The market finished the week on a positive note with record highs amid November F&O expiry, domestic data, and mixed global markets on the back of new United States law backing anti-government protesters in Hong Kong.

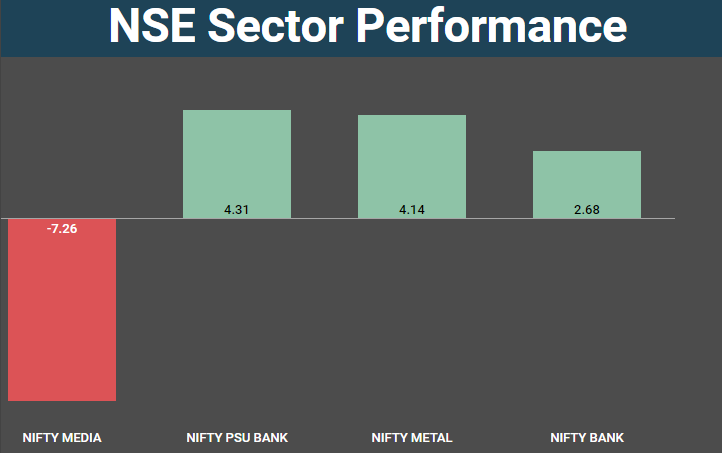

After starting the week on a strong note, Indian benchmark indices along with Nifty Bank rose to a fresh all-time high during the week, but investors booked profit at the end ahead of the gross domestic product (GDP) data.

India's Q2FY20 GDP growth stood at 4.5 percent versus 5 percent quarter-on-quarter (QoQ) and versus 7 percent year-on-year (YoY).

India's fiscal deficit for the month of October stood at Rs 68,900 crore against Rs 53,900 crore, while revenue deficit was at Rs 61,400 crore versus Rs 40,800 crore, YoY.

The October spending was at Rs 1.66 lakh crore against Rs 1.52 lakh crore and receipts were at Rs 97,400 crore versus Rs 98,500 crore, YoY.

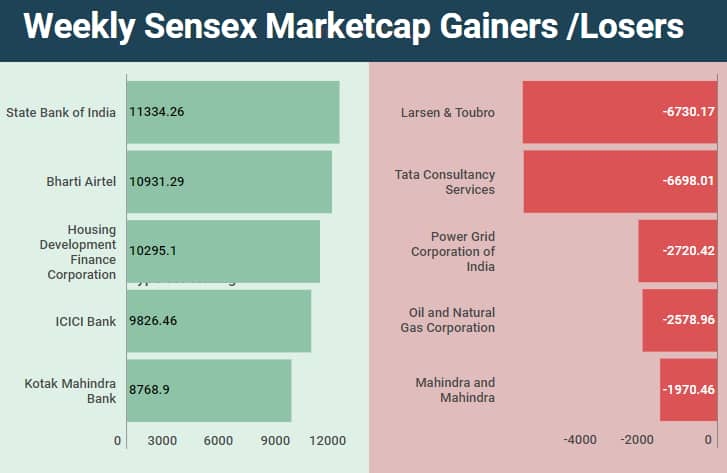

In the past week, the Sensex rose 437.12 points (1.07 percent) to end at 40,793.81, while the Nifty added 141.6 points (1.18 percent) to end at 12,056.

The Sensex and Nifty index touched a fresh record high of 41,163.79 and 12,158.80 respectively on November 28.

During the week, Reliance Industries (RIL) became the first Indian company to cross the total market cap of Rs 10 lakh crore and also became the most valued company in terms of market capitalisation.

"Markets will react to the GDP numbers in early trade on December 2. The recent feud between the US and China over Hong Kong could induce volatility in the global markets. Amid all, we reiterate our bullish view and suggest continuing with a stock-specific trading approach," said Ajit Mishra, VP - Research, Religare Broking.

Foreign Institutional Investors (FIIs) remained net buyers the past week as they bought equities worth Rs 4,798.18 crore, while Domestic Institutional Investors (DIIs) sold equities worth of Rs 3218.01 crore.

On a weekly basis, the rupee ended marginally lower at 71.74 on November 29 versus the November 22 closing of 71.71.

"There is some more steam left in the current move on the upside. For the Nifty a plausible minor degree dip towards 12,000 can be considered as a fresh buying opportunity. The short term target for the Nifty is placed at 12,350," said Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas.

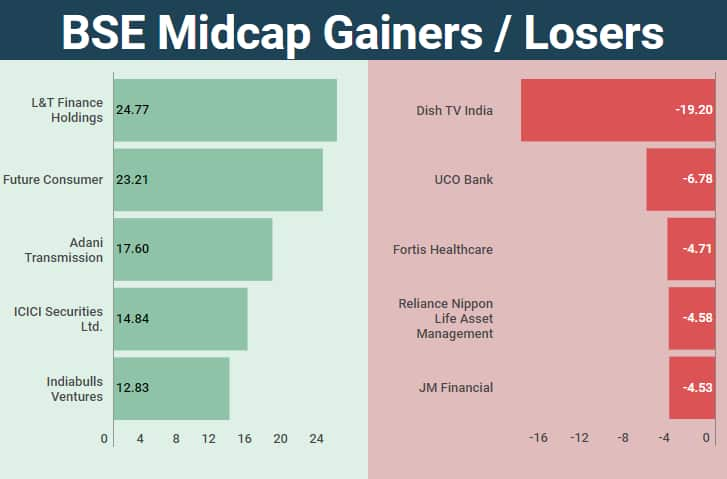

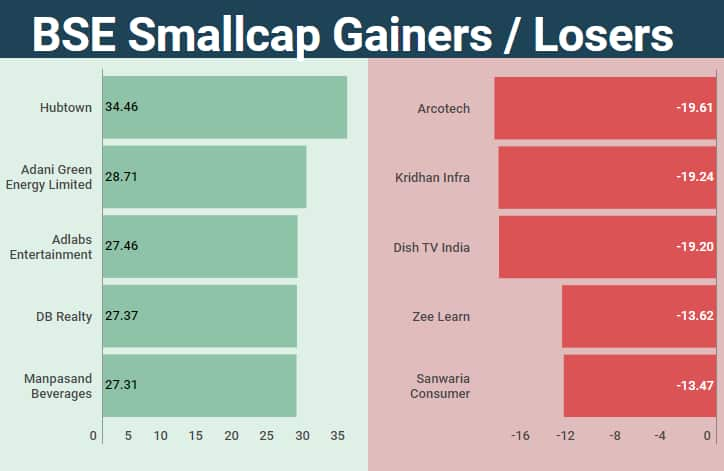

The BSE mid-cap index added 2.35 percent, while the small-cap index rose 1.55 percent and the BSE large-cap index was up 1.20 percent in the past week.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.