Domestic equity benchmarks the Sensex and the Nifty ended on a flattish note on April 6 as positive global cues failed to boost the market due to concerns over surging COVID-19 cases at home.

The Sensex closed with a nominal gain of 42 points at 49,201.39 and the Nifty settled 46 points higher at 14,683.50.

"The Nifty formed an Inside Bar and a Bearish candle along with a long shadow on the daily scale. It has to hold above 14,700 to witness an up move towards 14,850 and 15,000, while on the downside, support exists at 14,550 and 14,450 levels," said Chandan Taparia, Vice President & Derivatives Analyst at Motilal Oswal Financial Services.

Binod Modi, Head Strategy, Reliance Securities, believes that a near-term possible correction in the market would be creating an opportunity for bargain trading for investors.

"Investors must focus on quality stocks with robust earnings visibility and margins of safety," he said.

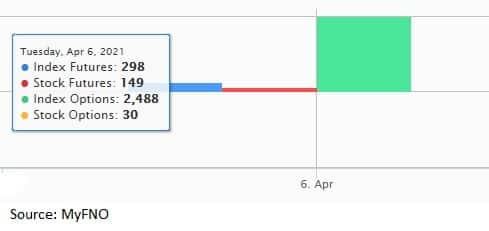

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 14,578.57, followed by 14,473.63. If the index moves up, the key resistance levels to watch out for are 14,783.77 and 14,884.03.

Nifty BankThe Nifty Bank index fell 178 points or 0.54 percent to 32,501.35 on April 6. The important pivot level, which will act as crucial support for the index, is placed at 32,223.93, followed by 31,946.56. On the upside, key resistance levels are placed at 32,893.13 and 33,284.97 levels.

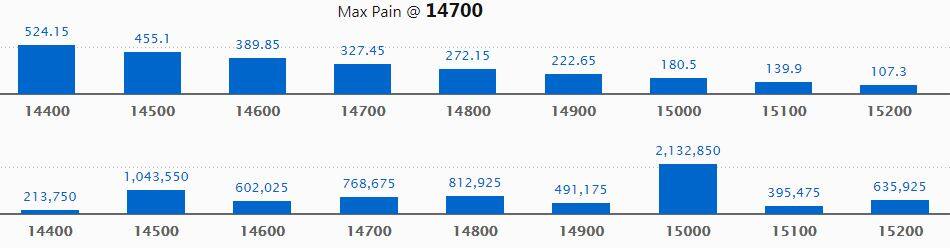

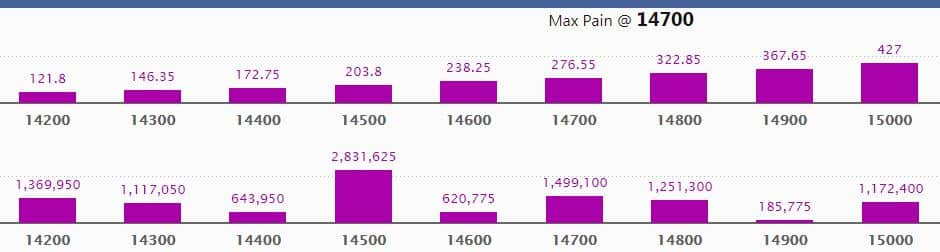

Maximum Call open interest of 21.33 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,500 strike, which holds 10.44 lakh contracts, and 14,800 strike, which has accumulated 8.13 lakh contracts.

Call writing was seen at 15,100 strike, which added 57,975 contracts, followed by 14,800 strike which added 44,250 contracts.

Call unwinding was seen at 15,000 strike, which shed 79,050 contracts, followed by 14,500 strike which shed 77,100 contracts.

Maximum Put open interest of 28.32 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the April series.

This is followed by 14,700 strike, which holds nearly 15 lakh contracts, and 14,200 strike, which has accumulated 13.7 lakh contracts.

Put writing was seen at 14,300 strike, which added 38,100 contracts, followed by 14,600 strike which added 35,925 contracts and 14,200 strike which added 19,425 contracts.

Put unwinding was seen at 15,000 strike, which shed 77,700 contracts, followed by 14,800 strike which shed 17,175 contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

