The market remained under pressure and ended lower for the fourth consecutive day on the back of weak global cues as United States opened a new trade war stating that it will impose tariffs on $7.5 billion of goods on the European Union.

The Sensex was down 198.54 points at 38106.87, while the Nifty was down 45.90 points at 11,314. About 958 shares have advanced, 1502 shares declined, and 155 shares are unchanged.

On the technical front, the Nifty50 registered a Doji kind of indecisive formation after moving in a range of 113 points.

"A close above 11,370 shall be considered as an initial sign of strength for extension of the pull back move towards 11,550 kinds of levels," Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

For time being short term trades are advised to wait for some initial signs of strength before creating fresh long side positions, he added.

We have collated 14 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 11,257.4, followed by 11,200.8. If the index starts moving up, key resistance levels to watch out for are 11,370.5 and 11,427.

Nifty Bank

Nifty Bank closed with a loss of 307 percent at 28,418.50. The important pivot level, which will act as crucial support for the index, is placed at 28,180.23, followed by 27,946.37. On the upside, key resistance levels are placed at 28,708.53 and 29,002.96.

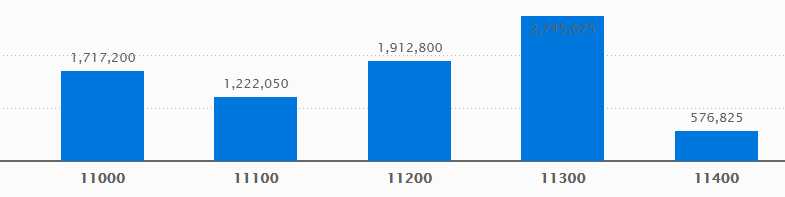

Call options data

Maximum call open interest (OI) of 23.30 lakh contracts was seen at the 11,500 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11,200 strike price, which holds 17.11 lakh contracts in open interest, and 11,700, which has accumulated 17.03 lakh contracts in open interest.

Significant call writing was seen at the 11,400 strike price, which added 3.67 lakh contracts, followed by 11,600 strike price that added 2.92 lakh contracts and 11,300 strike price which added 1.96 lakh contracts.

No major Call unwinding seen.

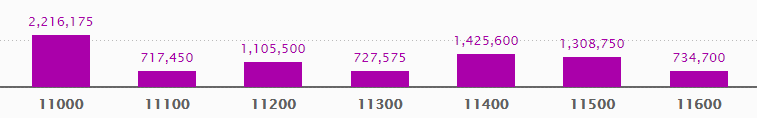

Put options data

Maximum put OI of 22.16 lakh contracts was seen at 11,000 strike price, which will act as a crucial support in the October series.

This is followed by 11,400 strike price, which holds 14.25 lakh contracts in open interest, and 11,500 strike price, which has accumulated 13.08 lakh contracts in OI.

Put writing was seen at the 11,400 strike price, which added 3.91 lakh contracts, followed by 11,000 strike price, which added 1.88 lakh contracts.

No major Put unwinding seen.

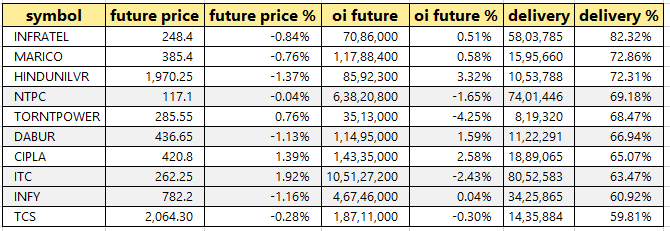

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

32 stocks saw long buildup

30 stocks saw long unwinding

Based on the lowest OI future percentage point, here are the top 15 stocks in which long unwinding was seen.

