The consistent buying by FIIs, positive Asian cues and fall in oil prices helped the market reach a nearly four-and-a-half-month high on August 17. Technology, banking and financial services, FMCG, and select metal and pharma stocks aided the market rally.

The benchmark indices maintained an uptrend for the seventh consecutive session as the BSE Sensex climbed 418 points to 60,260, while the Nifty50 rose 119 points to 17,944 and formed a bullish candlestick pattern on the daily charts.

In fact, the 50-share Nifty index closed above the downward sloping resistance trend line adjoining previous swing high points.

"On the daily charts, the Nifty added one more positive candle in the ongoing strong bull run and is moving towards the 18,000 mark. The momentum indicator RSI (relative strength index) is rising as the prices are moving higher. This shows that strong bullish momentum is present in the index," Vidnyan Sawant, AVP - Technical Research at GEPL Capital said.

The Nifty has immediate resistance levels at 18,115 (swing high) followed by 18,351 (swing high) and on the other side, it has a strong support level placed at 17,724 (gap support), followed by 17,566 (gap support).

As per the overall chart pattern, Sawant feels that the Nifty will continue to move towards 18,115 followed by 18,351 levels in the coming future. "Our bullish view will be negated if it sustains below 17,566 levels on the downside."

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,863, followed by 17,782. If the index moves up, the key resistance levels to watch out for are 17,996 and 18,047.

The Nifty Bank climbed 222 points to 39,462, the highest closing level since November 2021 and formed a small-bodied bullish candle on the daily charts on Wednesday. The important pivot level, which will act as crucial support for the index, is placed at 39,275, followed by 39,088. On the upside, key resistance levels are placed at 39,577 and 39,691 levels.

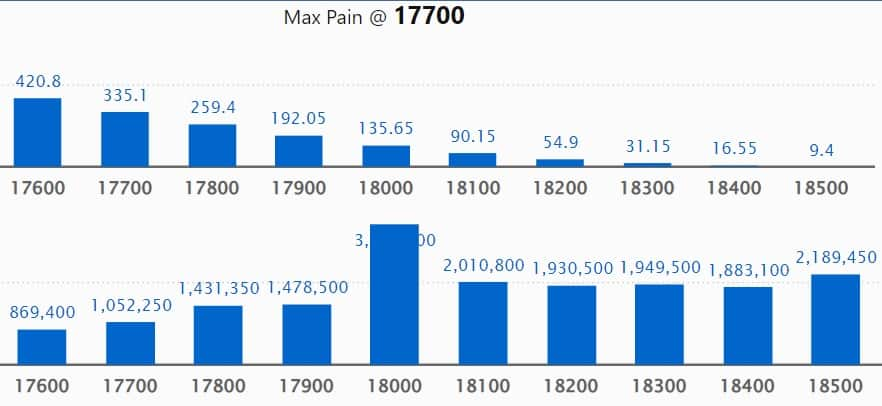

Maximum Call open interest of 38.96 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the August series.

This is followed by 18,500 strike, which holds 21.89 lakh contracts, and 18,100 strike, which has accumulated 20.1 lakh contracts.

Call writing was seen at 18,100 strike, which added 10.33 lakh contracts, followed by 18,400 strike which added 8.55 lakh contracts, and 18,000 strike which added 8.3 lakh contracts.

Call unwinding was seen at 17,800 strike, which shed 4.86 lakh contracts, followed by 17,700 strike which shed 2.43 lakh contracts and 17,500 strike which shed 1.84 lakh contracts.

Maximum Put open interest of 33.7 lakh contracts was seen at 17,500 strike, which will act as a crucial support level in the August series.

This is followed by 17,600 strike, which holds 27.17 lakh contracts, and 17,700 strike, which has accumulated 23.01 lakh contracts.

Put writing was seen at 17,900 strike, which added 14.01 lakh contracts, followed by 18,000 strike, which added 11.43 lakh contracts and 17,800 strike which added 7.7 lakh contracts.

Put unwinding was seen at 16,900 strike, which shed 3.83 lakh contracts, followed by 16,600 strike which shed 1.84 lakh contracts, and 17,000 strike which shed 1 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Alkem Laboratories, Kotak Mahindra Bank, Larsen & Toubro, Power Grid Corporation of India, and Syngene International, among others.

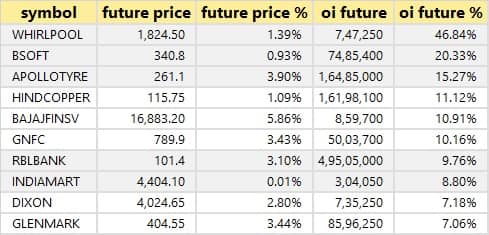

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Whirlpool, Birlasoft, Apollo Tyres, Hindustan Copper, and Bajaj Finserv, in which a long build-up was seen.

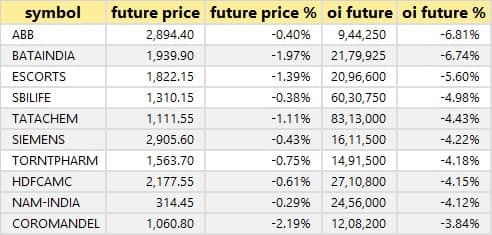

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including ABB India, Bata India, Escorts, SBI Life Insurance Company, and Tata Chemicals, in which a long unwinding was seen.

