Equity benchmarks the Sensex and the Nifty have been ending in the red for the last four consecutive sessions.

The Sensex and Nifty lost more than a percent in the week ended February 19, while BSE midcap and smallcap indices outperformed with gains of 0.63 and 1.23 percent, respectively.

In the coming week, the market may witness volatility due to the expiry of the February F&O series. Global cues, third-quarter GDP numbers and updates on Covid-19 cases will continue to dominate the mood of the

market.

Rohit Singre, Senior Technical Analyst at LKP Securities pointed out that Nifty formed a bearish engulfing kind of candle pattern on the weekly chart which represents trend reversal.

"As the index managed to breach its strong support of 15,000 mark which will act as an immediate resistance now so above the 15,000 mark, we may see some relief otherwise we may see more downside levels of 14,900-14,750. On the other hand, 15,100-15,170 will act as a strong hurdle on the higher side," he said.

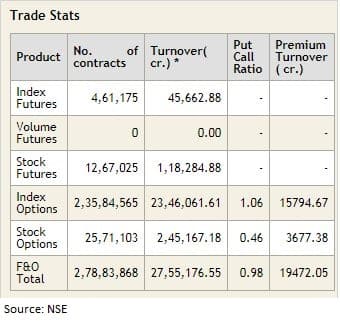

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the NiftyLast Friday, Nifty closed 137 points, or 0.91 percent, lower at 14,981.75. According to pivot charts, the key support levels for the Nifty are placed at 14,872, followed by 14,762.2. If the index moves up, the key resistance levels to watch out for are 15,117.8 and 15,253.8.

The Nifty Bank index fell 745 points, or 2.04 percent, to close at 35,841.60 on February 19. The important pivot level, which will act as crucial support for the index, is placed at 35,398.73, followed by 34,955.87. On the upside, key resistance levels are placed at 36,470.33 and 37,099.06 levels.

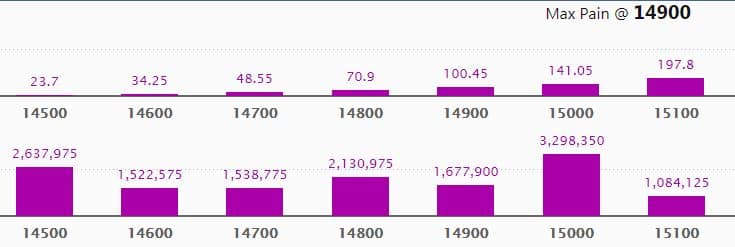

Call option dataMaximum Call open interest of 39.70 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,200 strike, which holds 34.07 lakh contracts, and 15,300 strike, which has accumulated 30.56 lakh contracts.

Call writing was seen at 15,200 strike, which added 13.8 lakh contracts, followed by 15,000 strike which added 12.93 lakh contracts and 15,500 strike which added 10.86 lakh contracts.

Call unwinding was seen at 14,500 strike, which shed 21,450 contracts, followed by 14,600 strike which shed 4,425 contracts.

Maximum Put open interest of 32.98 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the February series.

This is followed by 14,500 strike, which holds 26.38 lakh contracts, and 14,800 strike, which has accumulated 21.31 lakh contracts.

Put writing was seen at 14,800 strike, which added 6.30 lakh contracts, followed by 14,500 strike, which added 4.56 lakh contracts and 14,900 strike which added 4.53 lakh contracts.

Put unwinding was seen at 15,100 strike, which shed 4.65 lakh contracts, followed by 15,200 strike which shed 3.04 lakh contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

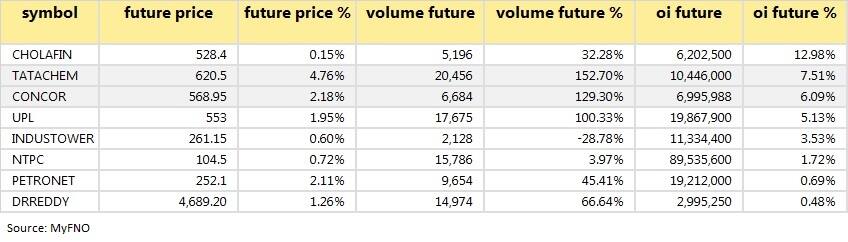

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

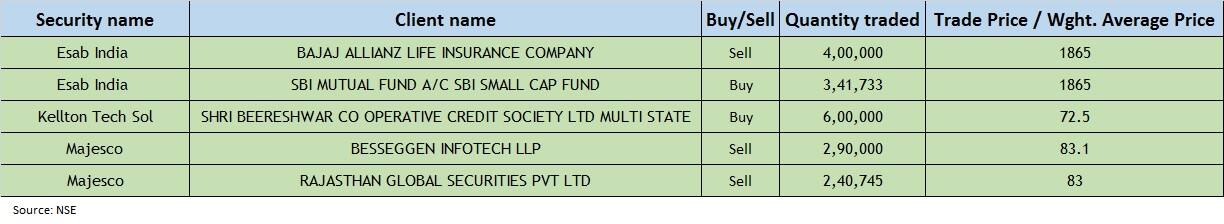

(For more bulk deals, click here)

Board meetingsApoorva Leasing Finance:The board will meet on February 22 to consider and approve quarterly results.

D B Realty:The board will meet on February 22 for the issue of warrants and the preferential issue of shares.

SPEL Semiconductor: The board will meet on February 22 to consider and approve quarterly results.

Unishire Urban Infra:The board will meet on February 22 for general purposes.

Stocks in the newsNarayana Hrudayalaya- The company will invest USD 100 million for capacity expansion in Cayman Islands.

Jubilant FoodWorks - Wholly-owned subsidiary Jubilant Foodworks Netherlands B.V. has entered into a purchase agreement to fully acquire Fides Food Systems Coöperatief U.A.

Lincoln Pharmaceuticals- ICRA has upgraded the company's long-term rating to ICRA A and short-term rating to ICRA A1.

Foseco India - Approved the appointment of Mohit Mangal, as the chief financial officer (CFO) in place of R Umesh.

Aarti Drugs - The company wound up UAE-based subsidiary Pinnacle Life Science LLC.

NTPC- On successful commissioning, 5 MW last part capacity for 20 MW Auraiya Solar PV Project at Auraiya, UP, has been declared on Commercial Operation w.e.f. 00:00 Hrs. of 20.02.2021.

Fund flow

Foreign institutional investors (FIIs) net bought shares worth Rs 118.75 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,174.98 crore in the Indian equity market on February 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSEFour stocks - BHEL, Canara Bank, Vodafone Idea and SAIL - are under the F&O ban for February 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!