Bulls failed to regain control over D-Street as the Nifty slipped below the crucial moving averages such as 5-day exponential moving average (EMA), 20-EMA, 13-EMA in a single day and made a "Bearish Belt Hold" kind of pattern on daily charts on September 17.

A 'Bearish Belt Hold' pattern is formed when the opening price becomes the highest point of the trading day (intraday high) and the index declines throughout the trading day making up for the large body. The candle will either have a small or no upper shadow and a small lower shadow.

The index slipped below the crucial short-term moving average and the next support is now placed at 11,250 which was the swing low formed on September 12. On the other hand, for bulls to take control, Nifty has to reclaim the 11,520 level.

The Nifty opened at 11,464 and slipped below 11,400 to touch its intraday low of 11,366 before closing the day at 11,377, down 137 points.

"The Nifty resumed its downswing with a Bearish Belt Hold formation as weekend review of the economy appears to have failed to impress the market participants with rupee going back to square one," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

"Technically speaking, as Monday’s down move filled the bullish gap present in the zone of 11,430 to 11,380 levels, registered on last Friday, it can be expected to initially test the recent corrective swing low of 11250 levels," he said.

Mohammad added that in such a scenario an ideal downside target for the fresh leg of downswing appears to be placed between 11,100 – 11,000 kind of levels. For the time being, upsides shall remain capped around 11,520 levels.

We have collated the top 15 data points to help spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 11,377.8 on September 17. According to pivot charts, the key support level is placed at 11,341.47, followed by 11,305.13. If the index starts moving upward, key resistance levels to watch out are 11,439.57 and 11,501.33.

Nifty Bank

The Nifty Bank index closed at 26,820.3. The important pivot level, which will act as crucial support for the index, is placed at 26,708.26, followed by 26,596.23. On the upside, key resistance levels are placed at 26,967.46, followed by 27,114.63.

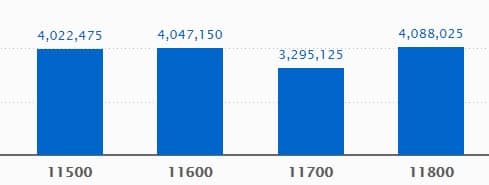

Call Options Data

Maximum call open interest (OI) of 40.88 lakh contracts was seen at the 11,800 strike price. This will act as a crucial resistance level for the September series.

This was followed by the 11,600 strike price, which now holds 40.47 lakh contracts in open interest , and 11,500, which has accumulated 40.22 lakh contracts in open interest.

Call writing was seen at the strike price of 11,500, which added 8.97 lakh contracts, followed by 11,600, which added 8.01 lakh contracts and 11,400, which added 6.49 lakh contracts.

Highest Call unwinding was seen at the strike price of 11,900, which shed 1.66 lakh contracts, followed by 12,000 which shed 1.28 lakh contracts.

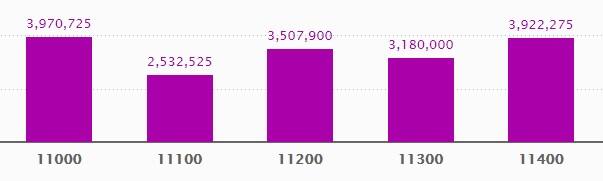

Put Options data

Maximum put OI of 39.70 lakh contracts was seen at the 11,000 strike price. This will act as a crucial support level for the September series.

This was followed by the 11,400 strike price, which now holds 39.22 lakh contracts in open interest, and the 11,200 strike price, which has now accumulated 35.07 lakh contracts in open interest.

Put writing was seen at the strike price of 11,300, which added 2.78 lakh contracts in open interest, followed by 10,700 which added 1.19 lakh contracts, along with 11,100, which added 90,600 contracts.

Put unwinding was seen at the strike price of 11,500, which shed 3.7 lakh contracts in open interest, followed by 11,600 which shed 1.72 lakh contracts and 11,400 which shed 1.33 lakh contracts.

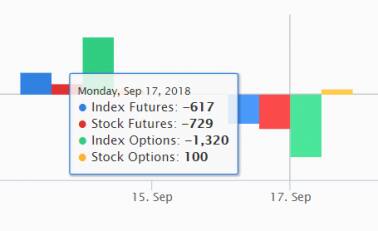

FII & DII data

Foreign institutional investors (FIIs) bought shares worth Rs 1,090.56 crore and domestic institutional investors worth Rs 115.14 crore in the Indian equity market on Friday, as per provisional data available on the NSE.

Fund Flow Picture:

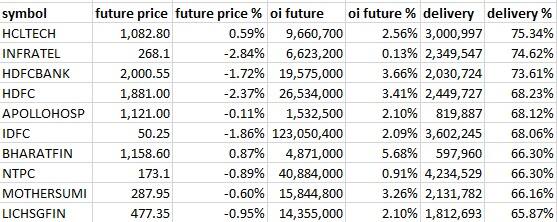

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

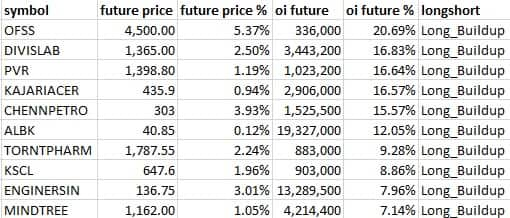

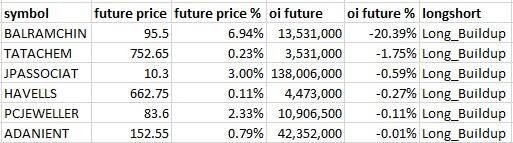

61 stocks saw a long buildup

6 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

136 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

5 stocks saw long unwinding

Bulk Deals

Cigniti Technologies Ltd: Infina Finance Private Limited bought 2,54,487 shares at Rs 390 per share

Dwarikesh Sugar Industries: Solutions Finquest Financial sold 10,00,000 shares at Rs 29.35 per share

Sakuma Exports Limited: KIFS Enterprise bought 1,25,000 shares at Rs 223.80 per share

Supreme Engineering Ltd: Ankit Raj Organo Chemicals Limited sold 1,64,000 shares at Rs 28.66 per share

Suumaya Lifestyle Limited: Vedant Commodeal Private Limited bought 4,00,000 shares at Rs 29.65 per share

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Music Broadcast: Officials from the firm will be attending Equirus Midcap Conference on September 18, 2018.

PPAP Automotive: The company will be attending Equirus conferfence on September 18, 2018.

Dr Lal Pathlabs: The firm will hold interactions with Nalanda Capital and Lucky Securities between September 18 and 24, 2018.

Shriram City: Representatives of the firm will be meeting those at JM Financial and TR Capital on September 18, 2018.

Stocks in news

Bank of Baroda: Merger process with Dena Bank & Vijaya Bank likely to take 4-6 months, to boost Bank's presence

Axis Bank: The bank has allotted 1,97,950 equity shares of Rs. 2/- each on 17.09.2018, pursuant to exercise of options under its ESOP Scheme.

Avenue Supermarts: The company has issued commercial paper worth Rs 70 crore.

Sterlite Technologies: Aims 10 percent global fibre market share by June 2020

GCPL: Board approves bonus share allotment

Oriental bank of Commerce: Icra downgrades long-term ratings; outlook negative

Infosys: Doubles investment in US-based TidalScale to $3 million

Cholamandalam Investment: Raises Rs 1,057 crore from ADB by issuing bonds

1 stock under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For September 18, Adani Enterprises is present in this list.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.