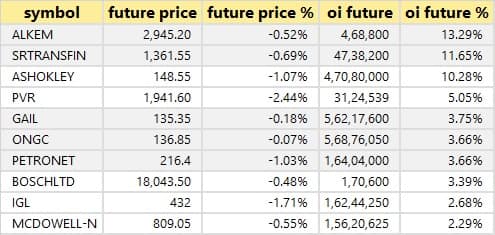

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Alkem Laboratories, Shriram Transport Finance, Ashok Leyland, PVR, and GAIL India, in which a short build-up was seen.

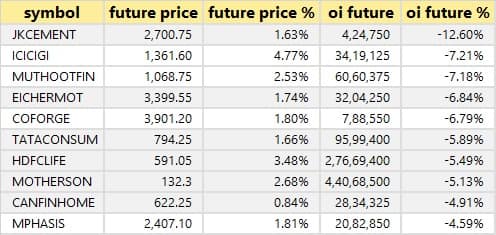

73 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including JK Cement, ICICI Lombard General Insurance, Muthoot Finance, Eicher Motors, and Coforge in which a short-covering was seen.

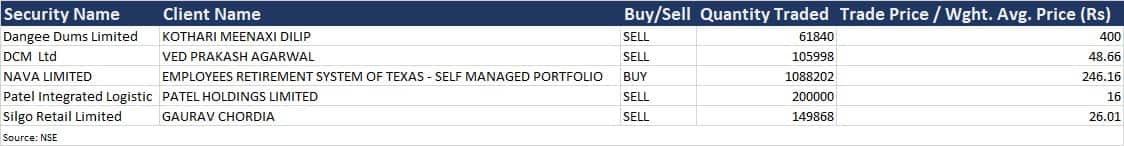

Nava: Employees Retirement System of Texas - Self-Managed Portfolio bought 10,88,202 equity shares or 0.75 percent stake in the company via open market transactions at an average price of Rs 246.16 per share.

(For more bulk deals, click here)

Investors Meetings on August 18

Hindalco Industries: Officials of the company will meet T Rowe Price, UK.

Tamil Nadu Newsprint & Papers: Officials of the company will meet investors and analysts.

ONGC, Pidilite Industries, Adani Enterprises, Vijaya Diagnostic Centre: Officials of the company will attend Edelweiss India Conference 2022 in Singapore.

Samvardhana Motherson International: Officials of the company will attend non-deal roadshows arranged by B&K Securities.

CRISIL: Officials of the company will meet JP Morgan Asset Management.

Indigo Paints: Officials of the company will meet various investors/analysts in London which is organised by Kotak Securities.

MCX India: Officials of the company will meet Ocean Dial Asset Management.

Rossari Biotech: Officials of the company will attend Motilal Oswal's-Specialty Chemical Day.

Computer Age Management Services: Officials of the company will meet Arisaig Partners.

Titan Company: Officials of the company will meet Fidelity Management & Research.

Emami: Officials of the company will participate in UBS India Virtual Consumer Corporate Day.

Fine Organic Industries: Officials of the company will attend an investor conference hosted by Motilal Oswal.

CG Power and Industrial Solutions: Officials of the company will meet Motilal Oswal Asset Management and Whiteoak Capital Management.

Indian Energy Exchange: Officials of the company will meet IIFL AMC.

Stocks in News

Oil and Natural Gas Corporation: ONGC will be in focus as it has signed a Heads of Agreement (HoA) with global petroleum giant ExxonMobil for deepwater exploration on the East and West coasts of India. The collaboration areas focus on the Krishna Godavari and Cauvery Basins in the eastern offshore and the Kutch-Mumbai region in the western offshore.

Natco Pharma: The company in its BSE filing said it has received tentative approval for its abbreviated new drug application (ANDA) for Trabectedin for injection for the 1mg/vial. Trabectedin is a generic drug for Yondelis. According to industry sales data, Yondelis generated annual sales of $49.7 million for 12 months ending June 2022 in the US market.

Indo Amines: The company has received environmental clearance for the expansion of 'synthetic organic chemical' production at its manufacturing plants in Thane and Dhule, Maharashtra.

Infibeam Avenues: Infibeam shares will be in focus after the company in its BSE filing said the board of directors on August 25 will consider fundraising.

Craftsman Automation: The company has commenced the commercial operations of its new plant at Pune, Maharashtra.

GAIL (India): The company received the board approval for additional fundraising of $3.125 billion via external commercial borrowing and up to Rs 25,000 crore via non-convertible debentures. This is on top of Rs 25,000 crore already borrowed by the company.

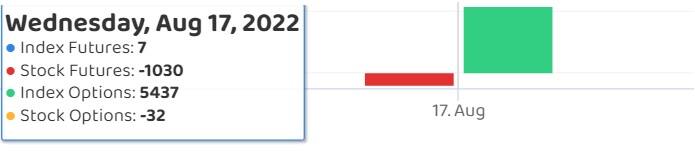

Fund Flow

Foreign institutional investors (FIIs) have net bought shares worth Rs 2,347.22 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 510.23 crore on August 17, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - Balrampur Chini Mills, Delta Corp and Tata Chemicals - are under the NSE F&O ban list for August 18. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.