2 IT companies grew at almost double the rate of tier-1 companies on an organic basis. “In the quarter, tier-I companies grew 5.2 percent QoQ (3 percent on organic basis) and tier-II companies grew 8.2 percent QoQ (6 percent on organic basis). Wipro and Coforge reported robust numbers, up 12.2 percent and 15.8 percent, respectively, led by acquisitions,” ICICIDirect said in a report. The acceleration in the order books and the deal pipeline for tier-1 and tier-2 companies continues to be strong, led by an increase in deal sizes and higher spending by enterprises on cloud migration and digital technology. In the current quarter, growth is being led by banking, financial services and insurance, retail, hi-tech, communication and healthcare. Even verticals that were laggards like travel and energy & utilities are seeing healthy traction, according to the report. IT companies are witnessing improved traction in digital technology, which is a key driver of their revenue growth. “We believe we are in the first phase of a multi-year technology transformation phase driven by digital technologies. In the current phase, enterprises are building a cloud-based foundation that will serve as a resilient, secure, scalable digital core,” the report added. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Tier-2 IT companies grew at almost double the rate of tier-1 companies on an organic basis. “In the quarter, tier-I companies grew 5.2 percent QoQ (3 percent on organic basis) and tier-II companies grew 8.2 percent QoQ (6 percent on organic basis). Wipro and Coforge reported robust numbers, up 12.2 percent and 15.8 percent, respectively, led by acquisitions,” ICICIDirect said in a report. The acceleration in the order books and the deal pipeline for tier-1 and tier-2 companies continues to be strong, led by an increase in deal sizes and higher spending by enterprises on cloud migration and digital technology. In the current quarter, growth is being led by banking, financial services and insurance, retail, hi-tech, communication and healthcare. Even verticals that were laggards like travel and energy & utilities are seeing healthy traction, according to the report. IT companies are witnessing improved traction in digital technology, which is a key driver of their revenue growth. “We believe we are in the first phase of a multi-year technology transformation phase driven by digital technologies. In the current phase, enterprises are building a cloud-based foundation that will serve as a resilient, secure, scalable digital core,” the report added. Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.