The Union Budget 2021 continued boosting sentiment as the equity benchmarks, S&P BSE Sensex and the Nifty indices ended in the green for the third consecutive session on February 3.

The 30-share pack closed 458 points, or 0.92 percent, higher at 50,255.75 and Nifty closed with a gain of 142 points, or 0.97 percent, at 14,789.95.

"The Budget is fuelling a rally in all economy driven sectors along with banking. The uptick in global markets, resumption of FII flows and strong earnings trend coming from Q3 results are other factors that are taking markets higher," said Jaideep Hansraj, MD & CEO, Kotak Securities.

"We can expect some resistance for Nifty at near 15,000 level. BSE Sensex will be higher than 50,000 if Nifty goes to 15,000."

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 14,619.87, followed by 14,449.73. If the index moves up, the key resistance levels to watch out for are 14,914.47 and 15,038.93.

Nifty BankThe Nifty Bank rose 491 points, or 1.43 percent, to 34,758.45 on February 3. The important pivot level, which will act as crucial support for the index, is placed at 34,210.83, followed by 33,663.26. On the upside, key resistance levels are placed at 35,107.03 and 35,455.67.

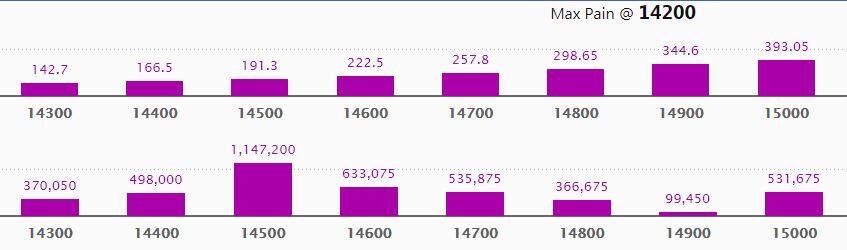

Call option dataMaximum Call open interest of 13.9 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the February series.

This is followed by 14,500 strike, which holds 9.1 lakh contracts, and 14,800 strike, which has accumulated 7.38 lakh contracts.

Call writing was seen at 15,200 strike, which added 1.5 lakh contracts, followed by 15,100 strikes which added 95,850 contracts, and 14,900 strike which added 54,975 contracts.

Call unwinding was seen at 14,500 strike, which shed 1.9 lakh contracts, followed by 15,000 strike which shed 1.2 lakh contracts, and 14,600 strike which shed 80,850 contracts.

Maximum Put open interest of 11.5 lakh contracts was seen at 14,500 strike, which will act as crucial support level in the February series.

This is followed by 14,600 strike, which holds 6.33 lakh contracts, and 14,700 strike, which has accumulated 5.4 lakh contracts.

Put writing was seen at 14,500 strike, which added 2.82 lakh contracts, followed by 14,800 strike, which added 2.62 lakh contracts and 14,700 strike which added 1.35 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 77,775 contracts, followed by 14,400 strike, which shed 34,425 contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