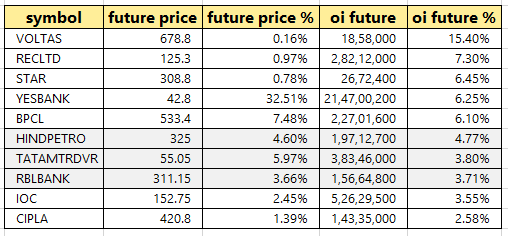

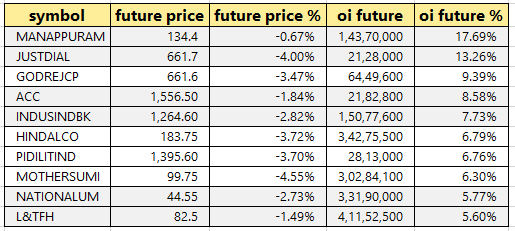

56 stocks saw short build-up

An increase in OI, along with a decrease in price, mostly indicates a build-up of short positions. Based on the OI future percentage, here are the top 15 stocks in which short build-up was seen.

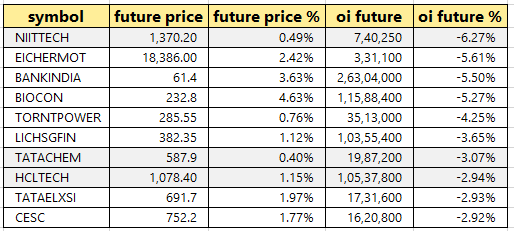

32 stocks witnessed short-covering

A decrease in OI, along with an increase in price, mostly indicates a short covering.

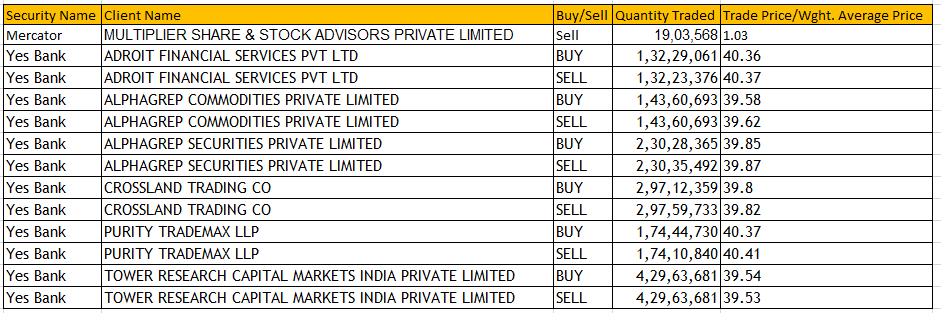

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

HDFC: Board meeting on November 4 to consider and approve the financial results for the period ended September 30, 2019

Karnataka Bank: Board meeting on October 15 to consider and approve the financial results for the period ended September 30, 2019

Marico: Board meeting on October 25 to consider and approve the un-audited consolidated and standalone financial results and consider interim dividend for the FY 2019-20

Stocks in news:

Dhamput Sugar Mills successfully launched Country Liquor at its Distillery unit at Dhampur.

Orient Cement - CARE Ratings assigns CARE AA- to the Long term Bank facilities and CARE Al+ to the Commercial Paper issue of the company

UCO Bank board approves the proposal for the issue of equity shares on preferential basis to Government of India against capital infusion of Rs 2,130 crore

Hindalco Industries - Novelis receives approval from European Commission for proposed acquisition of Aleris

Sintex Plastics Technology's independent director Sandeep M Singhi resigns w.e.f. October 02, 2019

New India Assurance Company signs pact to enter into ICA for company's exposure to debt instruments of Reliance Home Finance & DHFL

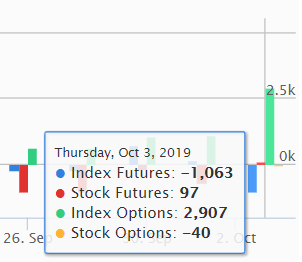

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 810.72 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 862.54 crore in the Indian equity market on October 3 , as per provisional data available on the NSE.

Fund flow

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.