Indian indices added 1.5 percent in the week ended December 20 amid no major domestic and international data.

Sensex, Nifty and Bank Nifty touched their respective record highs in the past week supported by rally seen in the global markets.

US markets touched new highs as sentiment had been bolstered after US Treasury Secretary Steven Mnuchin said the United States and China would sign their Phase 1 trade pact in early January.

"Nifty as per weekly timeframe, formed a long bull candle, after a sideways range movement of the last few weeks. This indicates an attempt of an upside breakout," Nagaraj Shetti, Technical Research Analyst, HDFC Securities said.

"The underlying trend of Nifty continues to be positive with range bound action. The lack of strength in the broad market and also a sluggish overall market breadth not a good sign for the bulls at highs. Crucial overhead resistance to be watched around 12,300-12,400 levels. There is a possibility of a downward correction in the short term," he added.

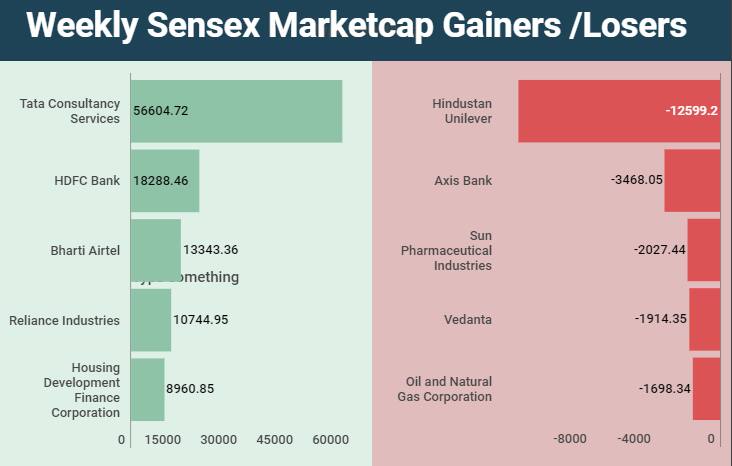

In the past week, the Sensex rose 671.83 points (1.63 percent) to end at 41,681.54, while the Nifty added 185.1 points (1.53 percent) to end at 12,271.8.

Foreign Institutional Investors (FIIs) remained net buyers the past week as they bought equities worth Rs 4,891.7 crore, while Domestic Institutional Investors (DIIs) sold equities worth of Rs 3,751.47 crore.

The Indian rupee ended lower by 31 paise at 71.12 on December 20 versus the December 13 closing of 70.81.

"It was a lacklustre week for the broader market indices, which is a cause of concern for the bulls as the rally is not a broad-based one. For the Nifty, the short term target of 12,350 is now a stone’s throw away. Over there the Nifty can witness some profit booking. On the downside, 12,180-12,158 will act as a near term support zone," Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas said.

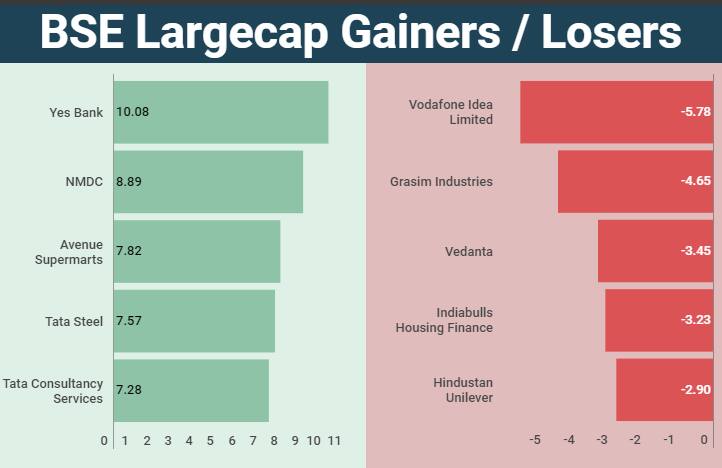

The BSE small-cap index rose 0.44 percent, and the BSE large-cap index rose 1.5 percent in the past week.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.