The Indian market fell for the fifth consecutive session on October 4 as it came under pressure after the announcement from the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) meet.

The committee slashed rates by 25 bps and kept its stance accommodative to revive growth in Asia's third-largest economy.

The MPC slashed policy rates for the fifth time in a row, in line with expectations. Consequently, the rate cut comes to a total of 135 bps in 2019 and the repo rate currently stands at 5.15 percent.

Rate sensitive stocks such bank, auto and real estate stocks fell the most, followed by metal, pharma, FMCG and infra stocks. However, IT stocks remained on the buying side.

All committee members voted for a rate cut. For FY20 RBI cuts GDP growth forecast to 6.1 percent from 6.9 percent, while raises inflation forecast marginally, said Dhiraj Relli, MD & CEO, HDFC securities.

RBI has also raised lending limit for MFIs. While reducing rate Governor added that OMOs will be done to deal with the liquidity situation, he added.

The index has fallen for the fifth consecutive session and broken its 200 DEMA, forming large bearish candle which can also be called as Long Black Day kind of formation on daily charts. It lost nearly 3 percent and formed bearish candle on weekly scale as well.

On October 4, the market fall was mainly because of RBI slashing FY20’s GDP growth target to 6.1 percent, down from its earlier forecast of 6.90 percent on the back of weakening domestic demand conditions, said Shrikant S Chouhan, Senior Vice-President, Equity Technical Research, Kotak Securities.

Nifty closed comfortably below the level of 200 days SMA, whereas Sensex closed just above the same. On the higher side, Nifty would face hurdles at 11,260, which is resistance of 200 days SMA, commonly followed by major participants of the market, he added.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 11,088.63, followed by 11,002.47. If the index starts moving up, key resistance levels to watch out for are 11,330.63 and 11,486.47.

Nifty Bank

Nifty Bank closed with a loss of 682.25 percent at 27,731.85. The important pivot level, which will act as crucial support for the index, is placed at 27,346.9, followed by 26,962. On the upside, key resistance levels are placed at 28,423.5 and 29,115.2.

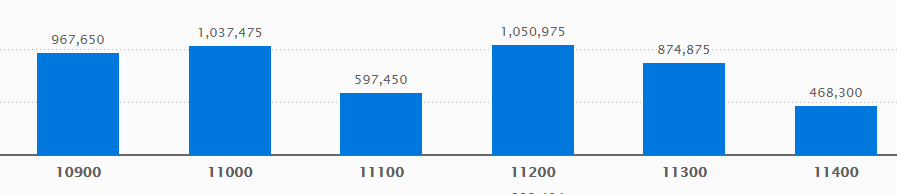

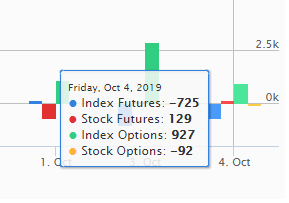

Call options data

Maximum call open interest (OI) of 10.50 lakh contracts was seen at the 11,200 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11,000 strike price, which holds 10.37 lakh contracts in open interest, and 10,900, which has accumulated 9.67 lakh contracts in open interest.

Significant call writing was seen at the 10,900 strike price, which added 4.62 lakh contracts, followed by 10,700 strike price that added 2.48 lakh contracts and 10,800 strike price which added 2.47 lakh contracts.

No major Call unwinding seen.

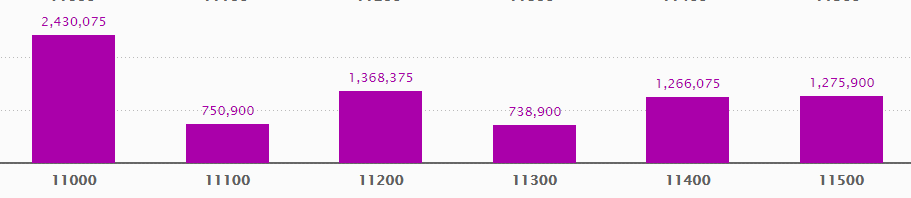

Put options data

Maximum put OI of 24.30 lakh contracts was seen at 11,000 strike price, which will act as a crucial support in the October series.

This is followed by 11,200 strike price, which holds 13.68 lakh contracts in open interest, and 11,500 strike price, which has accumulated 12.75 lakh contracts in OI.

Put writing was seen at the 11,200 strike price, which added 2.62 lakh contracts, followed by 11,000 strike price, which added 2.13 lakh contracts.

Put unwinding was seen at 11,400 strike price, which shed 1.59 lakh contracts, followed by 11,900 strike price which shed 73,800 contracts and 11,600 strike price which shed 50,625 contracts.

