Flagship equity indices the Sensex and the Nifty ended almost flat on May 25, taking a breather after the recent gains.

The key indices opened in the green following positive global cues but profit-taking in select heavyweights, especially from the banking space, erased all the gains.

Sensex closed 14 points, or 0.03 percent, lower at 50,637.53 while the Nifty settled with a gain of 11 points, or 0.07 percent, at 15,208.45.

"In absence of any major event, global cues will continue to dictate the market trend in near future. Besides, any news of unlocking by the state governments will also be closely watched as we’re seeing a sustained decline in new COVID cases," said Ajit Mishra, VP - Research, Religare Broking Ltd and Thematic Report by Religare Broking.

"We feel the choppiness may continue especially in the F&O stocks ahead of the upcoming monthly expiry of May month contracts. Traders should align their positions accordingly and continue with the buy on dips approach," he said.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 15,150, followed by 15,091.5. If the index moves up, the key resistance levels to watch out for are 15,280.4 and 15,352.3.

Nifty BankThe Nifty Bank underperformed benchmark indices, falling 282 points or 0.81 percent to 34,662 on May 25. The important pivot level, which will act as crucial support for the index, is placed at 34,339.63, followed by 34,017.27. On the upside, key resistance levels are placed at 35,055.13 and 35,448.27 levels.

Maximum Call open interest of 52.82 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,300 strike, which holds 46.62 lakh contracts, and 15,400 strike, which has accumulated 36.06 lakh contracts.

Call writing was seen at 15,300 strike, which added 9.98 lakh contracts, followed by 15,500 strike which added 4.82 lakh contracts and 15,700 strike which added 4.68 lakh contracts.

Call unwinding was seen at 15,100 strike, which shed 4.5 lakh contracts, followed by 15,000 strike which shed 2.82 lakh contracts, and 15,600 strike which shed 91,650 contracts.

Maximum Put open interest of 39.31 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the May series.

This is followed by 15,200 strike, which holds 32.83 lakh contracts, and 15,100 strike, which has accumulated 29.63 lakh contracts.

Put writing was seen at 15,200 strike, which added 11.7 lakh contracts, followed by 15,300 strike which added 3.85 lakh contracts and 15,100 strike which added 2.38 lakh contracts.

Put unwinding was seen at 15,000 strike which shed 8.12 lakh contracts, followed by 14,800 strike, which shed 2.93 lakh contracts and 14,700 strike which shed 2 lakh contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

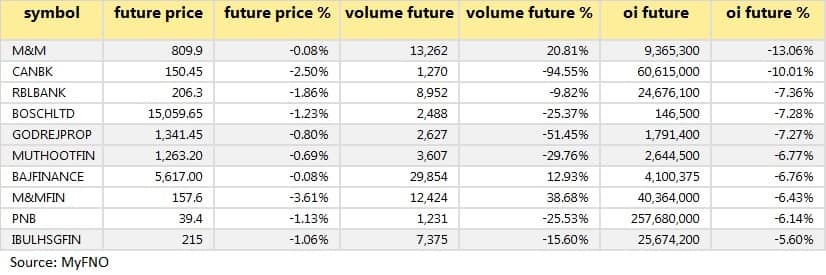

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

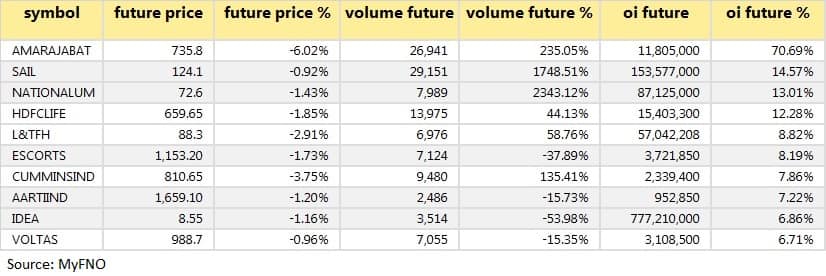

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was

seen.

