It’s often said that intraday trading in the stock market is not something for those with day jobs. But there are always some people who find ways to overcome such constraints.

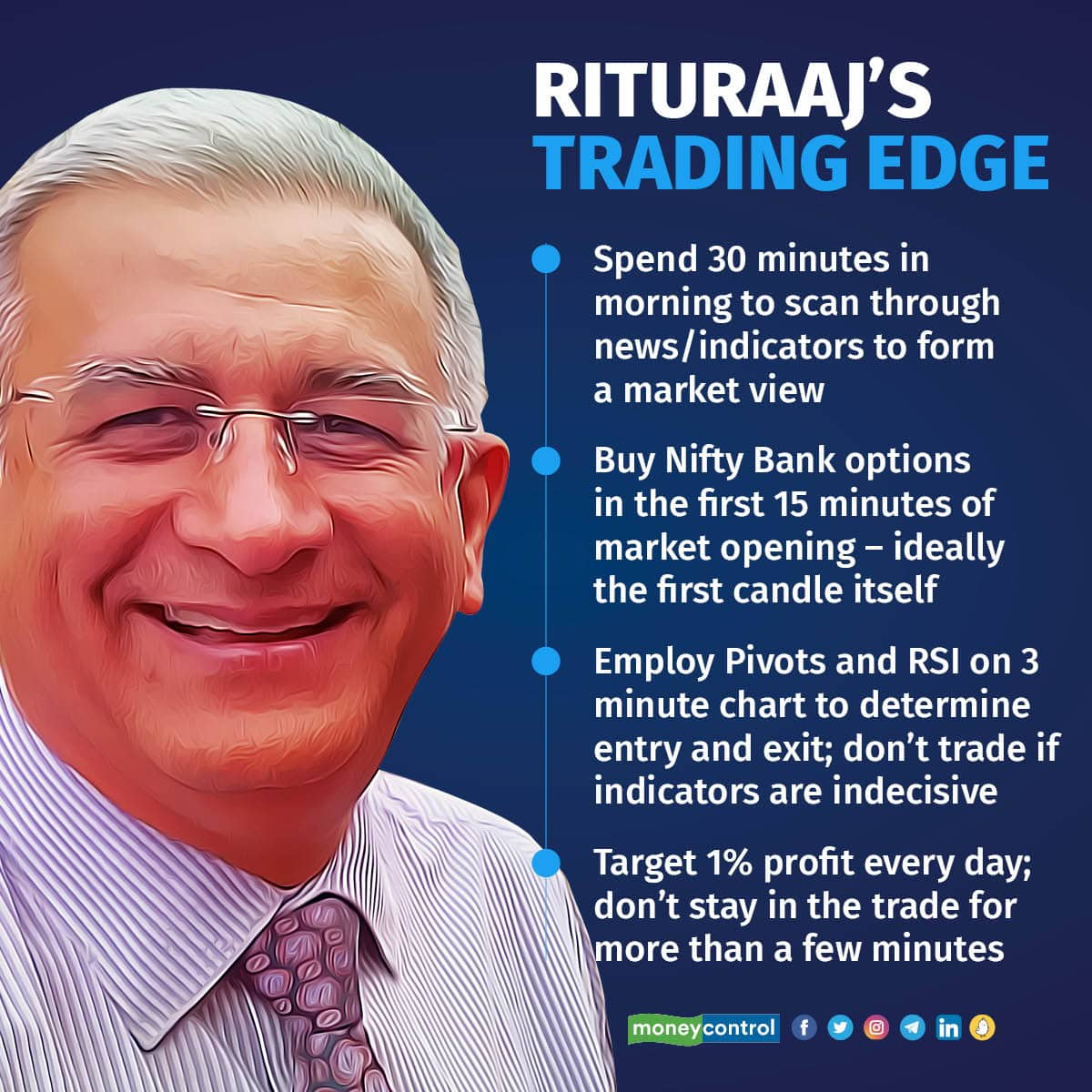

Rituraaj J (@simpletrades), a New Delhi-based corporate professional-turned-educator, has devised a setup that takes 15 to 30 minutes every day to generate consistent additional income every week by scalping Bank Nifty options.

Scalping refers to a day-trading strategy aimed at benefitting from small price movements.

“Being a working professional and officegoer, I had only limited time in the morning to take my trades and this is absolutely bang-on for busy people with limited time,” said Rituraaj, who prefers using only his first name. “It also works with people who do not want to risk huge capital in options trading, irrespective of buying or selling options.”

Initial mistakesAs with most successful traders, wisdom and risk management did not come without mistakes. Rituraaj’s fascination with the stock markets started with mutual funds in the early 2000s and soon developed into buying stocks on the basis of tips and recommendations.

“Now I realise how stupid that was! Well, I was making some money and losing some money, so there was no real ground covered except for acquiring knowledge,” he said. He also dabbled in out-of-money (OTM) options at his broker’s suggestion, which didn’t work.

These failures led Rituraaj to develop a strategy of starting small and staying in a trade for as little time as possible.

The first and foremost advice that the 56-year-old has to give is to start small. In the beginning, one should trade just one lot for six months to build consistency and aim to see at least four green days in a week, every week, he said.

Trading in options is extremely risky. The biggest folly of beginners is to bet a large amount, thus ending up losing their money in one bad trade. The idea here is to ingrain discipline so that you don’t take excessive risks.

“When consistency is developed, scaling up is simple as we are only trading the points and not money which is a by-product,” he told Moneycontrol. The basic premise of the strategy is to generate 1 percent profit every day.

An options buyer, Rituraaj was inspired to become a scalper two years ago when he came across an article in Moneycontrol about Sivakumar Jayachandran, an ace scalper.