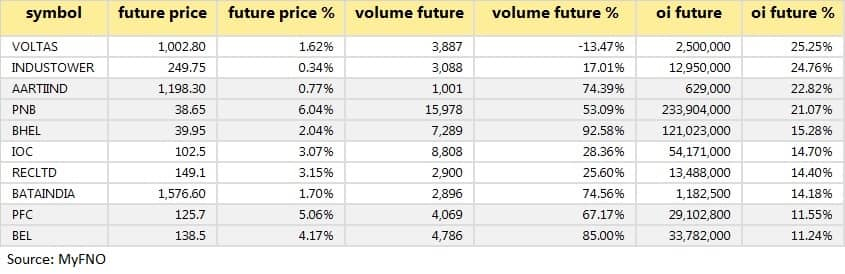

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

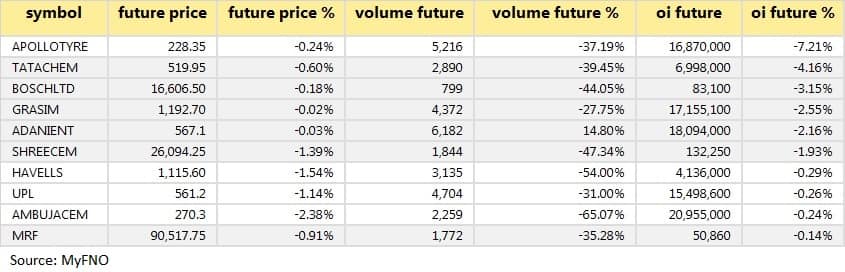

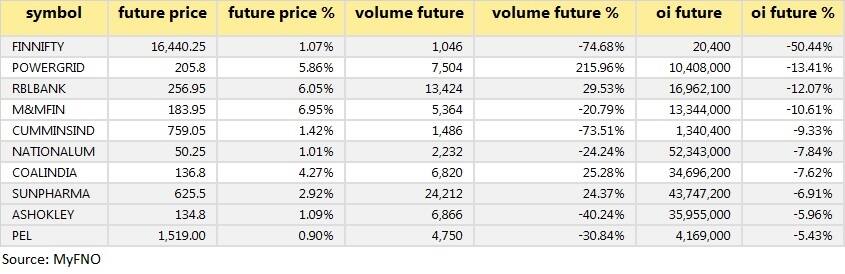

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

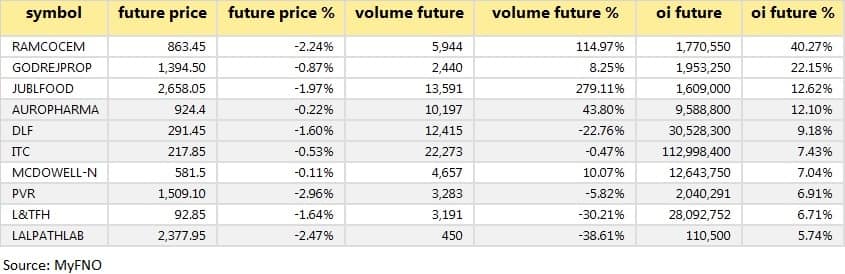

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

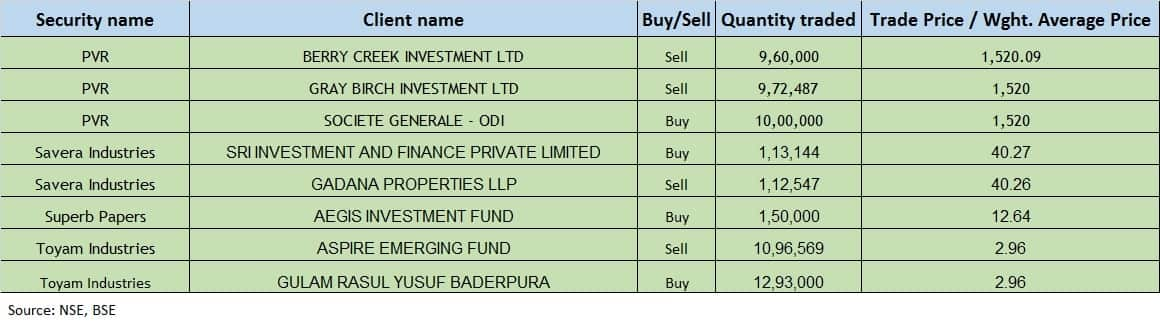

(For more bulk deals, click here)

Results on February 4: State Bank of India, Hero MotoCorp, Adani Power, Adani Transmission, Arvind, Bajaj Electricals, Chambal Fertilisers, Container Corporation, Gillette India, Godrej Agrovet, Godrej Properties, HPCL, Honeywell Automation India, ICRA, Ipca Laboratories, Jubilant Industries, Kalpataru Power Transmission, NTPC, REC, Sonata Software, Strides Pharma Science, Tata Power, Trent, Whirlpool of India, Zee Entertainment Enterprises, etc.

Stocks in newsBharti Airtel: The company posted a consolidated Q3 net profit of Rs 853.6 crore, driven by exceptional gains. The average revenue per user (ARPU) rose to Rs 166 for the quarter.

Future group stocks: SEBI barred Future Group Chief Executive Officer Kishore Biyani and others from accessing the securities market for a period of one year.

Jubilant FoodWorks: Prakash Chandra Bisht has resigned as the Chief Financial Officer of the company w.e.f. February 15, 2021.

Procter & Gamble Hygiene and Health Care:December quarter sales rose 19 percent YoY to Rs 1,018 crore. PAT rose 84 percent YoY to Rs 251 crore.

Prince Pipes And Fittings:Revenue from operations stood at Rs 549 crore, up 39 percent YoY. PAT at Rs 67 crore grew 175 percent YoY.

VIP Industries: December quarter income at Rs 243 crore against Rs 108 crore QoQ. It reported a loss of Rs 7 crore against a loss of Rs 35 crore QoQ.

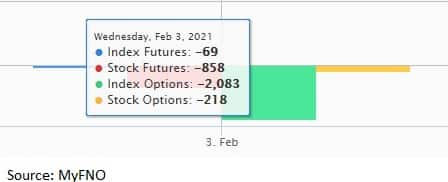

Fund flow

Foreign institutional investors (FIIs) net bought shares worth Rs 2,520.92 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 399.74 crore in the Indian equity market on February 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSEOne stock - SAIL - is under the F&O ban for February 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!