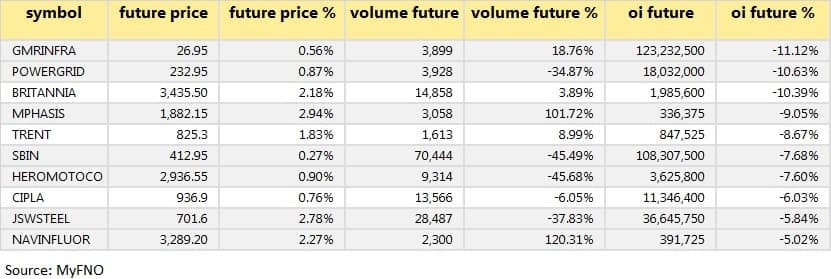

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

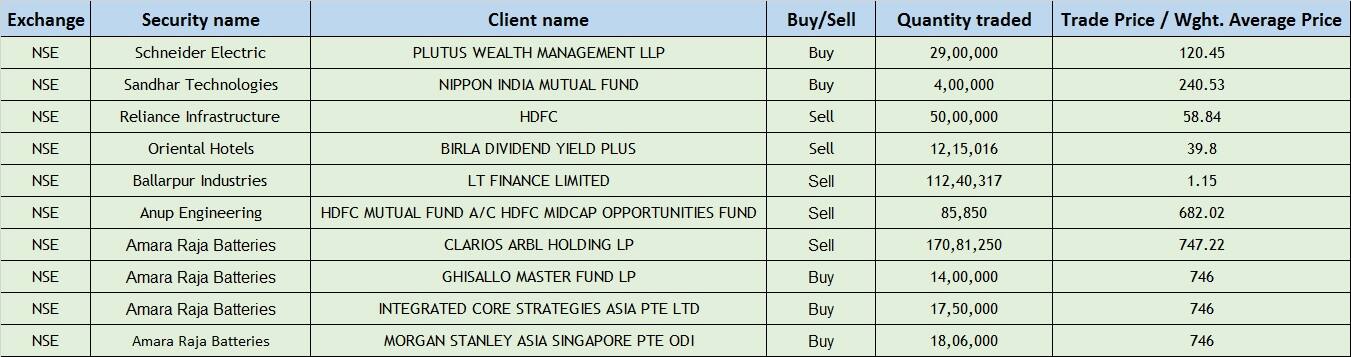

(For more bulk deals, click here)

Results on May 26Berger Paints India, Bharat Petroleum Corporation, Burger King India, Allsec Technologies, Arvind, Astra Microwave Products, Cummins India, LT Foods, Datamatics Global Services, FDC, Hindustan Composites, Hindustan Foods, J Kumar Infraprojects, Manappuram Finance, Mold-Tek Packaging, Pfizer, Pricol, Saksoft, Sharda Cropchem, Shreyas Shipping & Logistics, Sicagen India, The Investment Trust Of India, UFO Moviez India and Vardhman Holdings.

Stocks in the newsAnjani Portland Cement:The company board recommended a final dividend of Rs 5 per equity share.

AIA Engineering: The company board has recommended a final dividend of Rs 9 per equity share.

Bodal Chemicals:The company has incorporated a wholly-owned subsidiary in Indonesia.

Precision Camshafts:The company board has recommended a final dividend of Re 1 per equity share.

Mahindra Holidays & Resorts:The company's board approved the appointment of Sujit Vaidya as the chief financial officer (CFO) and key managerial personnel of the company w.e.f. June 1, 2021.

Kirloskar Brothers Limited has informed the Exchange that the Board of Directors at its meeting held on May 25, 2021, recommended a final dividend of 3 per equity share.

Maheshwari Logistics Limitedhas informed the Exchange regarding 'Setting up Plastic Boiler at manufacturing unit.

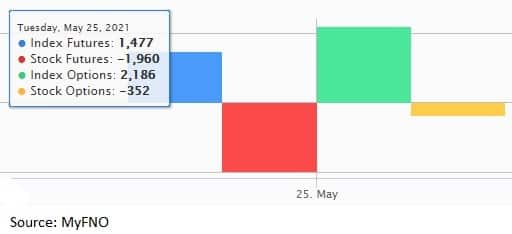

Fund flow

Foreign institutional investors (FIIs) net bought shares worth Rs 959.77 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 563.59 crore in the Indian equity market on May 25, as per provisional data available on the NSE.

Stocks under F&O ban on NSEThree stocks - Amara Raja Batteries, Canara Bank and Punjab National Bank - are under the F&O ban for May 26. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!