Trading with just one lot in the beginning, he bought a Rs 87,000 laptop within a month. He now generates returns of an average 40-50 percent every month and has scaled up trading to 8-10 lots of Bank Nifty options a day.

His tip: Only add that much money in your trading account that can buy one lot of options. Similarly, when you scale up, limit the money in your account. This trains your mind to not over-trade.

Setting up tradeMany traders generally refrain from trading the first candle of the day as volatility is high, but Rituraaj prefers it. He believes the best opportunity to make money is when bulls and bears are having a tug-of-war.

Candlesticks are part of technical analysis that display the range and trend of price movements in a specified time.

Rituraaj said making money in the market does not require complex strategies.

“You don’t need to go to the moon to measure the distance to the moon,” he added.

His morning setup is as follows:Step 1: Start half an hour before the market opens and scan through national and global news and events. Also check trends in global indicators such as the Dow Jones Industrial Average, the Dollar index, the rupee-dollar rate, Brent crude oil prices, the Hang Seng index, and the India volatility index to get a sense of the market for the day.

Step 2: Load up the Bank Nifty Futures chart with a 3 minute time frame. Also load up Standard Pivots (to plot support and resistance levels) and the Relative Strength Index (a momentum indicator), along with VWAP and SuperTrend. They help in determining the support and resistance levels for the counter.

Step 3: Log into the trading terminal before the market opens. Load up 7-8 in-the-money (ITM) strikes for both calls and puts.

Step 4: As soon as the market opens, check how the first candle is forming up. If it opens above any support on the pivot with good volumes, it is time to buy call options with a target at the next resistance level. An RSI above 60 supports the view.

Similarly, if it drops below any support level, buy put options. Don’t make a trade if the RSI is not supportive, volumes are not large or the candle is indecisive.

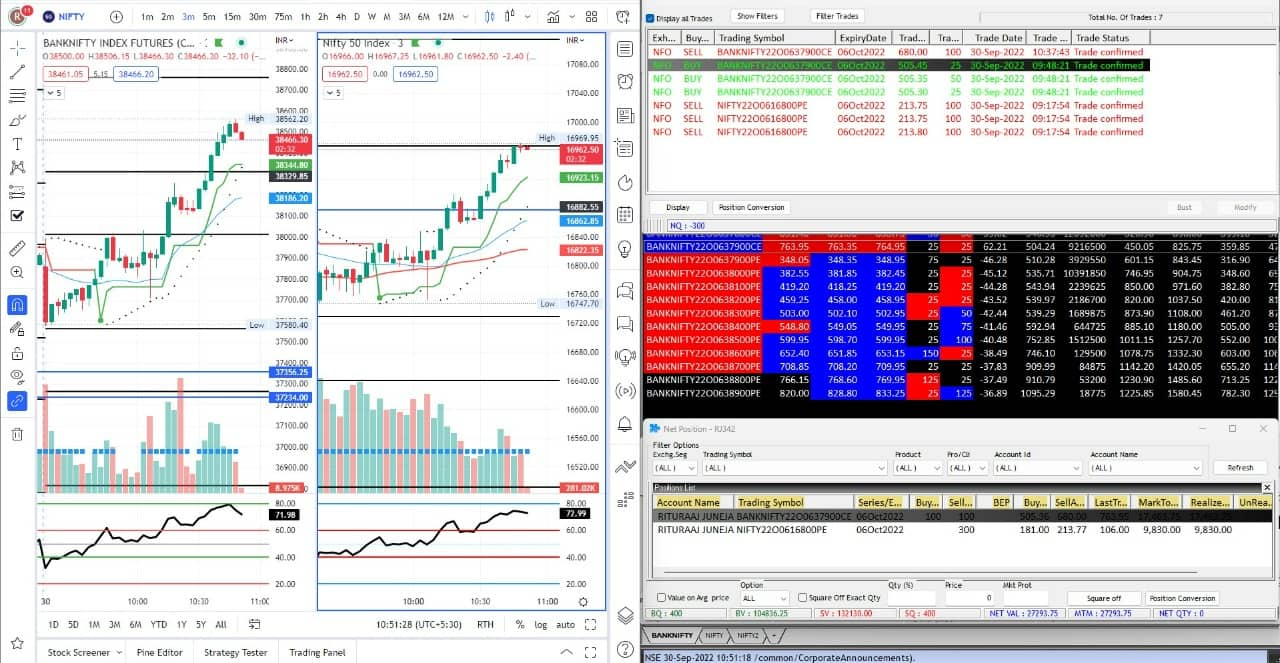

A screengrab of Rituraaj's terminal while trading.

A screengrab of Rituraaj's terminal while trading.Step 5: Set up a stop-loss immediately after buying the options. It should ideally be 25-30 points below the buy price (or profit of your last trade). For volatile days, this could be higher, say 50-70 points.

Step 6: Exit as soon as you are close to your target, which will be the very next resistance on the pivot or RSI on the futures chart.

Step 7: Close all terminals. Don’t make any other trades even if you’ve triggered a stop loss. Go to the office.

Managing risksRituraaj’s strategy can be best described as conservative. It has greater emphasis on conserving capital so that you live to trade another day.

Usually, his stop-losses are limited to the profit made the previous day. He also refrains from averaging trades if losses are booked.

“I exit losing positions when my stop-loss is hit. Be humble, accept defeat with dignity and grace,” he said.

Rituraaj also suggests spending time in the market to understand it better.

“The market is like a pet,” he said. “Even though you don’t understand their language, after spending some time with them, you get an idea of what they want. Vice-versa, they also start understanding what you want to say.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.