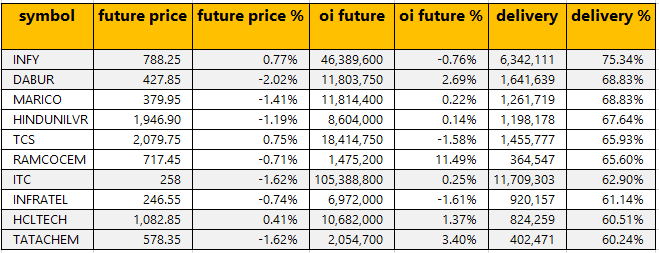

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

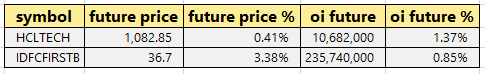

2 stocks saw long buildup

58 stocks saw long unwinding

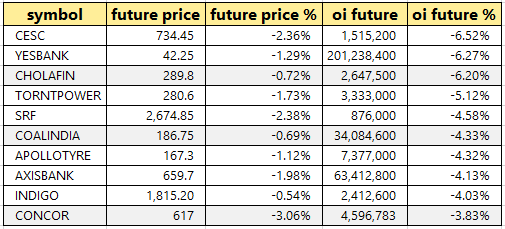

Based on the lowest OI future percentage point, here are the top 15 stocks in which long unwinding was seen.

76 stocks saw short build-up

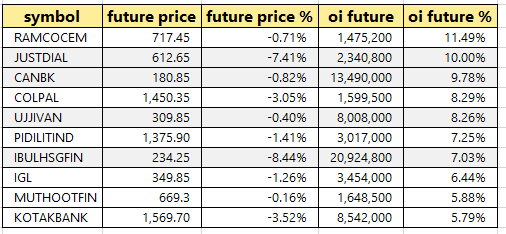

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 15 stocks in which short build-up was seen.

16 stocks witnessed short-covering

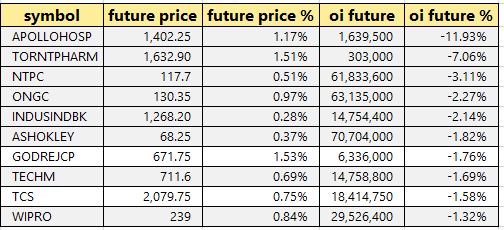

A decrease in OI, along with an increase in price, mostly indicates a short covering.

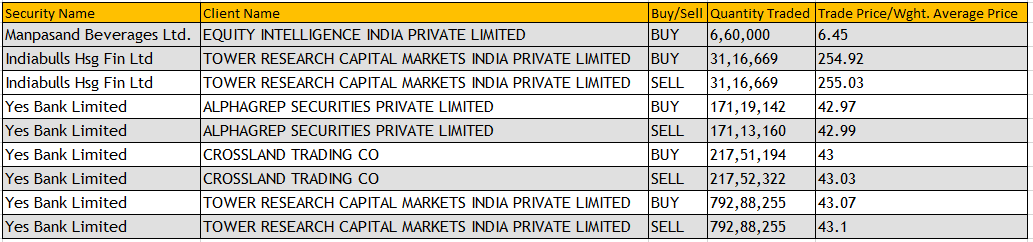

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

HUL: Board meeting on October 14 to consider and approve the financial results for the period ended September 30 and dividend.

M&M: Board meeting on November 8 to consider and approve the standalone and consolidated financial results of the company for the second quarter and half year ended September 30.

Union Bank of India: Board meeting on October 9 to consider and approve issue of equity shares on preferential basis to the government of India.

RBL Bank: Board meeting on October 22 to consider and approve the financial results for the period that ended on September 30.

Ambuja Cements: Board meeting on October 18 to consider and approve the financial results for the period that ended September 30.

Stocks in news:

Lupin launches Mycophenolate Mofetil capsules USP.

Garden Silk Mills: Withdrawal of invitation for bids and sale of financial assets/loan account of company.

Wipro completes acquisition of International TechneGroup Incorporated (ITI).

Care Ratings reaffirmed Long Term Bank facilities rating as CARE A; stable.

JSW Steel raised $400 million by allotment of fixed rate senior unsecured notes.

Eveready Industries appoints Roshan L Joseph as independent director of the company w.e.f. October 04, 2019.

Prakash Industreis: CARE Ratings reaffirmed the credit rating CARE BB (Double B) with stable outlook for bank facilities of the company.

Ashok Leyland: The company's plants at various locations will be observing non-working days ranging from 2-15 days, during the month of October.

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 682.93 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 606.28 crore in the Indian equity market on October 4, as per provisional data available on the NSE.

Fund flow

No stock under ban period on NSE

There are no stocks under the futures and option (F&O) ban for October 3. Securities in ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.