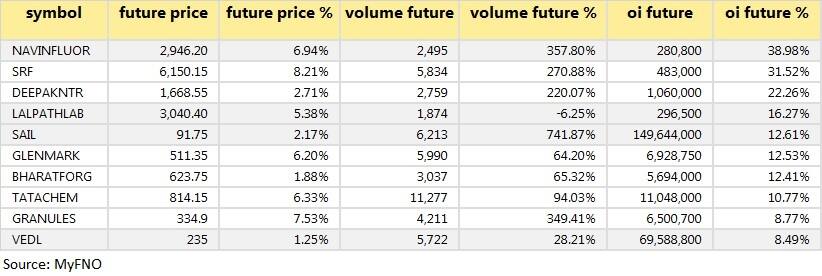

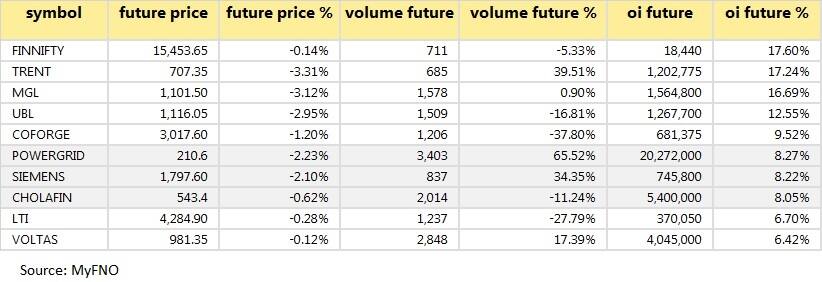

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

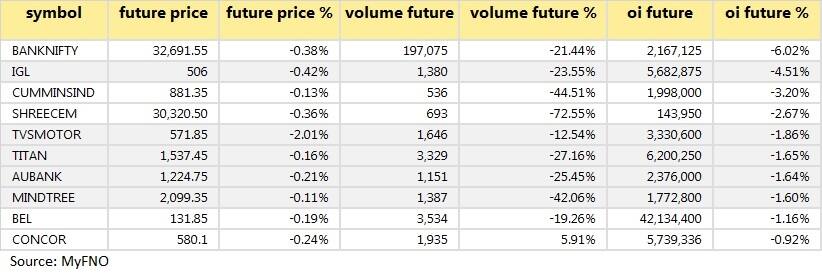

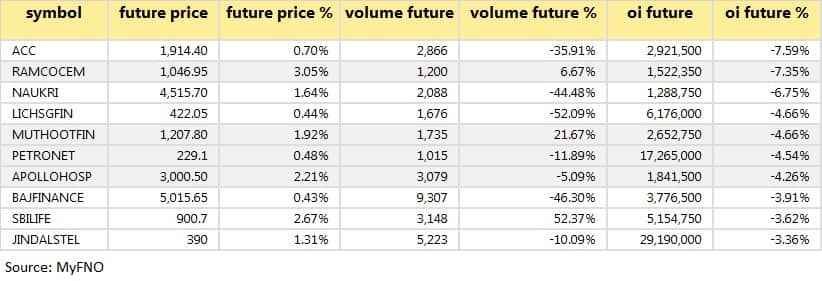

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 10 stocks in which short-covering was seen.

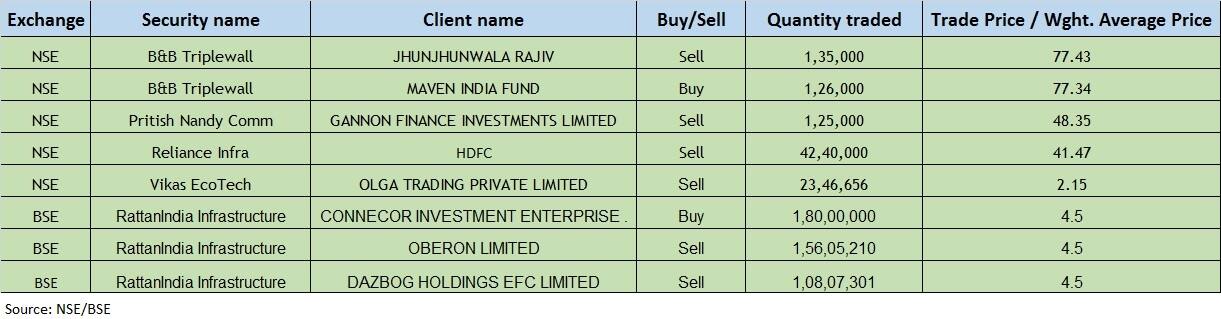

(For more bulk deals, click here)

Board MeetingsArvind Fashions: The board will meet on April 7 to consider and approve the rights issue of equity shares.

Akme Star Housing Finance:The board will meet on April 7 to consider and approve employee stock option plans, increase in authorised capital and the preferential issue of shares, among others.

UCO Bank:The board will meet on April 7 to consider and approve the preferential issue of shares.

Lloyds Metals and Energy:The meeting of the board of directors of the company is scheduled for April 12 to consider the audited financial results (standalone and consolidated) for the quarter and year ended March 2021.

Blue Blends (India):The meeting of the board of directors of the company is scheduled on April 15 to consider the audited standalone and consolidated financial results quarter and year ended March 2021.

Stocks in the newsTata Steel: Tata Steel India achieved the highest ever quarterly crude steel production of 4.75 million tonnes with a 3 percent QoQ growth in Q4FY21.

Punjab Chemicals & Crop Protection:CARE revised credit rating on the company's long term bank facilities to 'BBB' from 'BBB-', with a stable outlook, and also revised rating on short term bank facilities to 'A3+' from 'A3'.

Somi Conveyor Beltings: The company in its BSE filing said it has secured major orders worth Rs 30.68 crore from March till date.

Tata Steel Long Products:TSLP in its BSE filing achieved the highest-ever quarterly crude steel production of 1,86,000 tonnes with a growth of 7 percent QoQ and 19 percent YoY on the back of debottlenecking at steel melting shop and arcing.

Reliance Industries, Bharti Airtel: RIL in its BSE filing said Reliance Jio Infocomm has entered into a definitive agreement with Bharti Airtel for the acquisition of the right to use spectrum in the 800MHz band in Andhra Pradesh, Delhi and Mumbai circles through spectrum trading.

Fund flow

Foreign institutional investors (FIIs) net sold shares worth Rs 1,092.75 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 416.59 crore in the Indian equity market on April 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSEOne stock - SAIL - is under the F&O ban for April 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!